A closer look at Super Streamers and their attitudes towards adverts

Media consumption patterns have changed markedly since the start of the pandemic, with an increasing portion of the population flocking to streaming services. While a rise in online media consumption could be great news for advertisers, they are also faced with the challenge of navigating ad-blockers.

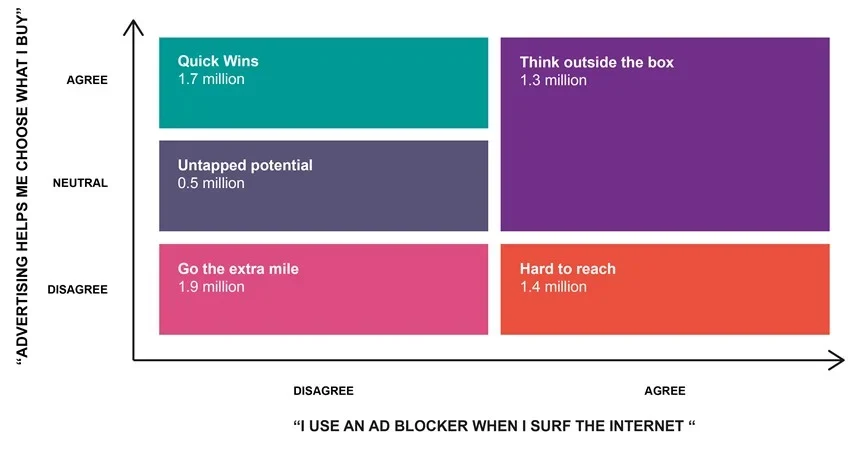

In this YouGov Profiles framework study, we examine attitudes towards advertising among Super Streamers — people who subscribe to two or more paid video streaming services and at least one paid music streaming service. The data provides insight into how marketers can reach different groups within this wider segment by dividing them according to their agreement or disagreement with two core statements:

A.) “Advertising helps me choose what I buy”

B.) “I use an ad blocker to surf the internet”

We’ve grouped consumers into the following five categories based on their responses:

Quick wins – those who agree that their purchase choices are influenced by advertising and who don’t use ad-blockers.

Go the extra mile – consumers who disagree that their purchase choices are influenced by advertising and who don't use ad-blockers

Think outside the box – those who are neutral or agree that their purchase choices are influenced by advertising and use ad-blockers

Hard to reach – consumers who disagree that their purchase choices are influenced by advertising and who use ad-blockers.

Untapped potential – those who are neutral about the influence of advertising on their purchase choice but don't use ad-blockers

YouGov framework: how to reach a Super Streamer

Total GB Super Streamer population: 7.5 million (14%)

People who subscribe to two or more paid video streaming services and at least one paid music streaming service.

Quick wins

Super Streamers in the ‘Quick wins’ category appear much more likely than others to take notice of and engage with various forms of online as well as offline advertising. For instance, they are much more likely to notice advertisements on the internet than the average Super Streamer (77% vs 59%). Members of this group are also 19 percentage points ahead of average Super Streamers when it comes to noticing ads in newspapers and magazines (52% vs 33%).

But willingness to engage with ads comes with a higher expectation of creativity from marketers, with 92% saying “brands need to find innovative ways to market themselves and their products” against 84% among Super Streamers overall.

Females are over-represented in this group (59%) compared to average Super Streamers (48%).

Think outside the box

This group, consisting of those who use ad blockers but are still somewhat receptive to advertising, is two-thirds (67%) male, which is 15% higher than the overall Super Streamers group. Respondents in this group were likelier to indicate that they engage with offline advertising channels such as billboards and posters.

Almost half the people in this group (44%) said “Advertisements outside my home affect how I see a brand” compared to 25% for the average Super Streamer. Two-thirds (67%) of them also indicated that billboards showing dynamic content capture their attention. This group diverged significantly from the average Super Streamer group in terms of how likely they are to notice adverts on the sides of buses (68% vs 55%) and at train stations (56% vs 40%).

Go the extra mile

Both in terms of its demographic make-up and its attitudes, this group – made up of consumers who disagree that their purchase choices are influenced by advertising and who don't use ad-blockers - closely resembles average Super Streamers. Like in the overall category, 52% of respondents in this category are male and the age split also bears a striking resemblance to that of the wider Super Streamers group.

Yet a higher proportion of individuals appear to be unwelcoming in their attitudes towards advertising. Half of them (50%) said “I think ads are a waste of time” against two in five (39%) of the wider group. In the same vein, four in five (82%) agreed that they “find advertising annoying” versus 76% in the average Super Streamers category.

Hard to reach

This group, comprised of consumers who disagree that their purchase choices are influenced by advertising and who use ad-blockers, features a marked increase in the proportion of males (64%) compared to average Super Streamers (52%). Overall, the group displayed more reluctance to engage with any form of advertising when compared to the wider group.