Global: Half of consumers say the cinema is too costly

The story of the cinema industry’s fight with coronavirus is – per some reports – an unfolding disaster movie. Despite blockbuster films returning to theatres worldwide as the pandemic winds down, market leading global brands such as Cineworld are struggling to stay afloat and to get consumers back into seats, and they’re far from alone in that.

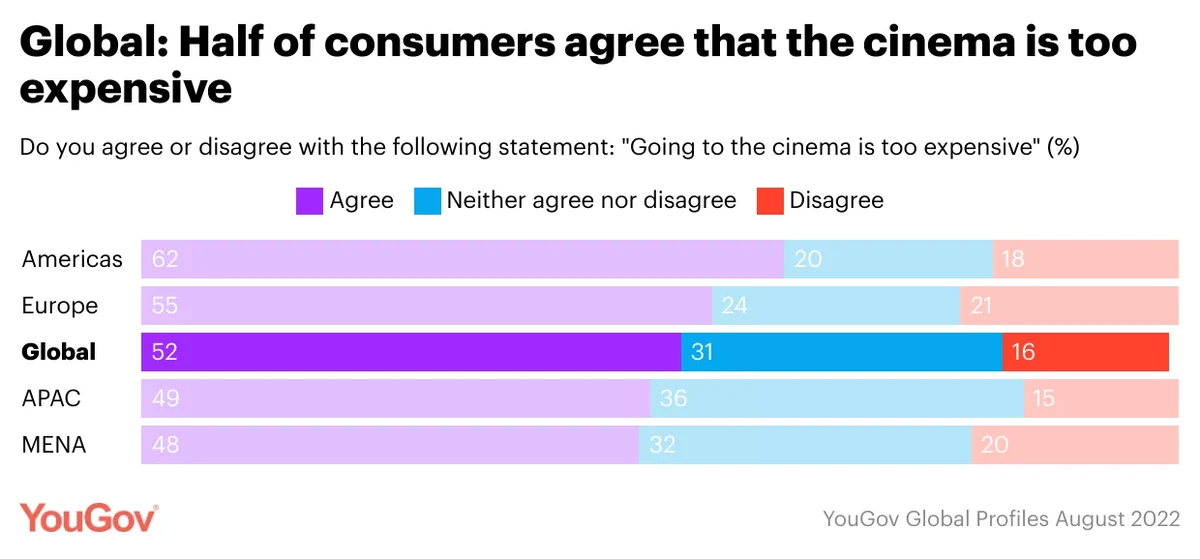

Data from YouGov Global Profiles shows that half of consumers across the Americas, Europe, MENA, and APAC (52%) agree that the cinema is too expensive. While there’s some variation across regions – people in the Americas, for example, are more likely than average to say movie theatres are too costly (62%), with just a fifth in dissent (18%) – it hovers around half of consumers everywhere else.

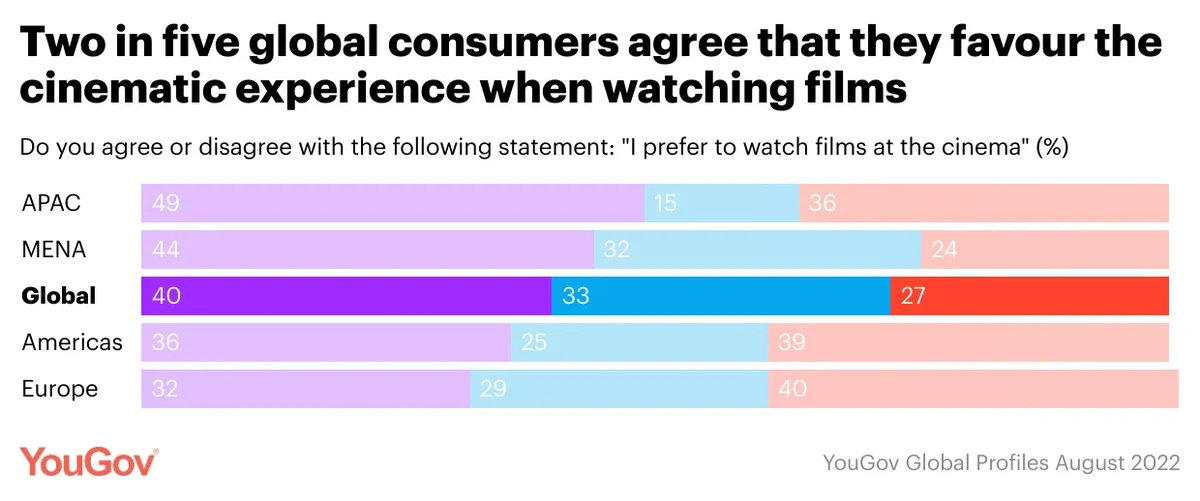

With inflation rising across the globe and energy bills dramatically increasing in some markets, it would be easy to assume the cinematic experience is becoming expendable to consumers in what may well become an age of belt-tightening and penny pinching. But that doesn’t tell the whole story. Watching movies in the cinema is, for many consumers, their favourite way to watch movies. Across each of these markets, two in five consumers say the moviegoing experience is their preferred way to see films (40%), with just a quarter disagreeing (27%).

Again, there is some more variation here: the public in APAC are most likely to say they prefer to watch movies at the cinema (49% agree vs. 36% disagree), with consumers in MENA (44% vs. 24%) right behind them. In the Americas (36% vs. 39%) and Europe (32% vs. 40%), consumers are more likely to disagree that the cinematic experience is their favourite way to watch films, but in each case, more than a third agree.

So if consumers can’t necessarily justify the cost of a cinema trip, this doesn’t necessarily mean they don’t want to go to the cinema. Indeed cinema chains are complaining about a lack of movies releases too. Theatre operators may therefore wish to think about how they can offer greater value – or lower costs – to consumers, if they can do so without unduly impacting their bottom line or the cinema experience many consumers cherish.

Discover more leisure and entertainment content here

Want to run your own research? Start building a survey now

Explore our living data - for free

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Methodology

YouGov Global Profiles is a globally consistent audience dataset with 1000+ questions across 43 markets. The data is based on continuously collected data from adults aged 16+ years in China and 18+ years in other markets. The sample sizes for YouGov Global Profiles will fluctuate over time, however the minimum sample size is always c.1000. Data from each market uses a nationally representative sample apart from India and UAE, which use urban representative samples, and China, Egypt, Hong Kong, Indonesia, Malaysia, Morocco, Philippines, South Africa, Taiwan, Thailand and Vietnam, which use online representative samples. Learn more about Global Profiles.