Urban Indians look forward to an electronic Diwali this year

Along with popular gadgets, home automation products and smart appliances may have their moment this festive season

The festive season has commenced in India and now everyone is eagerly awaiting the festival of lights. Although brands are betting big on Diwali to light up sales, are consumers ready to shop again?

YouGov’s Diwali Spending Index 2020, an indicator of the spending intent among Indian consumers, reveals a below average spending propensity (80.96%) among urban Indians this festive season.

The Index is calculated as a weighted impact of 10 factors (like increase in gross household income, increase/decrease in household expenses, intent to invest or splurge and general optimism towards economy) on their intent to spend more/less this Diwali season versus last.

Among the 10 factors, while an increase in gross household income has the strongest impact on consumers’ intention to spend more this year, only 15% of the respondents indicated an increase in their gross household incomes. On the other hand, close to 50% of the respondents agreed that they are more careful with their finances today than they used to be in the past. Highlighting a strong “negative” relationship with spending intent, it is this factor that is likely pulling down the overall sentiment to spend more this Diwali than last year.

The final Index, i.e. 80.96, being less than 100 indicates a below average intent to spend more this Diwali versus last year.

In addition to the Index score, YouGov’s survey shows 54% respondents said they were likely to spend lesser than last year during Diwali, as compared to 23% who said this in 2019. One in five (20%) were planning to spend the same amount as last year while only 17% said they would splurge more this time.

Even though the overall buying sentiment is lower as compared to last year, people are likely to invest in certain categories- with ‘Gadgets’ topping the list (22%), closely followed by ‘Clothes’ (22%). Appliances (17%), fashion accessories (15%) and jewellery (12%) are also high on shopper’s priority list.

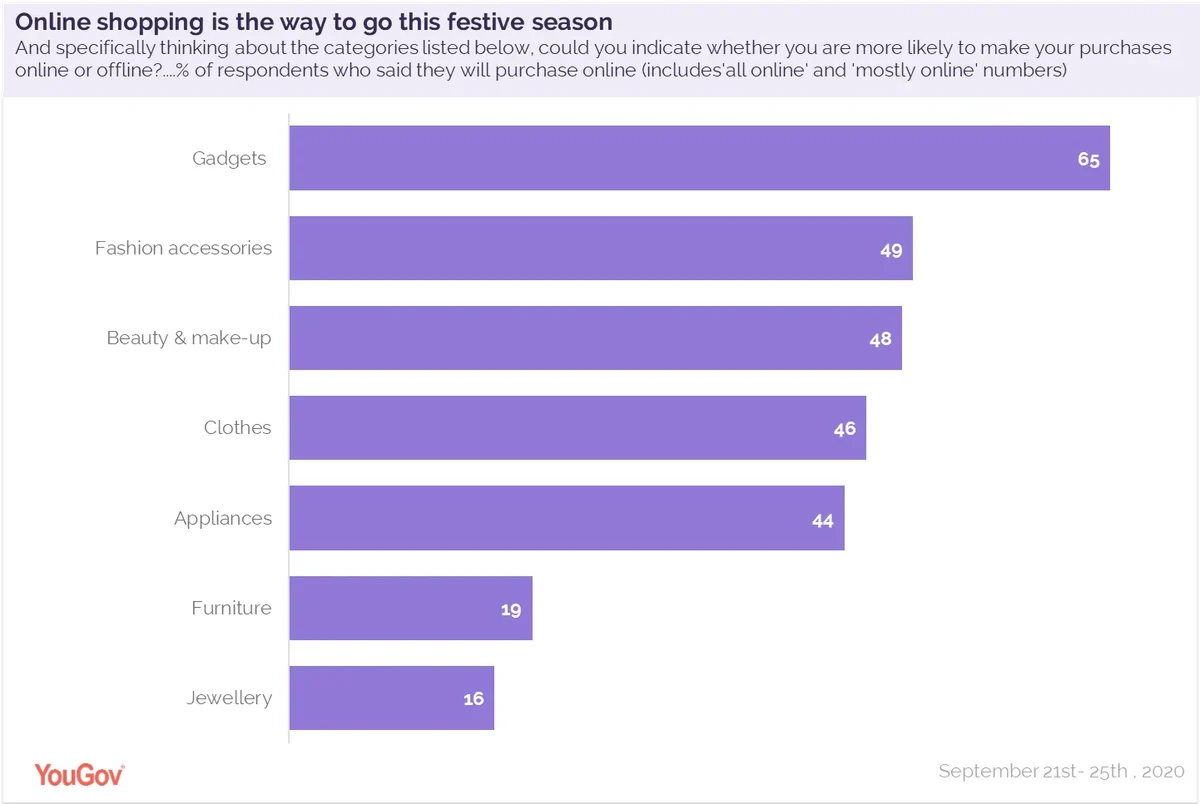

When it comes to the mode of shopping, online shopping is likely to see a surge with more than half (54%) saying they prefer to shop online this Diwali. It appears most gadget buyers are likely to buy products online than offline (65% vs 18%). Online also appears to be the preferred medium of shopping for other categories like Fashion accessories (49%), beauty & make-up (48%), clothes (46%) & appliances (44%). However, for high-ticket items like Jewellery (61% offline vs 16% online) and Furniture (55% offline vs 19% online) people prefer in store purchases over contactless online shopping.

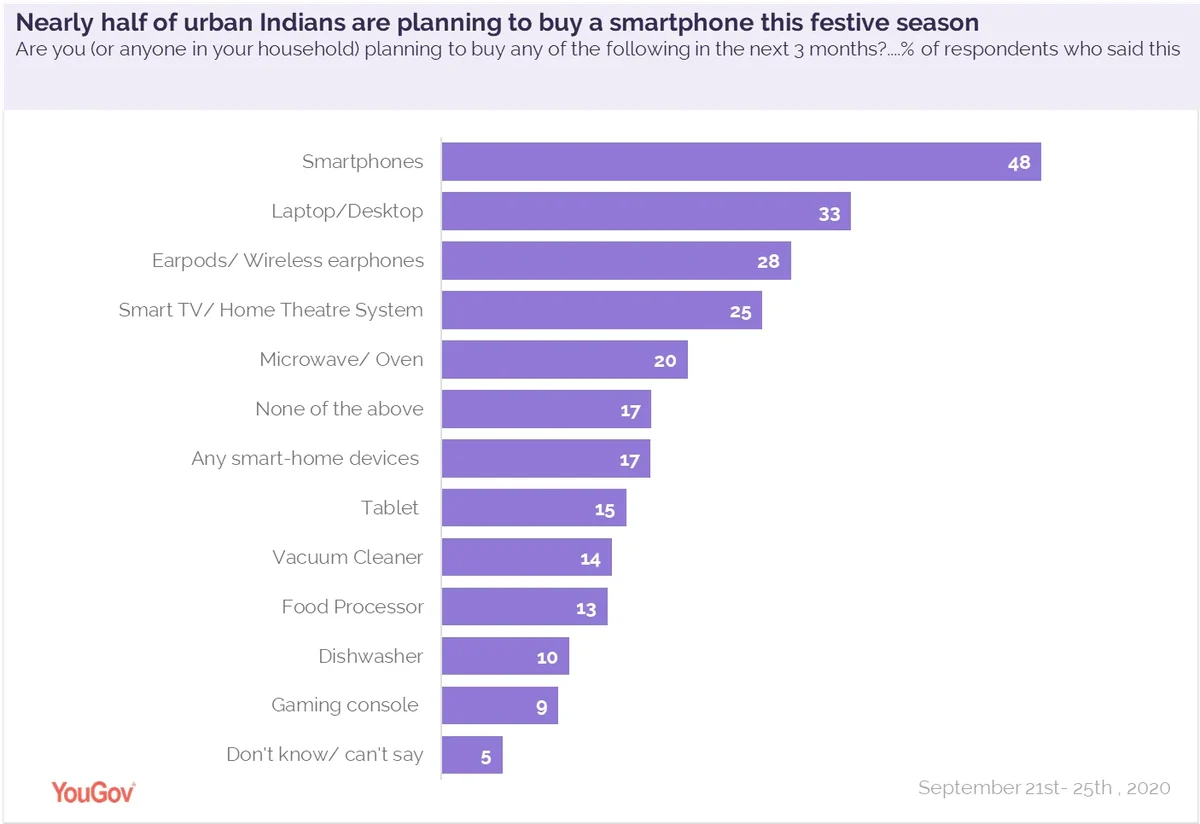

When asked what products within gadgets & electronics are they likely to purchase in the next three months, Smartphones emerged as the top choice for nearly half the respondents (48%). This was followed by Laptops (33%), Wireless earphones (28%), Smart TVs (25%) and microwave/ oven (20%).

In addition to upgrading their devices, people are looking to buy smartphones for the purpose of online education. The same is true regarding the demand for laptops/ desktops, where people are seeking to buy these products for work as well as for educational use.

Apart from the usually popular gadgets like smartphones and laptops, this year people also seem to be interested in home automation products such as microwaves, food processors, vacuum cleaners and dishwashers.

Traditionally, India has never been a big market for automation products but the prolonged impact of the pandemic could be driving the demand for these products. As millions of Indians increasingly balance work from home, along with managing household chores, more than a third have started thinking about purchasing a food processor (35%) or a dishwasher (34%) in the next three months. Another third are a step ahead in the purchase cycle, and have started looking out for brands to purchase vacuum cleaners and smart home devices (34% each).

Although consumers are being cautious with their spending, money is not the sole criterion for purchase. Most consumers are looking at mid-tier or premium budget segment for most of the listed categories of appliances and electronics. Value- segment is a consideration for few items such as dishwasher, Smart TV and wireless earphones.

Talking about the festive shopping fervor this Diwali, Deepa Bhatia, General Manager, YouGov India, said, “After an economic slowdown caused due to the pandemic, businesses are looking forward to the festive season for revival. Even though enthusiasm among consumers is low this year, certain categories are likely to witness a demand from consumers. There also seems to be an inclination towards products that ensure autonomy and fill the gap in the absence of domestic help. It is therefore important to understand the requirements of these buyers and extend offers that lift the buying sentiment.”

Methodology

This survey has been conducted on a sample of 2,500 respondents on the YouGov India’s online panel between 21st Sep to 25th Sep 2020. The sample primarily constitutes consumers from NCCS A and B; and matches the population numbers of urban India in terms of basic demographics like age, gender, regions and city tiers.

The Index has been derived using Ordinal Logistic Regression and Johnson’s Relative Weight modelling to understand the relationship between each of the factors and overall intention to spend more this Diwali amongst consumers.

For the calculation of the final Index, two sets of weighted averages were calculated basis respondent data – 1) assuming an equal weightage for all factors (which has been used as the base); 2) with actual weightages for each of the factor derived from the regression and JRW analysis. The final Index, i.e. 80.96, being less than 100 indicates a below average intent to spend more this Diwali versus last year.

The final Index = Actual weighted spending intent / Hypothetical spending intent assuming equal weightage to all 10 predictors