Is customer advocacy all about service?

With the CMA (Competition in Markets Authority) having recently published their second set of bank satisfaction results, the focus on understanding the key drivers of customer advocacy has never been greater for banks and building societies.

While the direct experience that consumers have will no doubt have the most impact on the way they feel about their bank, we consider how other attitudinal factors may be influencing people’s likelihood to recommend their bank to family members and friends.

We question the extent to which advocates are nurtured by the direct experience they have with their bank versus the role of deeply engrained attitudinal traits that influence the extent to which they are likely to recommend any brand or organisation.

Using our vast UK panel and connected data, we asked over 2,000 nationally representative UK adults how likely they were to recommend their bank. This resulted in a sample of over 400 advocates (those likely to recommend their bank) and 800 detractors (those unlikely to recommend their bank) that we then analysed to reveal any attitudinal or behavioural differences.

From this analysis we can reveal how those that would recommend their bank (advocates) often behave differently and have a different set of values and beliefs to those that would not recommend their bank (detractors).

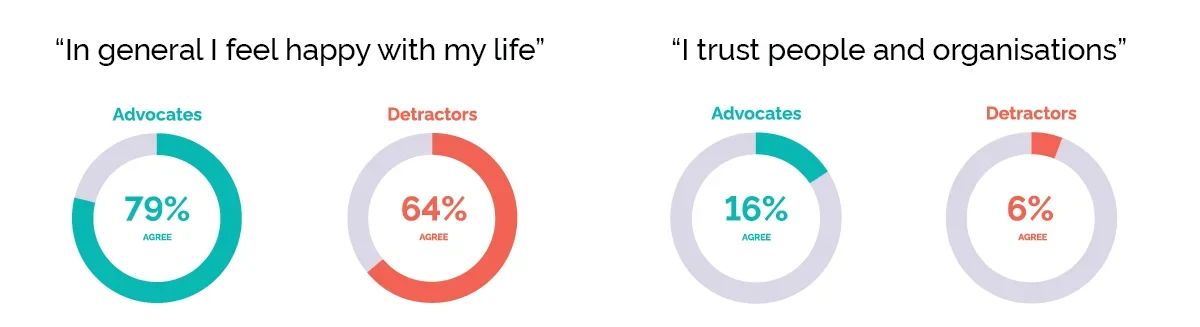

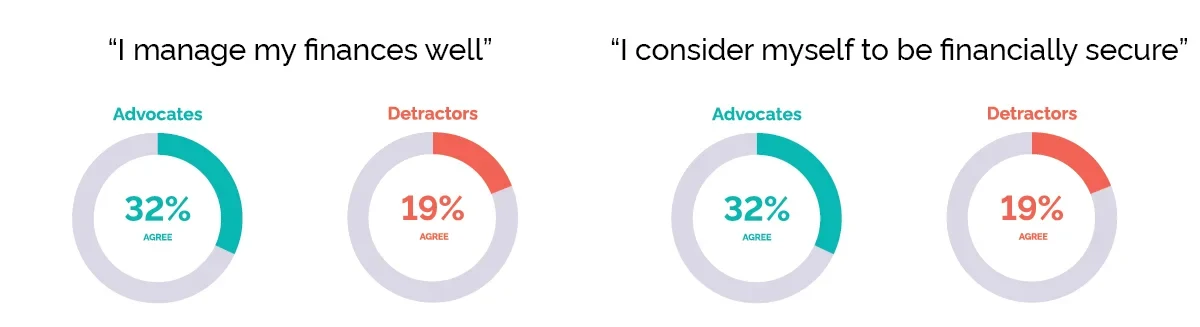

Our research shows how advocates feel significantly happier in their lives and are generally more trusting of people and organisations. This more positive and optimistic mind-set is a deeper seated emotional state of mind that will influence their propensity to recommend not only their bank, but any other service or brand that they use.

The research also reveals how advocates tend to be more confident in the way that they manage their finances and generally feel more financially secure. Again, these elements are more circumstantial in nature rather than a direct consequence of the service that they receive from their bank.

We can therefore suggest that those who are more confident in managing their financial affairs and consider themselves to be financially secure will be more likely to recommend their bank.

The research identifies many other ways in which advocates exhibit different attitudes and behaviours compared to detractors, and that these are often deeper rooted traits unlikely to be influenced by the direct experience they have with their bank or building society.

The extent to which these traits vary for customers of one brand versus another and the potential for brands to influence them is questionable, leading us to consider whether some brands have a circumstantial advantage over others simply based on the make-up of their customer base.

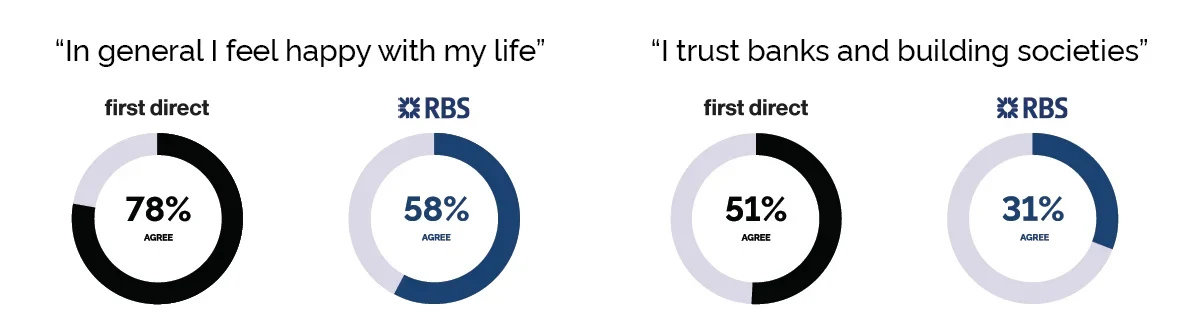

For example, first direct has consistently been rated top for customer advocacy across a wide range of studies over the years while RBS often find themselves performing poorly within such studies. While no one would contest that first direct does indeed offer a superior service to many other banks or building societies, we do need to consider whether first direct and other brands attract a certain type of consumer that will be more or less likely to recommend them to family and friends.

Certainly, if we look at the differences in some of the traits we have already highlighted, we see that first direct customers are far more likely to be happy in their lives and trust people and organisations in general. If these traits are, as suggested above, underlying drivers of recommendation, then one could argue that first direct has a circumstantial advantage when it comes to customer advocacy for example, the type of customers that they have are just more likely to recommend compared to those who bank with RBS.

While it is difficult to quantify this advocacy bias and consider the extent to which this is responsible for driving performance, a knowledge that these traits can influence customer advocacy leads us to question the traditional way in which we assess advocacy performance and formulate strategy.

Traditionally advocacy is considered a customer metric which will be driven by the direct experience that customers have with their bank but if there are other, deeper-seated attitudinal factors at play, then we may consider other means of increasing advocacy scores such as targeting a more optimistic, forward-thinking consumer with targeted marketing. For example, rather than try to turn those that are brand detractors or critics into advocates, why not just target and recruit more advocates?

This leads to the question as to whether customer advocacy should be considered as a separate endeavour to brand equity. Perhaps the challenge is really about positioning the brand so that it resonates and is more appealing to a more optimistic, forward-looking consumer that will naturally be more likely to want to recommend your brand.

About the research

The research has been conducted by Matt Palframan, YouGov’s head of financial services research. Matt has over 15 years’ experience in financial services both client side and agency side. Having managed large scale customer advocacy and Brand tracking studies for HSBC UK’s retail bank brands, Matt has an intricate knowledge of the key drivers of customer advocacy and how to present actionable insight and strategic recommendations to the board.

With this experience and access to YouGov’s extensive connected data on UK consumers, Matt has been able to shed new light on the challenge of understanding and driving customer advocacy.

Matt would be delighted to present the full findings from the research to you and your key stakeholders at your convenience and free of charge either face-to-face or by video conference.

If you are interested in arranging a session, please email sanjay.khandelwal@yougov.com.