APAC Biggest Brand Movers – April 2023

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

Indonesia: Matahari leads with new stores and mudik gifts

PT Matahari Department Store Tbk is Indonesia’s Biggest Brand Mover for April.

The department store made gains in six out of 13 YouGov BrandIndex metrics, across the the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (Value, Corporate Reputation, Quality) and Purchase Funnel category (Current Customer).

In April, besides opening two new retail stores in East Kalimantan’s Balikpapan and Bali’s Kuta, Matahari also provided free plane, train and bus tickets to 1,000 customers who were returning to their hometown for their annual mudik visits, as part of its "Mudik Bersama Matahari" program.

Monde is the runner-up, with the biscuit manufacturer scoring upticks in four metrics across the Media and Communication and Purchase Funnel categories. Traveloka takes third place, with the online travel agency seeing improvements in three metrics across the Media and Communication and Brand Perception categories.

TikTok and biscuit manufacturer Khong Guan round out the top five, making gains in three metrics each.

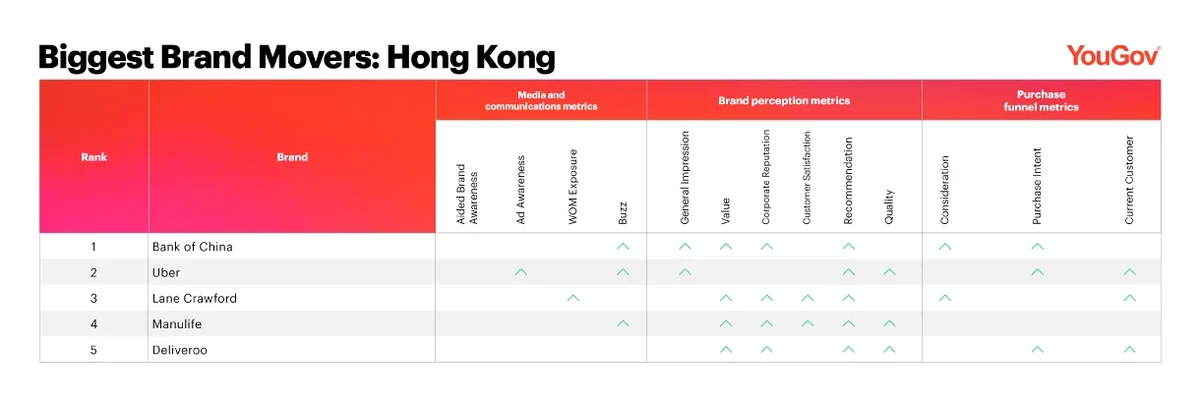

Hong Kong: BOCHK climbs to top of table with celebrity partnerships

Bank of China Hong Kong (BOCHK) is Hong Kong’s Biggest Brand Mover for March.

The state-owned bank made gains in seven out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Recommendation) and Purchase Funnel category (Consideration, Purchase Intent).

BOCHK recently launched its “#YouTalk Finance” campaign to seek out finance influencers on YouTube, enlisting stock commentator Agnes Wu and influencer 80hhslc (紅磡索螺絲) as judges for this contest. BOCHK also tapped local singer Mike Tsang (曾比特) as brand ambassador for its new subsidiary "BOCHK Cross-Border GO", which provides one-stop cross-border financial services for customers traveling across China, Southeast Asia and overseas.

Uber is the runner-up, with the ride-hailing platform scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Lane Crawford takes third place; the fashion retailer sees improvements in seven metrics across all three categories as well.

Insurance provider Manulife and food-delivery platform Deliveroo round out the top five, making gains in six metrics each.

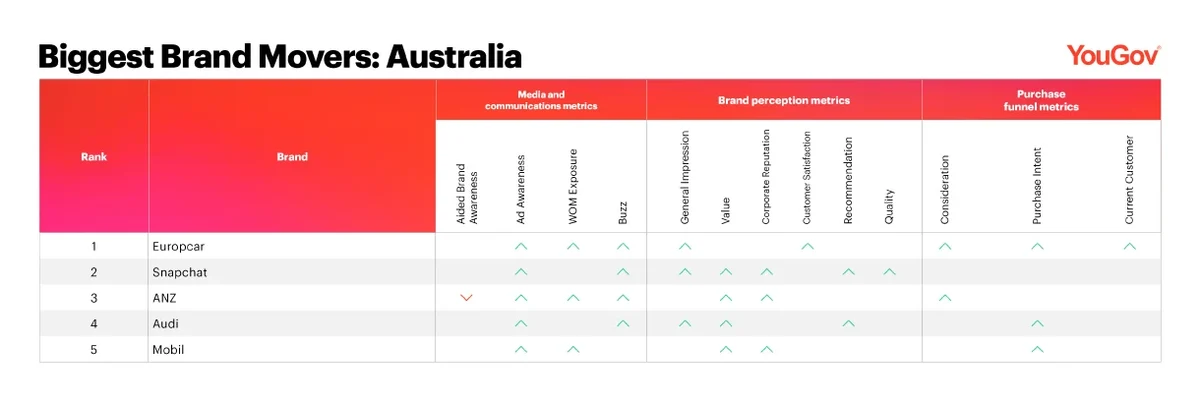

Australia: Europcar makes headway with mystery vehicle campaign

Europcar is Australia’s Biggest Brand Mover for April.

The car rental company made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Customer Satisfaction) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

Europcar is currently running a Mystery Vehicle campaign, where customers can enjoy a competitive vehicle rental rate of $79/day for a 2+ day rental, by agreeing to rent any vehicle that is available from Europcar’s passenger range on their day of pickup.

Snapchat is the runner-up, with the social media platform scoring upticks in seven metrics across the Media and Communication and Brand Perception categories. ANZ takes third place, with the multinational banking group seeing improvements in six metrics across the Media and Communication, Brand Perception and Purchase Funnel categories.

Automotive brand Audi and petroleum provider Mobil round out the top five, making gains in six and five metrics respectively.

Was your brand one of APAC’s Biggest Movers in April?

Uncover the other brands that were among the top ten in Australia, Indonesia, Singapore by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for April 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Japan, Hong Kong, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for April 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between March and April 2023.

Methodology: Biggest Brand Movers for April 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between March and April 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time