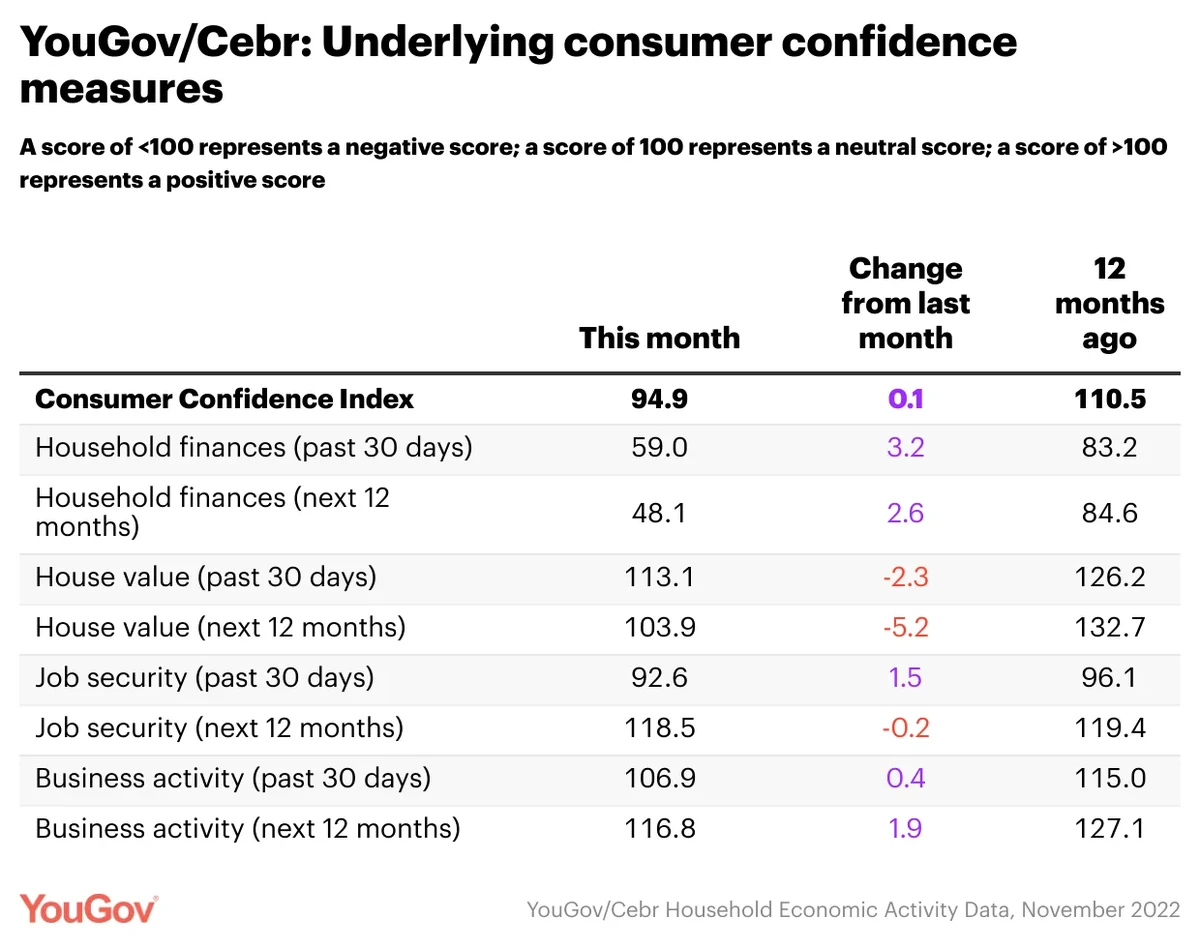

Confidence in house prices declines for the fourth month in a row

- Overall index sees slight growth (+0.1)

- Confidence in house prices falls in the short-term (-2.3) and outlook also declines (-5.2)

- Confidence in household finances improves for the retrospective (+3.2) and forward-looking (+2.6) metrics

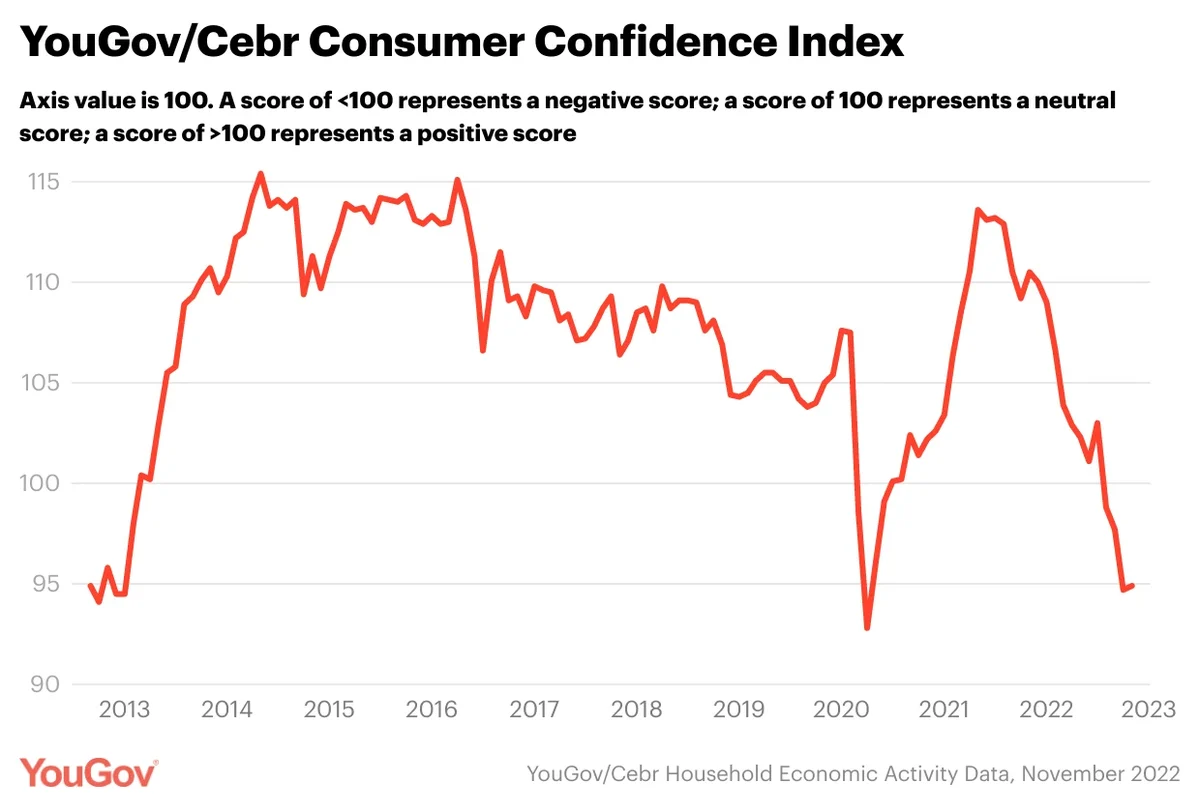

Consumer confidence saw little movement in November, according to the latest research from YouGov and the Centre for Economics and Business Research (Cebr). Thanks to declining scores for home values and improving scores for household finances, the overall index grew by 0.1 points.

YouGov collects consumer confidence data every day, conducting over 6,000 interviews a month. Respondents answer questions about household finances, property prices, job security, and business activity, both over the past 30 days and looking ahead to the next 12 months.

The most dramatic movements in this month’s Index revolved around house prices. Scores for the past 30 days declined from 115.4 to 113.1 (-2.3), with outlook dropping from 109.1 to 103.9 (-5.2). Recent headlines have shown that house prices between October and November saw the fastest decline since the financial crisis of 2008.

Both household finance scores saw improvements: retrospective measures improved from 55.8 to 58.0 (+3.2), and forward-looking measures jumped from 45.5 to 48.1 (+2.6). Amid the ongoing cost of living crisis, however, these scores remain firmly negative.

Among workers, perceptions of business activity in the short-term got slightly worse ahead of Christmas (-0.4), perhaps counterbalanced by an improvement in outlook (+1.9). Employees were also more likely to say that their job security had improved (+1.9) over the past 30 days, but forward-looking measures stagnated (-02.).