Betting behaviours surrounding the UEFA Champions League 2022 Final

The 2022 UEFA Champions League final had a considerably large impact on the sports gambling industry in the UK. But what drove this higher volume of betting? What companies were used most widely for sports betting? And what had the biggest influence on British sports bettors’ behaviours?

We answer these questions and more with data from a recent study of monthly sports bettors in the UK. This comprehensive custom research was conducted using a selected audience chosen from Global Gambling Profiles - YouGov's existing syndicated data tool. The audience was then screened to reflect only those Brits who place a sports bet at least once a month.

The results of the study were discussed in depth by our panel of industry experts in a recent webinar, ‘Stay Ahead of the Game’.

Key Group Demographics

Of the monthly sports bettors profiled for the study, four in five are male (82%), and the group is predominantly aged above 55 (54%). While 80% of our monthly sports bettors are from England, 11% are from Scotland, 4% are from Wales, and 2% from Northern Ireland.

The UEFA Champions League and sports betting in the UK

The UEFA Champions League (UCL) is a significant draw for gamblers, and they are more likely to watch a game (25.6%) than the population as a whole (16.1%). In fact, six in 10 monthly sports bettors placed a bet on the 2022 Champions League final and a further 9% of bettors intended to do so but, in the end, did not.

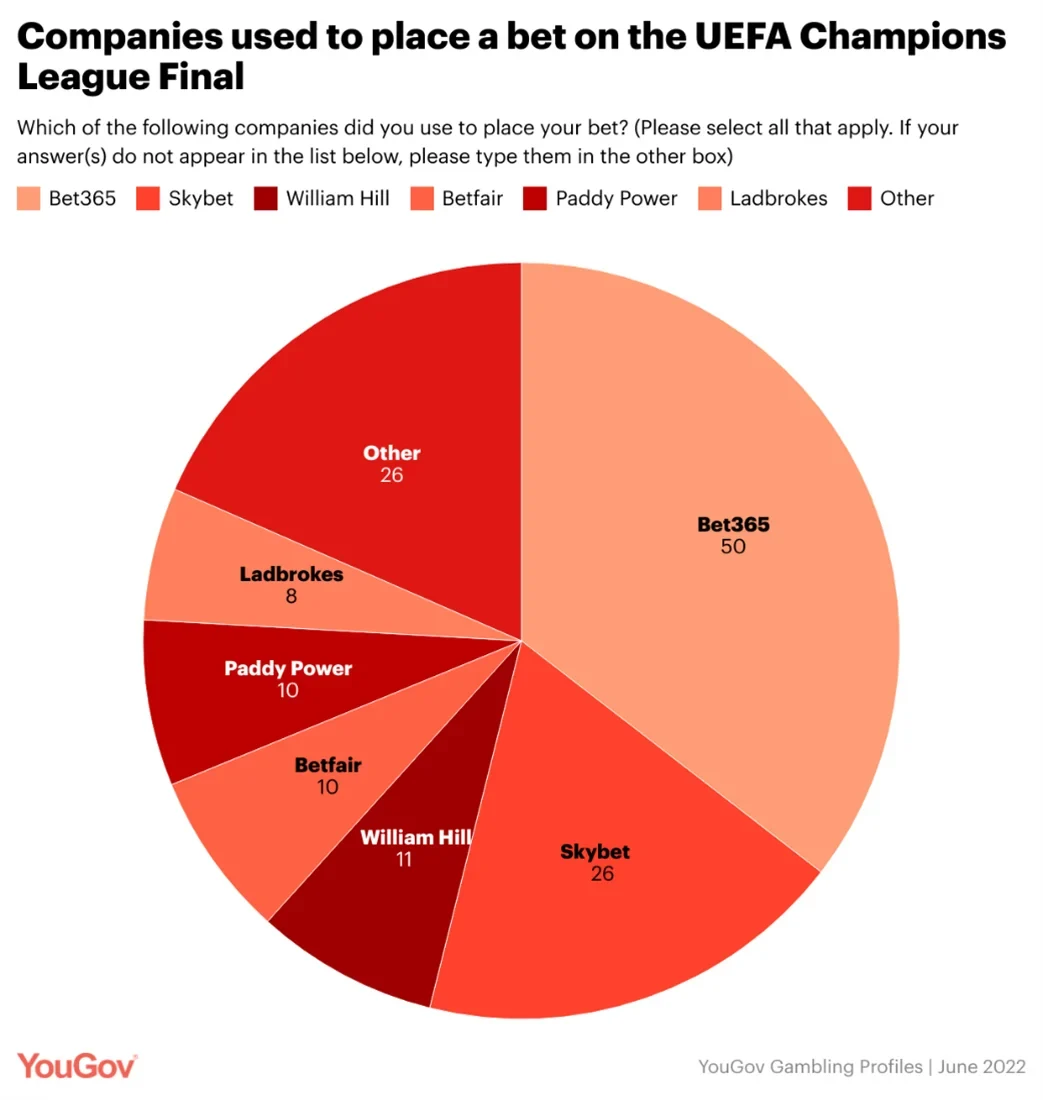

Of all the bookmakers we asked about, Bet365 (50%) enjoyed the highest levels of custom for UCL markets among monthly sports bettors in the UK. Skybet is a distant second (26%) followed by William Hill (11%), Betfair (10%), Paddy Power (10%), and Ladbrokes (8%). Notably, the average sports bettor in the UK uses only one online betting company (73%).

Interestingly, three out of five bettors (61%) placed a singles bet, with the next most popular type a Build-A-Bet (37%). Significantly fewer bettors opted for free to play games (9%), doubles and trebles (6%) and accumulators (7%).

This preference for standalone betting is an important factor in Bet365’s popularity and offers made available to the bettors.

Engagement, promotions and offers are key driving factors

More than half of all monthly sports bettors who placed a bet on the UCL final (57%) stated that betting on the match helped them feel more engaged with the game.

More than half (54%) indicated that receiving adverts and other communication is a useful reminder to place their bets, helping them act on their intention. Three out of five bettors (65%) who didn't intend to, placed a bet due to such promotions.

Good value for money also holds a considerable sway, with 57% of bettors motivated by special offers and 64% holding out on placing their bet until receiving these offers.

An increase in TV ads (15%), social media ads (13%), online ads (15%), and window & newspaper ads (7%) in the lead up to the final game is also a key factor in influencing bettor behaviour.

However, as senior research director and webinar panellist Richard Moller reminds us, “whilst offers can have a big impact on the increase in brand awareness, there could be an argument to say that it limits the scope of betting activity".

Looking forward to the FIFA World Cup

Just like the UEFA Champions League final, the FIFA World Cup - especially the first game - is going to be one of the biggest customer acquisition opportunities for online sportsbooks in Europe. The increasing success of Bet365 shows us that building brand loyalty and engagement is going to be key when looking forward to November’s event.

Discover more leisure and entertainment content here