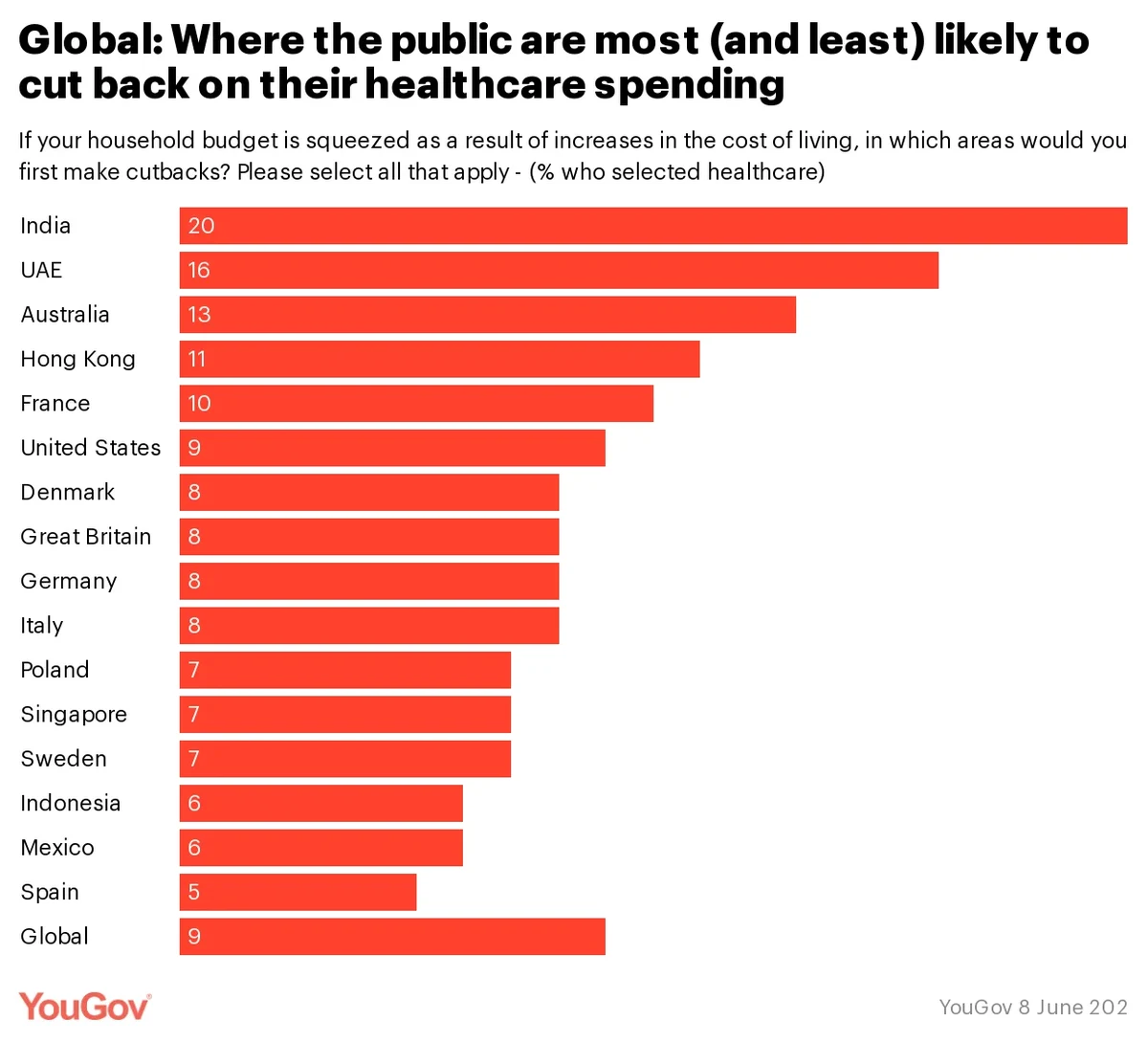

Global: Where the public are most and least likely to cut back on their healthcare spending

Rising inflation across the globe has led some consumers to think about where they can – and can’t – afford to limit their spending. Global YouGov data indicates that healthcare is the area where people are least likely to cut back as a priority: just 9% of consumers across all 17 markets in this study say they’d tighten their belts first in this area, compared to some 61% who say they’d try to eat out at restaurants less in response to the rising cost of living.

But our data also shows some variation among the markets we have surveyed. At the upper end of the scale, a fifth (20%) of Indian consumers plan to prioritise reducing their healthcare spending if the rising cost of living squeezes their household budget; nearly as many consumers in the UAE (16%) feel the same. Australian consumers are further behind in third place (13%), and Hong Kongers (11%) and French (10%) consumers even more so, as the fourth and fifth-most likely markets to reduce healthcare spending first.

Consumers are least likely to reduce healthcare spending immediately in Spain (5%), Mexico (6%) and Indonesia (6%). It is possible that healthcare spending is less likely to be reduced because it is more likely to be covered by governments or insurance policies (which 12% of consumers are expected to cut back on). For many it simply may not be a regular enough expense for cutting back to make much difference to a regular monthly budget.

Methodology

The data is based on surveys of adults aged 18 and over in 18 markets with sample sizes varying between markets. All surveys were conducted online in June 2022. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.

To receive monthly insights about the health and pharma industry register here.

To read YouGov’s latest intelligence on the health and pharma sector explore here.