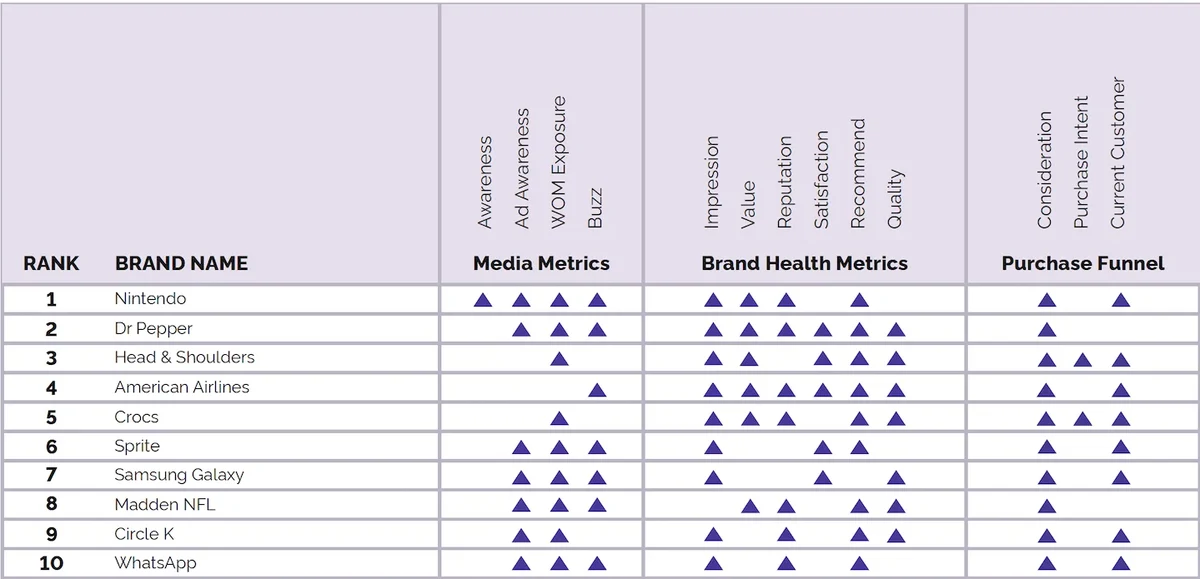

US Biggest Brand Movers – January 2022

Every month, YouGov highlights the brands registering notable upticks in brand health and advertising performance.

Nintendotakes the top spot among US brands this month, finding success during the holiday season despite a

plaguing many tech brands.

The video game company released a new OLED version of its popular Switch console just in time for the 2021 holiday season and

many gamers seemed to welcome the idea of a console refresh

. According to YouGov BrandIndex, which tracks consumer perceptions toward brands, Nintendo improved across ten out of 13 brand metrics.

Consumer goods brand

Dr Pepperalso saw gains across ten out of the 13 YouGov brand metrics though the brand registered lifts in different areas. Dr Pepper’s growth across key brand health metrics such as Impression, Value, Reputation, Satisfaction, Recommend and Quality overlaps its sponsorship of college football and indicates how strongly the bottled beverage brand has been viewed through the eyes of its customers this month. And while Dr Pepper may tie Nintendo in the number of areas it improved on this month, Nintendo’s new brand health score sits above that of the soda brand’s and secures it the top spot (35.7 vs. 24.1)

Anti-dandruff shampoo brand

Head & Shouldersmade significant gains in purchase funnel metrics such as Consideration, Purchase Intent and Current Customer. This shows the brand’s success at converting those in-market for hair care products to customers of the brand right now.

Despite concerns over new variants during the holiday season,

American Airlinesmanaged to improve in nine of the 13 brand metrics in our analysis. This includes improvements across the board in brand health measures— Impression, Value, Reputation, Satisfaction, Recommend and Quality—that are decided by American Airlines’ customers.

Footwear brand

Crocsalso showed improvement in nine brand metrics, including all three purchase funnel metrics (Consideration, Purchase Intent and Current Customer). The shoe company became a fashion success during the pandemic as consumers came to value comfort more and even pledged to go completely vegan by 2021.

Technology brands

Samsung Galaxyand

WhatsAppalso make the list of top ten Biggest Brand Movers in the US, each making improvements in eight of the 13 brand metrics. At a critical point in the holiday season, the Samsung Galaxy phone series saw lifts in brand awareness, specifically in metrics that measure Advertising Awareness, Word of Mouth exposure and Buzz. The popular phone line also seems to be improving its customers’ experience with its products, making significant improvements to its Impression, Satisfaction and Quality scores among its customers during this period.

Convenience store and fuel retailer

Circle Kended the year with improvements in eight of the 13 brand metrics in this evaluation, including Ad Awareness, Word of Mouth exposure, Impression, Reputation, and Recommend. Following the convenience store operator rolling out checkout-free technology in select Arizona Circle K stores and announcing that more than 9,000 stores will transform into PokéStops and Gyms in a partnership with Niantic, Inc., Circle K also saw lifts in Consideration for the brand.

Methodology:

Data for the Biggest Brand Movers in January compared statistically significant score increases across all BrandIndex metrics between November and December 2021. Brands are ranked based on the number of metrics that saw a statistically significant increase from month to month. Metrics considered are:

Media Metrics

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Health Metrics

Awareness – Whether or not a consumer has ever heard of a brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Impression – Whether a consumer has a positive or negative impression of a brand

Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Recommend – Whether a consumer would recommend a brand to a friend or colleague or not

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within a specified period