Brand Profile: State Farm

Last month, YouGov BrandIndex’s 2021 Finance Purchase Funnel Rankings highlighted the banking and insurance businesses that are best at turning brand awareness into consideration.

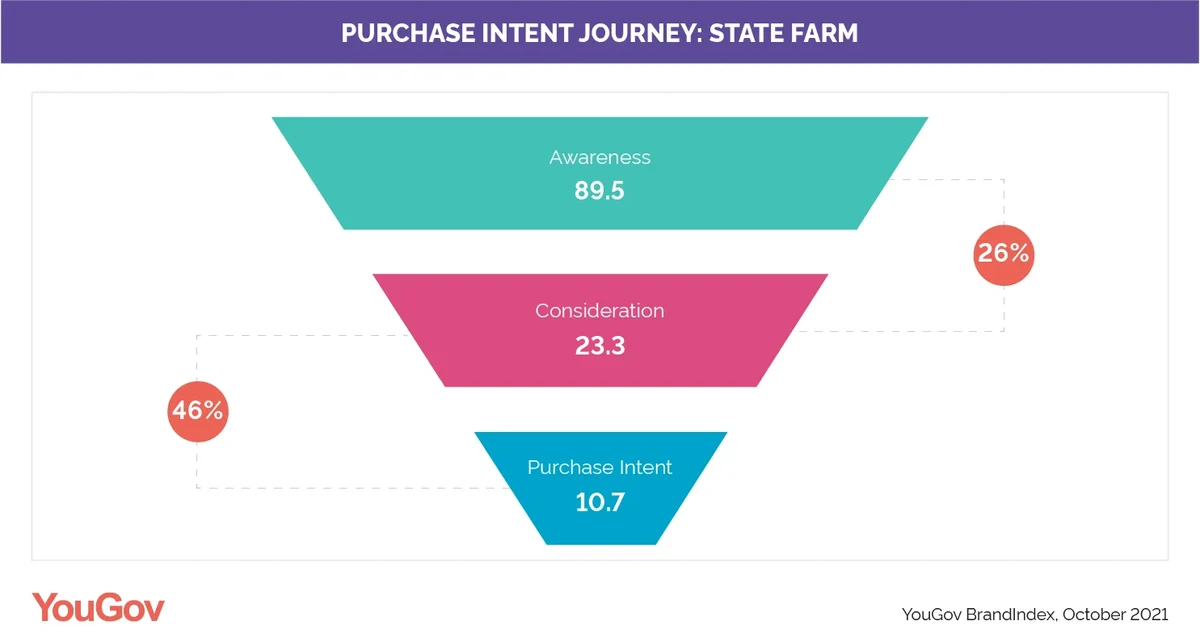

To do that, we looked at the highest Consideration scores among consumers who are aware of each brand over a 12-month period. This year’s winner in the US insurance market was State Farm: almost a quarter of adult consumers (23.3%) are aware of the company and would consider them when next in market – giving them a conversion rate of 26% from all those aware of the brand.

Among those who would consider State Farm, 46% say they would be likely to purchase from them when they are next in the market for an insurance product.

On a demographic level, consideration of State Farm is a mixed bag: 9% of Considerers (compared to 12% of the nation overall) are aged 18-24, 16% are aged 25-34 (vs. 18%), 18% are aged 35-44 (vs. 16%), 16 are aged 45-54 (vs. 17%), and 42% are over 55 (vs. 37%). The gender split is in line with the general population: 50% male vs. 50% female.

Considerers of State Farm also demonstrate some key differences in their attitudes: nearly three in five say they tend to trust banks and credit unions (57%) next to just over half of the general population (53%). They also show a generally higher propensity to use cash for in-store purchases (69% vs. 61% nat rep) – which may reflect the older makeup of this audience. That said, they can’t reasonably be called technophobes: this group are considerably more likely to say they’re using Paypal for mobile payments (46% vs. 37%), for example.

Overall, State Farm’s audience are slightly older at the far end of the scale (55+), and a slightly more old-fashioned group – but one with enough clout to put them firmly at the top of our rankings.