One in two urban Indians are early adopters of technology, predominantly young and affluent

- New YouGov whitepaper reveals habits and attitudes of early tech adopters across 25 markets worldwide

- Technophiles in India skew towards the 18-34 years demographic to a greater extent than many other surveyed markets

- More than three in five (62%) dedicated followers of new technology are males

- Dedicated followers are twice more likely than the public to get influenced by opinions of celebrities and influencers

YouGov’s new research shows India has a high proportion (49%) of early tech adopters, and they are eager to buy new products as well as adopt new technology.

The “First in Line: Early technology adopters around the globe” whitepaper looks at technology adoption across 25 markets worldwide, based on more than 370,000 interviews with consumers about their tech habits and attitudes. In addition to this, the report includes deep dive analysis of technology adoption in six key markets.

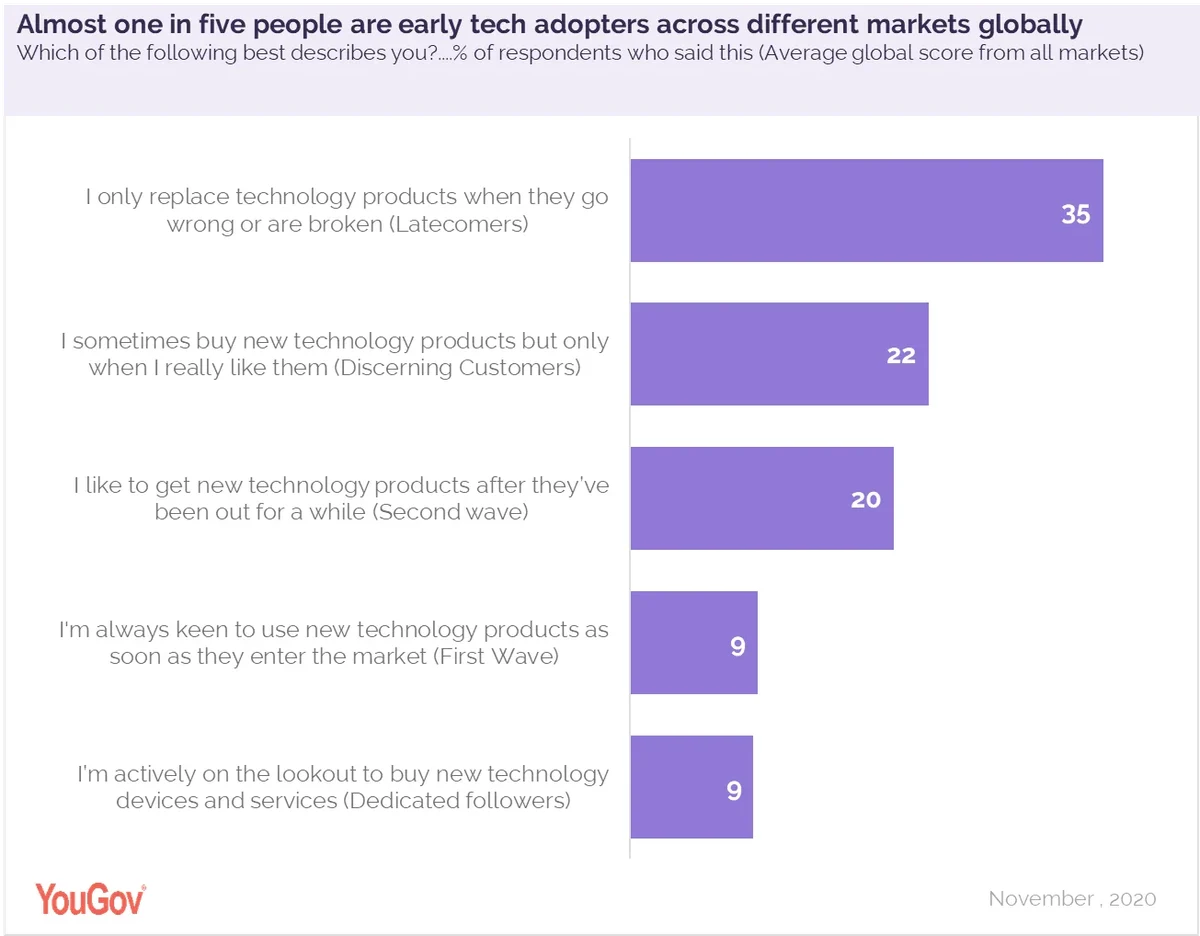

The data reveals that almost a fifth (18%) of consumers across 25 markets are early adopters of technology – with 9% saying they’re “actively on the lookout” for new devices and services (dedicated followers), and another 9% saying they’re “always keen” to use new products as soon as they’re available (first wave consumers).

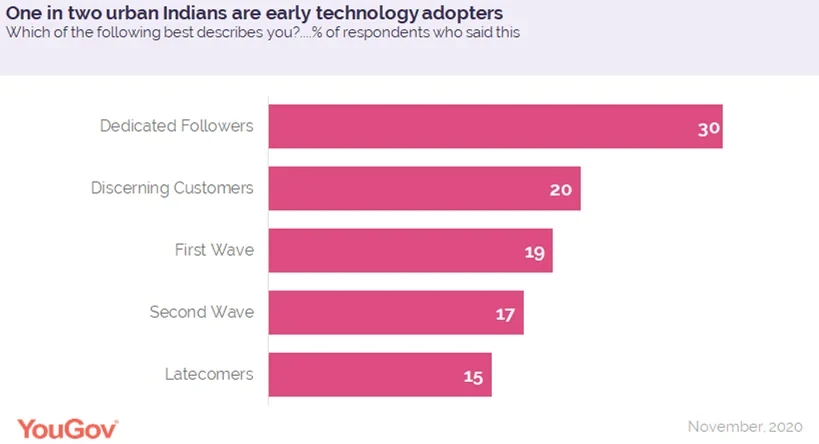

In India (where the sample is an urban rep), around half (49%) of the consumers meet the criteria – with one in three (30%) belonging to the “dedicated followers” group and a fifth (19%) to the “first wave consumers”. Latecomers account for just 15% of the online population. The second wave make up 17% of the Indian online population while discerning customers make up another 20%.

The early adopters are a lucrative group for anyone in the technology sector. By demographics, they tend to be younger (the largest proportion are often within the 18-34 age groupings), male and affluent.

In India, specifically, early adopters skew towards the 18-34 years demographic to a greater extent than many other surveyed markets. When it comes to personal disposable income, a third of early adopters (34% DF 35% FW) have between 10,001 – 50,000 rupees per month to spend on themselves, compared to 28% of the urban online population.

In terms of attitudes, the early adopter group in India tends to be aspirational and are comfortable taking risk with their money. They enjoy testing new products before they go on sale.

Their attitudes appear consistent with the public in some areas but deviate from them in other important areas.

Dedicated followers, for example, are twice more likely than the public to take the opinions of celebrities and influencers into account when making a purchase (32% dedicated followers vs. 16% online rep). A similar difference is visible when looking at their attitudes towards brands, where they are more likely to say that brands must connect with customers in real life in order to be successful (64% vs. 55%).

Dedicated followers’ affinity towards social media also stands important for brands, as they are more likely to seek experiences that make for great content on social media (39% vs 24%). Therefore, if a brand wants to engage with these new tech enthusiasts, they should approach them with enticing ways rather than mundane marketing gimmicks.

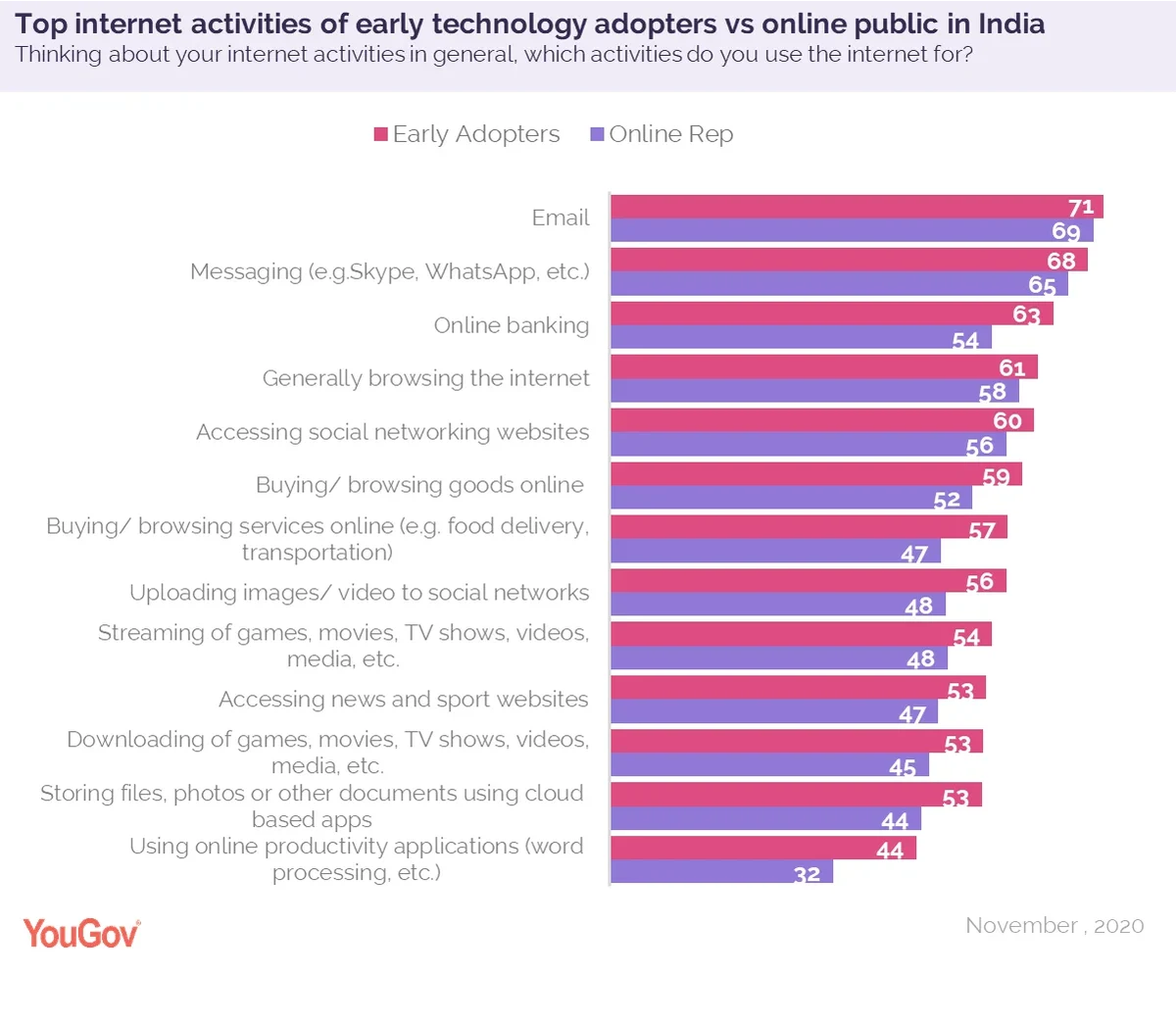

Early tech adopters in India differ from the online public even in terms of their usage of internet. This group of technophiles is more likely to engage in every category of digital activity such as browsing, email, messaging and streaming.

The key differences arise in the usage of internet for online productivity applications such as word processors, where 44% early adopters use the internet for this purpose as compared to 32% online population. There are notable differences while using the internet for buying/ browsing services online (57% vs 47%), and usage of cloud-based apps (53% vs 44%).

This suggests that while there is still a substantial general audience for these products, marketers may want to emphasize aspects that appeal to consumers with higher technological literacy and enthusiasm.

Speaking about the whitepaper, Russell Feldman, Director of Digital, Media and Technology research at YouGov: “YouGov’s whitepaper shows that India has a substantial proportion of early tech adopters, with a high appetite for technology as well as high engagement with it.

Although eager to try new products, these tech enthusiasts differ from the online public in terms of their expectations from brands. Their aspirational and risk-taking nature makes them a lucrative group for those in the business of technology. Therefore, understanding audience demographics, sentiments and trends within the sector is key for brands looking to target this highly engaged group of consumers."

Download the full whitepaper here.

Methodology

For this study, YouGov used data from our leading syndicated tool, YouGov Profiles – which, together with BrandIndex, forms part of our YouGov Plan & Track suite that enables businesses to make informed decisions about the trajectory of their businesses.

| Code | Market | Region | Sample | Data set |

|---|---|---|---|---|

AU | Australia | Pacific | Nat Rep | Profiles+ Australia 2020-10-18 |

VA | Canada | North America | Nat Rep | Profiles+ Canada 2020-10-18 |

CN | China | Asia | Nat Rep | Profiles+ China 2020-10-18 |

DK | Denmark | Europe | Nat Rep | Profiles+ Denmark 2020-10-18 – English |

FI | Finland | Europe | Nat Rep | Profiles+ Finland 2020-10-18 – English |

FR | France | Europe | Nat Rep | Profiles+ France 2020-10-18 – English |

DE | Germany | Europe | Nat Rep | Profiles+ Germany 2020-10-18 – English |

GB | Great Britain | Europe | Nat Rep | Profiles+ Great Britain 2020-10-18 |

HK | Hong Kong (Online-Rep) | Asia | Online Rep | Profiles+ Hong Kong 2020-10-18 |

IN | India (Urban rep) | Asia | Online Urban Rep | Profiles+ India (urban) 2020-10-18 |

ID | Indonesia (Online-Rep) | Asia | Online Rep | Profiles+ Indonesia 2020-10-18 |

IT | Italy | Europe | Nat Rep | Profiles+ Italy 2020-10-18 – English |

JP | Japan | Asia | Nat Rep | Profiles+ Japan 2020-10-18 – English |

MY | Malaysia (Online-Rep) | Asia | Online Rep | Profiles+ Malaysia 2020-10-18 |

MX | Mexico | North America | Nat Rep | Profiles+ Mexico 2020-10-18 – English |

NO | Norway | Europe | Nat Rep | Profiles+ Norway 2020-10-18 – English |

PH | Philippines (Online-rep) | Asia | Online Rep | Profiles+ Philippines 2020-10-18 |

RU | Russia | Europe | Nat Rep | Profiles+ Russia 2020-10-18 – English |

SG | Singapore | Asia | Nat Rep | Profiles+ Singapore 2020-10-18 |

ES | Spain | Europe | Nat Rep | Profiles+ Spain 2020-10-18 – English |

SE | Sweden | Europe | Nat Rep | Profiles+ Sweden 2020-10-18 – English |

TW | Taiwan (Online-rep) | Asia | Online Rep | Profiles+ Taiwan 2020-10-18 |

TH | Thailand (Online-rep) | Asia | Online Rep | Profiles+ Thailand 2020-10-18 |

US | USA | North America | Nat Rep | Profiles+ USA 2020-10-18 |

VN | Vietnam (Online-rep) | Asia | Online Rep | Profiles+ Vietnam 2020-10-18 |