Global: Where do consumers prefer Buy Now Pay Later plans?

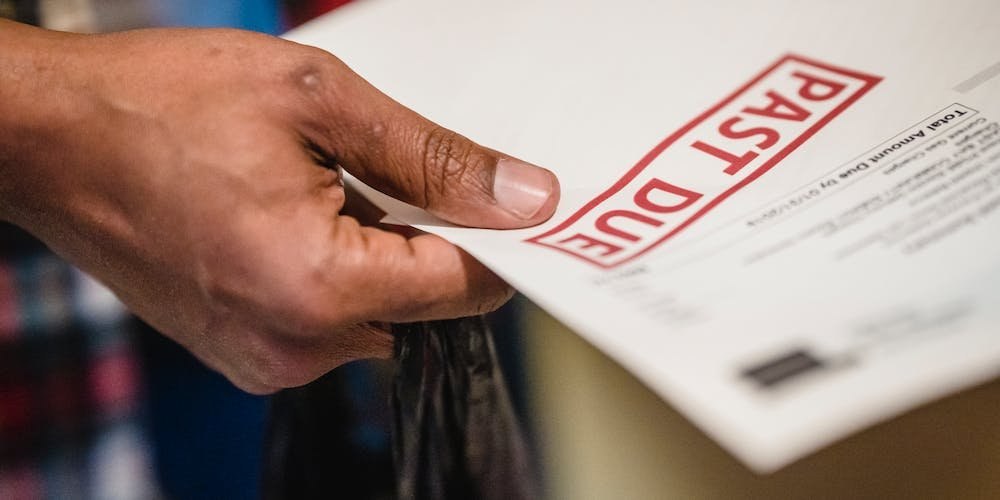

“Buy Now, Pay Later” plans have become a contentious topic in retail circles. While some commentators praise how these schemes allow consumers to finance their purchases over a longer period of time, others caution against their potential for amassing unsustainable levels of debt.

When you ask consumers about their preferred options for purchasing an item when they can’t afford it outright, the most popular choice – cited by a third of all respondents across 17 global markets (35%) – is to simply not buy the item. The next most popular selection was traditional credit cards (28%), chosen by nearly three in ten.

But Buy Now Pay Later (BNPL) plans came in a very close third, with over a quarter (27%) saying they’d pick them over any alternative purchase method. Naturally, there’s some variation from market to market.

Perhaps surprisingly, given that it is home to arguably the most well-known Buy Now, Pay Later firm of all, Sweden is among the countries where consumers are least likely to use these schemes. Just over a fifth (22%) say they would use them if they could not afford the upfront cost of an item. And given that Denmark is the only country where consumers are less likely to cite BNPL as a preferred option (17%), it looks like an unpopular option for the Scandinavian public.

Consumers in East Asia are also less inclined to use these tools: members of the Hong Kong (26%), Singaporean (25%), and Chinese public (22%) are all below the global average. Americans also hover beneath the 17-market total.

At the other end of the table, Indonesian (38% - online rep), Indian (32% - national urban rep), Mexican (32% - national urban rep) and Polish consumers (31%) are most likely to opt for BNPL plans when making a purchase they otherwise wouldn’t be able to financially justify.

Methodology

The data is based on the interviews of adults aged 18 and over in 18 markets with sample sizes varying for each market. All interviews were conducted online in December 2021. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.

Receive monthly topical insights about the banking and insurance industry, straight to your inbox. Sign up today.

Discover more banking and insurance content here