The impact of pursuing CSR goals on sports and brand perception in Britain

YouGov conducted a comprehensive survey to gather insights from 2,022 Britons on their thoughts and awareness of CSR in popular sports such as football, rugby, tennis, motorsport, golf and cricket.

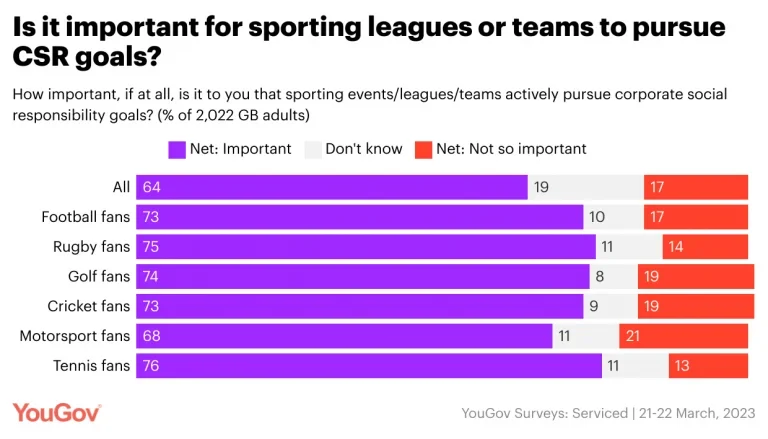

Two-thirds of Britons say it is important for sports events/leagues/teams to actively pursue CSR goals (64%). The strongest support comes from tennis fans, where over three-quarters (76%) view it as important. Although still a majority, motorsport fans are least likely to say it is important to pursue these goals (68%). This suggests a broad agreement among sports enthusiasts in Britain that CSR should be an integral part of the sports industry. For this study, fans are consumers who watch or follow the sport.

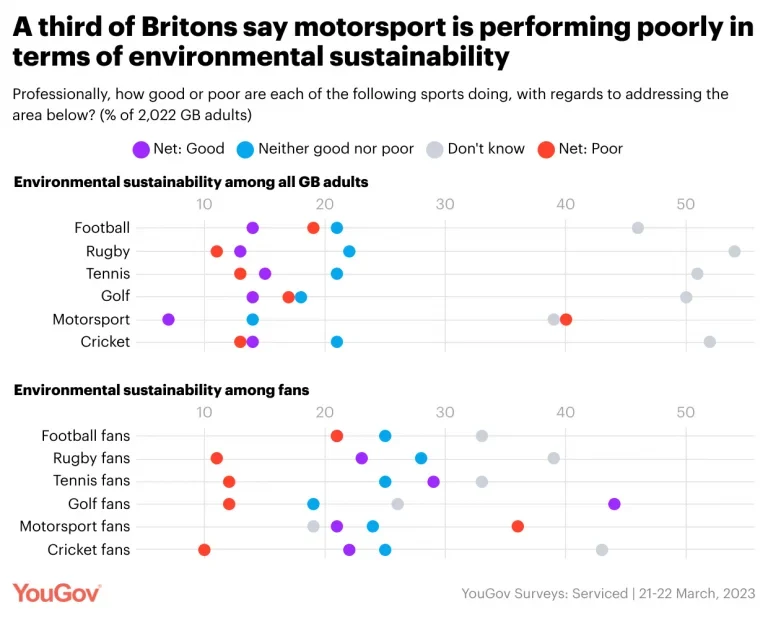

Our data reveals interesting insights into perceptions of environmental sustainability, athlete welfare, and community activities within various sports among Britons.

Environmental sustainability represents the most significant challenge, as the majority of the ratings fall in the “neither good nor poor” category. Motorsport is perceived to be performing the worst, with two-fifths of 2,022 Britons and a third of motorsport fans (36%) rating the sport as poor in environmental sustainability. Golf is the exception – two in five golf fans (44%) say the sport is performing well in terms of environmental sustainability.

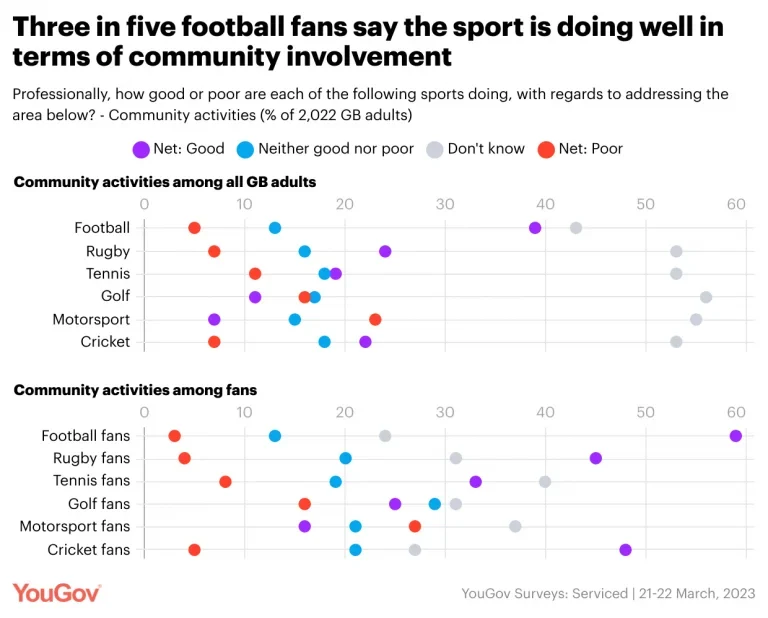

In terms community involvement, football leads the way, with three in five football fans (59%) rating the sport positively. Rugby (45%) and cricket (48%) follow suit. Motorsport and golf are lagging behind in terms of community engagement, most likely due to the comparatively lower number of Britons participating in these sports as compared to others.

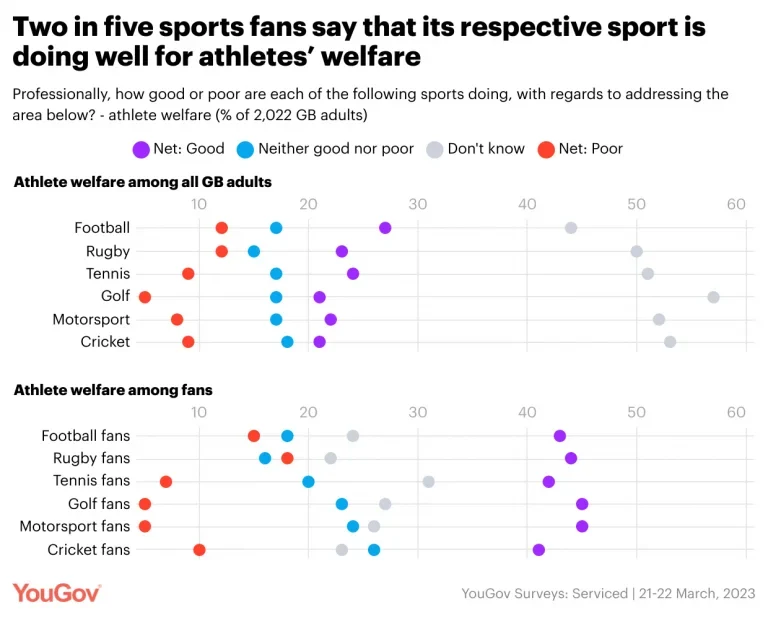

More than one in five Britons believe that football (27%), rugby (23%), tennis (24%), motorsport (22%), and cricket (21%) are positively impacting athlete welfare. However, when looking specifically at fans of each sport, these percentages nearly double (43%, 44%, 42%, 45%, and 41% respectively).

Broadly, sports are seen to be performing best in terms of athlete welfare (which is perhaps to be expected), followed by community activities, with environmental sustainability being the area with the most room for improvement. Fans of specific sports, especially football, rugby, and cricket, have a more positive outlook on their sports’ community engagement.

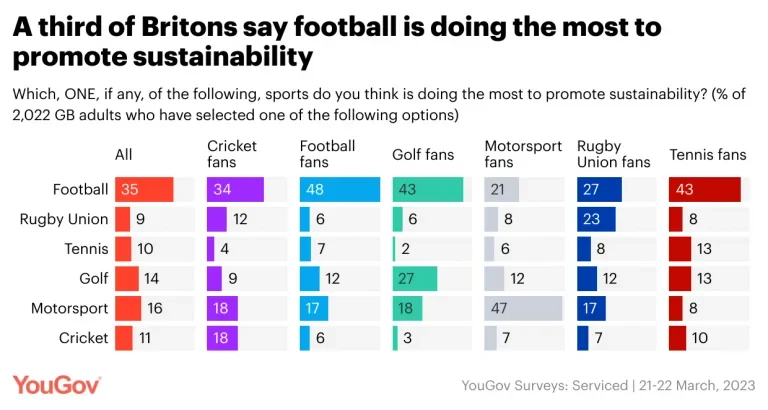

Digging further into what specific sports are doing the most to promote sustainability, football emerges as the leader with a third of Britons (35%) and nearly half of football fans (48%) saying that it is best in promoting sustainability. Motorsport is the most divisive among motorsport fans. Despite being rated ‘poor’ for environmental sustainability, nearly half (47%) credit it for promoting sustainability.

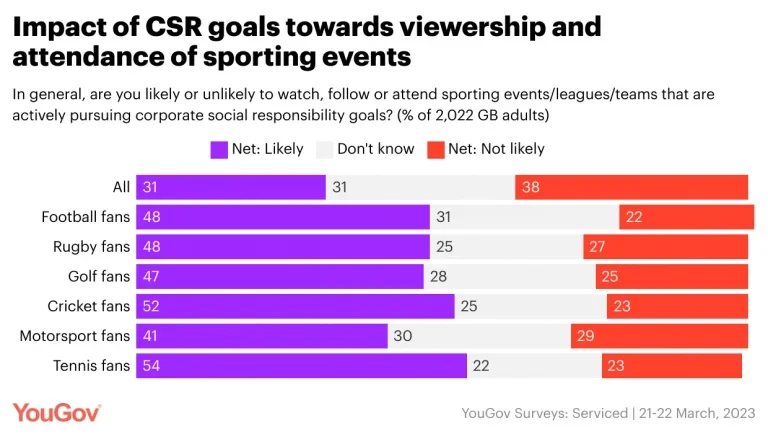

Our data further shows that actively pursuing CSR goals can positively impact the viewership and attendance of sporting events, leagues, and teams. Over half of tennis fans (54%) are more likely to watch a sport or event knowing it is actively pursuing CSR objectives. Notably, adults aged 18-24 (42%) are significantly more likely to watch sports events that pursue CSR goals, suggesting that embracing CSR could be an effective strategy to attract and engage younger fans to a game.

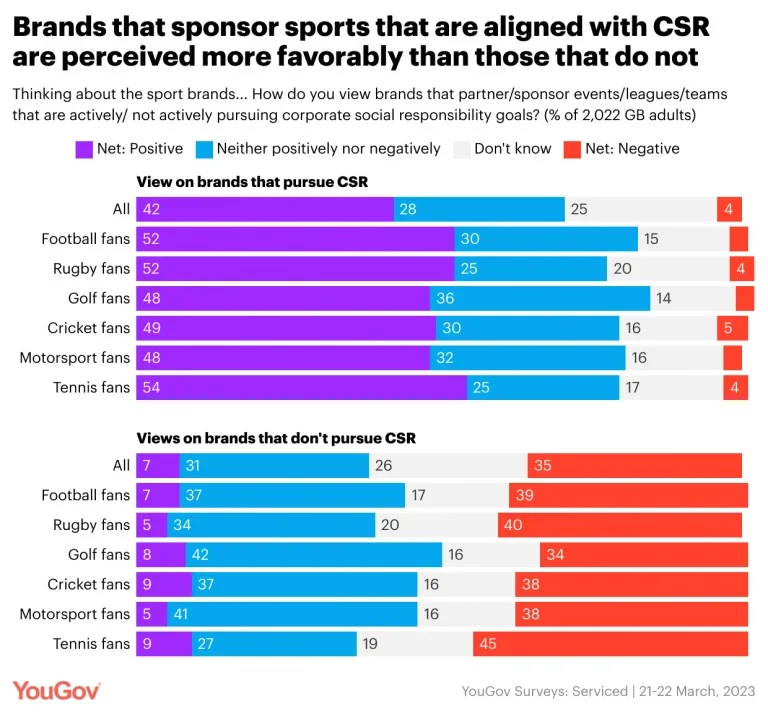

Brands that sponsor CSR-aligned sports or events are viewed more positively than those that do not (42% positive vs 35% negative). This view is particularly strong among tennis fans (54%) and adults aged 18-24 (54%). As a result, brands should actively seek partnerships with properties that demonstrate a strong commitment to CSR goals to bolster their positive perception among consumers.

Explore our living data – for free

Want to run your own research? Run a survey now

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Methodology: YouGov Surveys: Serviced provide quick survey results from nationally representative or targeted audiences in multiple markets. This study was conducted online on 21-22 March 2023 with a nationally representative sample of 2,022 adults in Britain (aged 18+ years), using a questionnaire designed by YouGov. Data figures have been weighted by age, gender, education, region, and race to be representative of all adults in Britain (18 years or older) and reflect the latest ONS population estimates. Learn more about YouGov Surveys: Serviced.