Almost a third of Indonesian residents say they have subscribed to a streaming platform

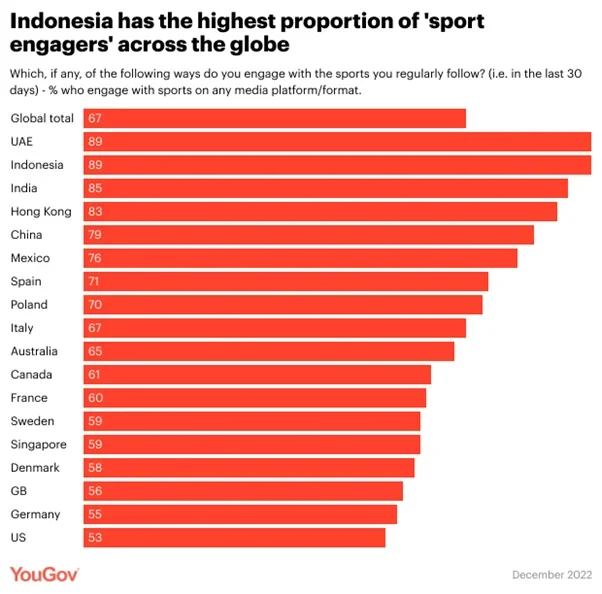

New data from YouGov’s latest report- The Global Sports Media Landscape, reveals that just over two thirds of global consumers (67%) follow sports on a regular basis (in the last 30 days) via various media platforms.

In this new report, YouGov sets out to understand how consumption of sports content is changing and how sports organizations need to adapt to keep up with changing media behavior.

Looking at the data by country, we see that Indonesia has the highest proportion of ‘sport engagers’, along with UAE (89% each). ‘Sport engagers’ are defined as those who engage with sports they regularly follow (in the last 30 days) across any traditional and digital media platforms or formats.

Other Asian markets reporting high level of sports engagement are India (85%), Hong Kong (83%) and China (79%). Comparatively, European countries and America register lower levels of engagement.

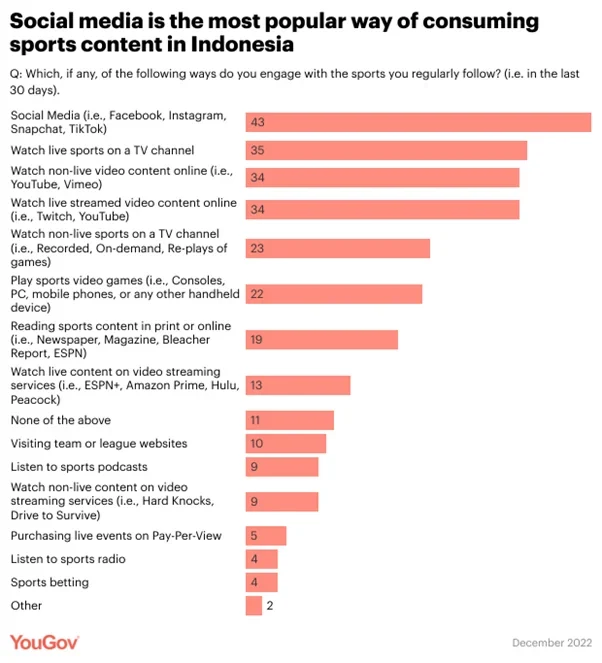

Examining how consumers engage with the sports they regularly follow by country reveals that live TV is the preferred method in 12 out of the 18 markets surveyed. Live sports on TV dominates in the more traditional European markets along with North America (US, Mexico, and Canada), whilst social media occupies pole position in all Asian countries.

In Indonesia, more than two in five people engage with sports on social media and it is the most popular way of consuming sports content (43%). Watching live sports on a TV channel (35%) and watching non-live content online (34%) are the next best ways to watch sports among Indonesian residents.

An examination of their streaming behaviour shows that nearly a quarter of Indonesian residents (32%) claim they have subscribed to a streaming platform or service to gain access to exclusive sports content, which is much above the global average of 21%.

Sports-led subscriptions enhance the level of sports consumption among subscribers. In fact, two-thirds of Indonesian residents (67%) report that their sports content subscription has encouraged them to consume more sports content with more than a quarter (28%) maintaining their current levels of sports viewership.

In the area of digital sports streaming and content, soccer is the most popular sport – with 53% of sports subscribers accessing soccer content. This increases to 73% in Indonesia. The next most popular sport among Indonesian sport subscribers is Racing (30%) and Basketball (23%).

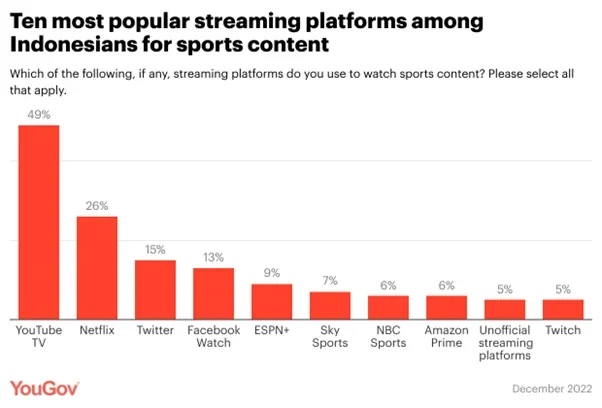

When it comes to the most popular platform for streaming sports content, YouTube TV is the top choice among a fifth (20%) of global consumers, rising to almost half (49%) among Indonesian consumers. Netflix is the next most popular streaming platform for sports among Indonesians (26%), followed by Twitter (15%).

While YouTube is popular across age groups of Indonesians, Netflix is more popular among 25–34-year-olds (at 35%) and Twitter has a greater significance among 18-24 years adults (at 24%).

Methodology: The insights in this report are drawn from a recent global YouGov Survey to understand the challenges and opportunities for sport in an evolving media landscape, how the consumption of sports content is changing, and what sports organizations should do to adapt to changing media behavior. Our research covers 18 global markets of more than 19,000 respondents. The survey results were further bolstered by connecting respondent level YouGov Research data to YouGov’s proprietary syndicated data solution for the sports industry specifically. Our survey was fielded from the 11th November to 30th November 2022. Data for Indonesia is based on an online sample of 1050 respondents. Data is adjusted with mild weighting using interlocking demographic characteristics.