Global: Will consumers wait for new cars?

The global chip supply crisis has impacted the availability of new models of car. Some of the cosumers have chosen second-hand cars as a compromise.

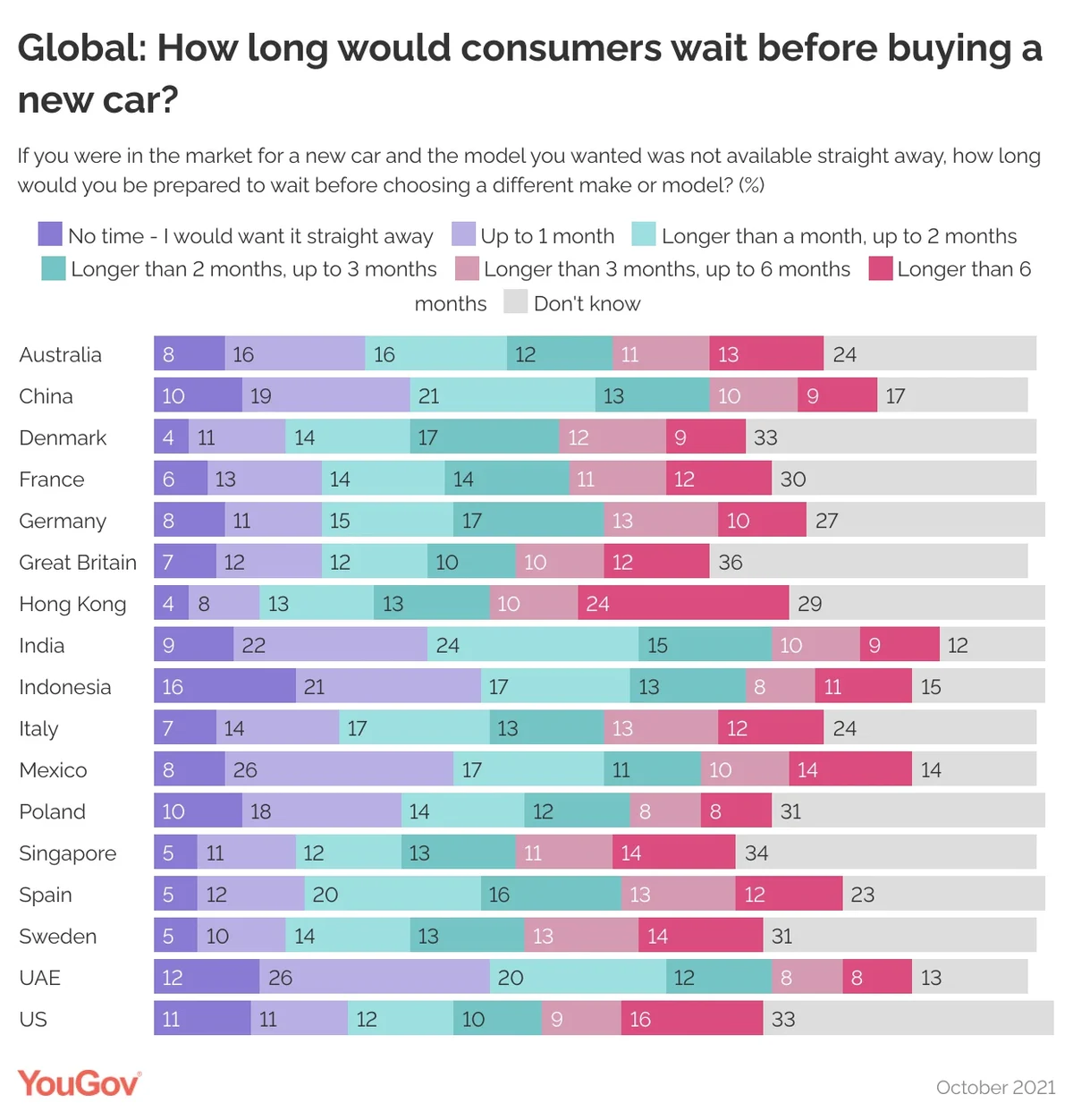

This naturally raises the question of how long consumers are prepared to wait before seeking out a different new model to the one they originally desired. Using new YouGov data, from across 17 global markets, we can say that just 12% would be willing to wait longer than six months, while 11% would wait between three and six months. Around one in eight (13%) said they’d wait two or three months, 16% would wait one to two months and 15% would wait for up to a month. Eight percent say they wouldn’t be prepared to wait any time and would want the vehicle straightaway. A quarter say they “don’t know”.

Adding some of these groups up, a quarter (23%) would be willing to wait for a month or less, and just over half (52%) would be willing to wait three months or less. That doesn’t necessarily give manufacturers a lot of time to resolve issues if they’re not producing enough models to meet demand.

Consumers are least likely to wait for a new model of car in the United Arab Emirates, where three in five (58%) would only be willing to wait for two months or less, and just 8% would be willing to wait more than six months. Indonesia, where 54% would wait two months or less and only 11% would wait six months or more, comes close, as does China (50% would wait two months or less; 9% would wait six months or more). Automakers operating in these markets therefore have an interest in getting replacement models to consumers in these countries as quickly as possible – or in getting acceptable replacements in front of consumers in good time.

In some countries, however, consumers are a little more patient. In Hong Kong, consumers are most likely to wait six months or more if it means getting the right car model (24%), with American buyers some way off as the runner-up (16%), and Singaporean, Mexican and Swedish consumers a little behind them (14% for all). Hong Kongers and Danes (4%) are least likely to want a new model straight away, with Singaporeans, Swedes, and Spaniards (5%) trailing very close behind.

Methodology

The data is based on the interviews of adults aged 18 and over in 17 markets with sample sizes varying in each market. All interviews were conducted online in October 2021. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.

Receive monthly topical insights about the auto industry, straight to your inbox. Sign up today.

Discover more Automotive content here

Want to run your own research? Start building a survey now