Automotive: Trends and insights round-up for 2021

In this piece, we’re rounding up the highlights of a year of automotive insights and trends.

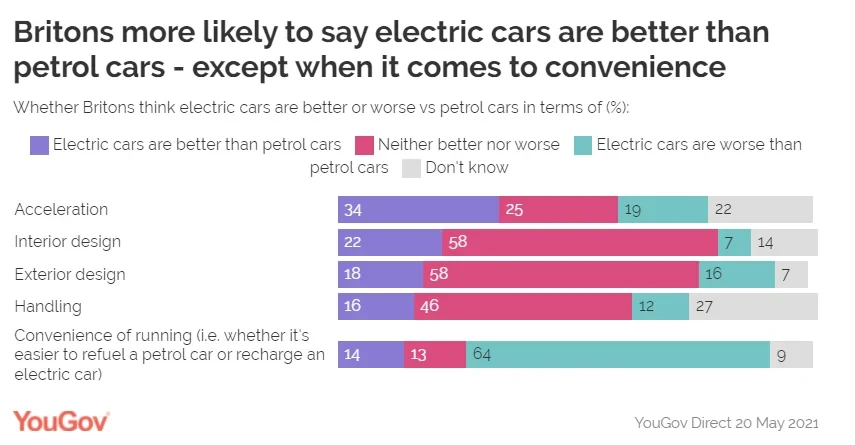

The automotive industry is headed towards an all-electric future. But has that altered consumer behaviour and sentiments this year? In a 17-market study, YouGov data revealed that even if all models were to cost the same, two in five global consumers would still prefer a hybrid engine (40%). A separate study among consumers in Great Britain – the second biggest home to electric cars in Europe – showed that while electric cars outperform petrol cars in a number of key areas, a comfortable majority of the public thinks battery-powered vehicles are more inconvenient to run than petrol cars (64%).

The automotive industry also witnessed behavioural shift among consumers in mobility and transformation because of the pandemic. YouGov’s International Automotive Report 2021 provides a detailed overview of these behaviours and sheds light on the relationship between the mobility and traditional automotive sector, examining what we should expect moving forward in a post-pandemic world.

This year, YouGov Profile Peek put the spotlight on consumers who are looking to purchase a new car over the next 12 months. The report revealed that in the US, this audience is more likely to be 30-44-year-olds than any other age group. It’s the same scenario in the UK – as more consumers between 35-44 years told us they plan to buy a car over the next year.

Mid-way through the year, we also turned our attention to how consumers in a number of key driving markets change their tyres. The survey indicated that Britons are most likely to change their tyres only when it is absolutely necessary: three in five car owners (60%) switch them out only when carrying on using them becomes untenable. Meanwhile, US car owners are most likely to change their tyres when something’s wrong with them or when it’s strictly required (46%).

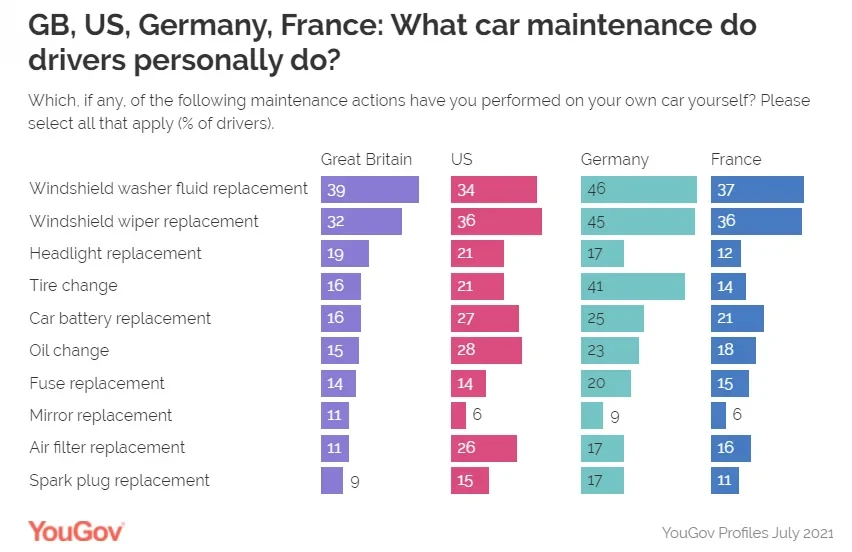

But are consumers changing their tyres on their own? What other car maintenance do drivers do personally? Our data showed that just two in five German drivers (41%), a fifth of US drivers (21%), and less than one in five British (16%) or French drivers (14%) have changed a tyre themselves. Beyond tyres, most drivers haven’t replaced their windshield washer fluid in Britain (39%), the US (34%), Germany (46%) or France (37%).

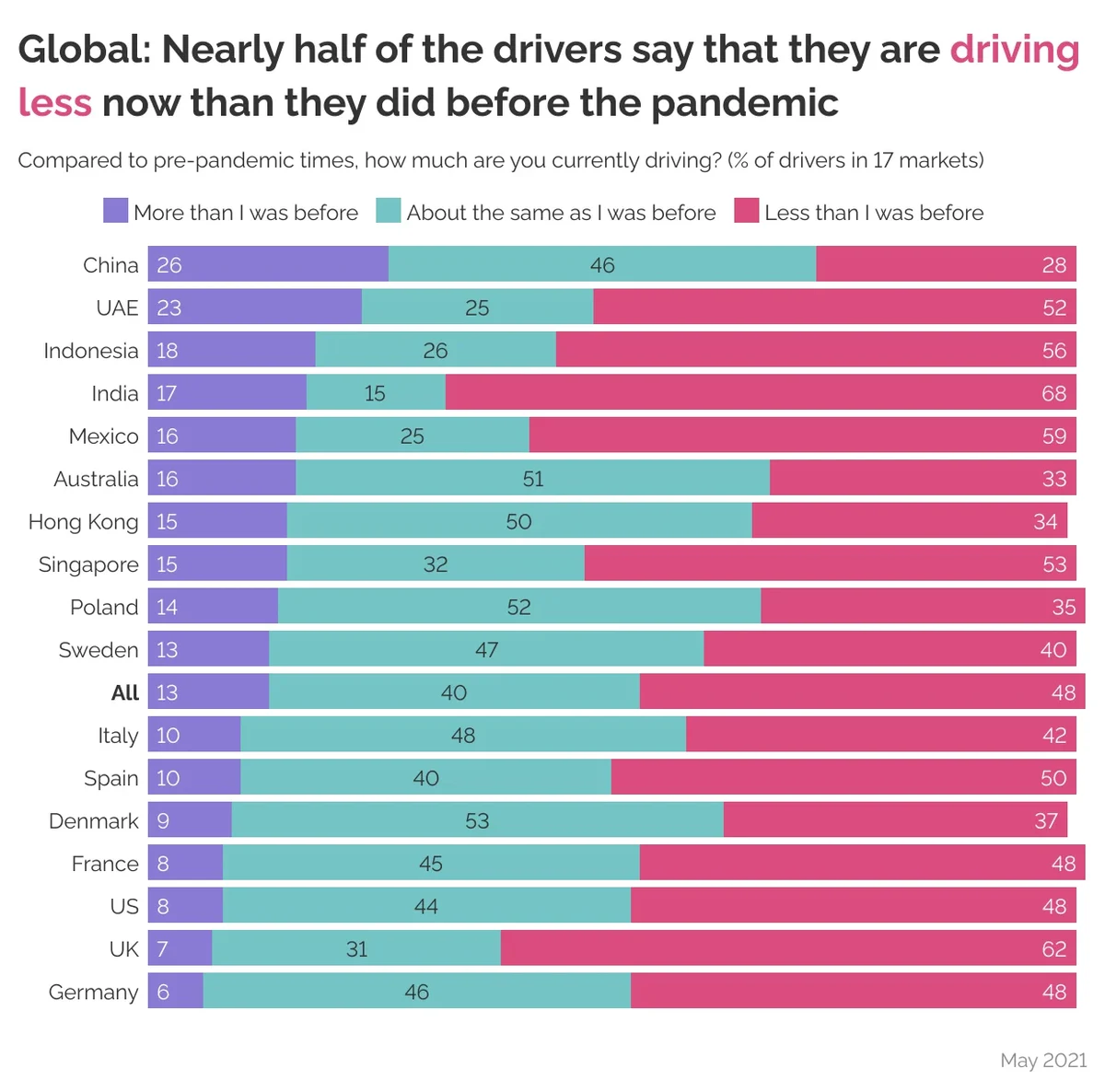

Issues around sustainability and climate change have been burning this year. A YouGov survey showed that over half of people with a driving license in Great Britain, Spain, the UAE, the US, and Australia agree with the statement: “We should drive less to save the environment”. Further, we also looked if there were changes to driving habits when compared to pre-pandemic times. The research indicated that nearly half of the drivers (48%) globally say that they are driving less now than they did before the pandemic. Closely following this group are drivers who are driving about the same as they did pre-pandemic (40%).

Later this year, a YouGov study also asked global consumers if they feel automotive companies are doing their bit to make durable products. Only half of global consumers feel that these companies are (49%), while 17% are unsure about the matter. A third of all consumers globally (33%) feel that automakers should be doing more to make their products more durable.

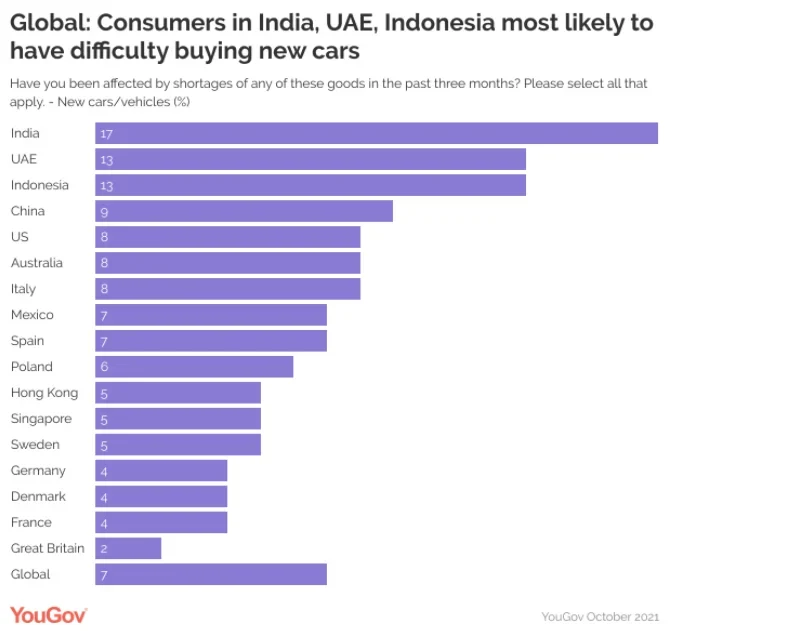

Finally, it’s no secret that the pandemic-induced global supply chain shortage impacted the automotive industry – halting sales in many parts of the world. A YouGov study showed that consumers in India (17% - national urban sample) have been most affected by shortages of new cars or vehicles, followed by the UAE (13%) and Indonesia (13%). Consumers are less likely to be affected in European countries: in Spain (7%), Poland (6%), Sweden (5%), Germany (4%), Denmark (4%), France (4%), and Great Britain (2%), fewer than one in ten reported being affected by shortages of new cars or vehicles.

As more people get vaccinated and relaxations around movement ease, consumer behaviours around car ownership and vehicle preference will be subject to change. YouGov will keep tracking these changes for marketers to get better insights about the automotive industry.

Talk to us about your data needs