On trend: America’s top fashion brands of 2024

When it comes to fashion, which brands are winning the hearts—and carts—of American consumers? From timeless staples to trendsetters shaping the future, we’ve compiled the definitive rankings of the most considered fashion brands in the US in 2024.

Leveraging data from YouGov’s always-on brand tracker, we can reveal the top names among the general population, but also those dominating with men, women, and Gen Z.

Plus, we spotlight the fashion brands making the biggest year-on-year gains—showcasing which brands are on the rise.

Ready to discover which fashion brands are setting the style agenda as we enter 2025?

- Top 10 fashion retail brands among the general population

- Top 10 fashion retail brands among men

- Top 10 fashion retail brands among women

- Top 10 fashion retail brands among Gen Z

- The most improved fashion retail brands year-on-year

- Americans' attitudes towards fashion

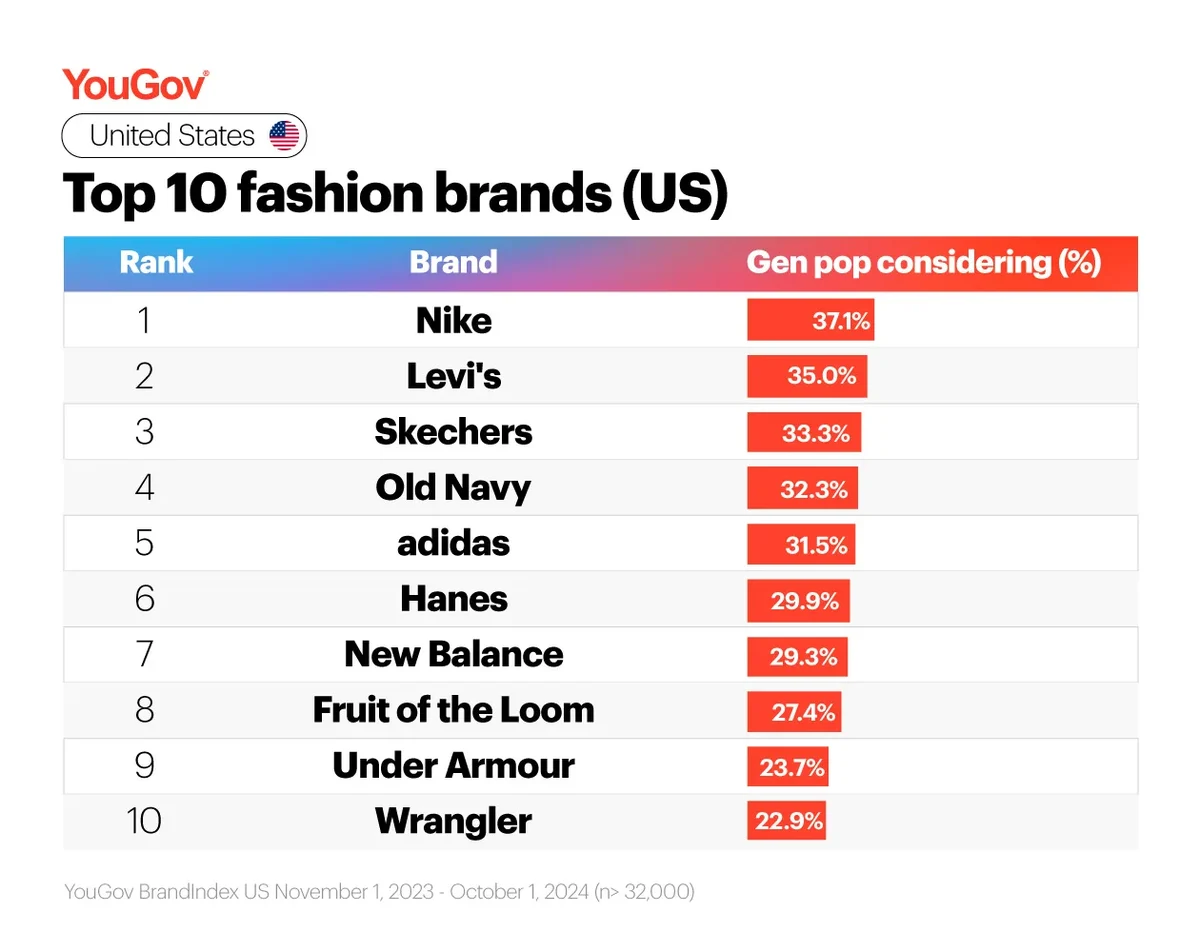

Top 10 fashion retail brands among the general population in the US

Nike swooshes ahead in our overall fashion brand rankings, with a consideration score among the general population of 37.1%.

Levi’s (35.0%), Sketchers (33.3%), Old Navy (32.3%), and adidas (31.5%) complete the top five.

How have fashion brand preferences evolved over the past decade?

Three brands have led our fashion rankings over the past 10 years: Nike, Levi's and, for a brief time in 2018, Old Navy. See the visualization below to track fashion brand consideration over time.

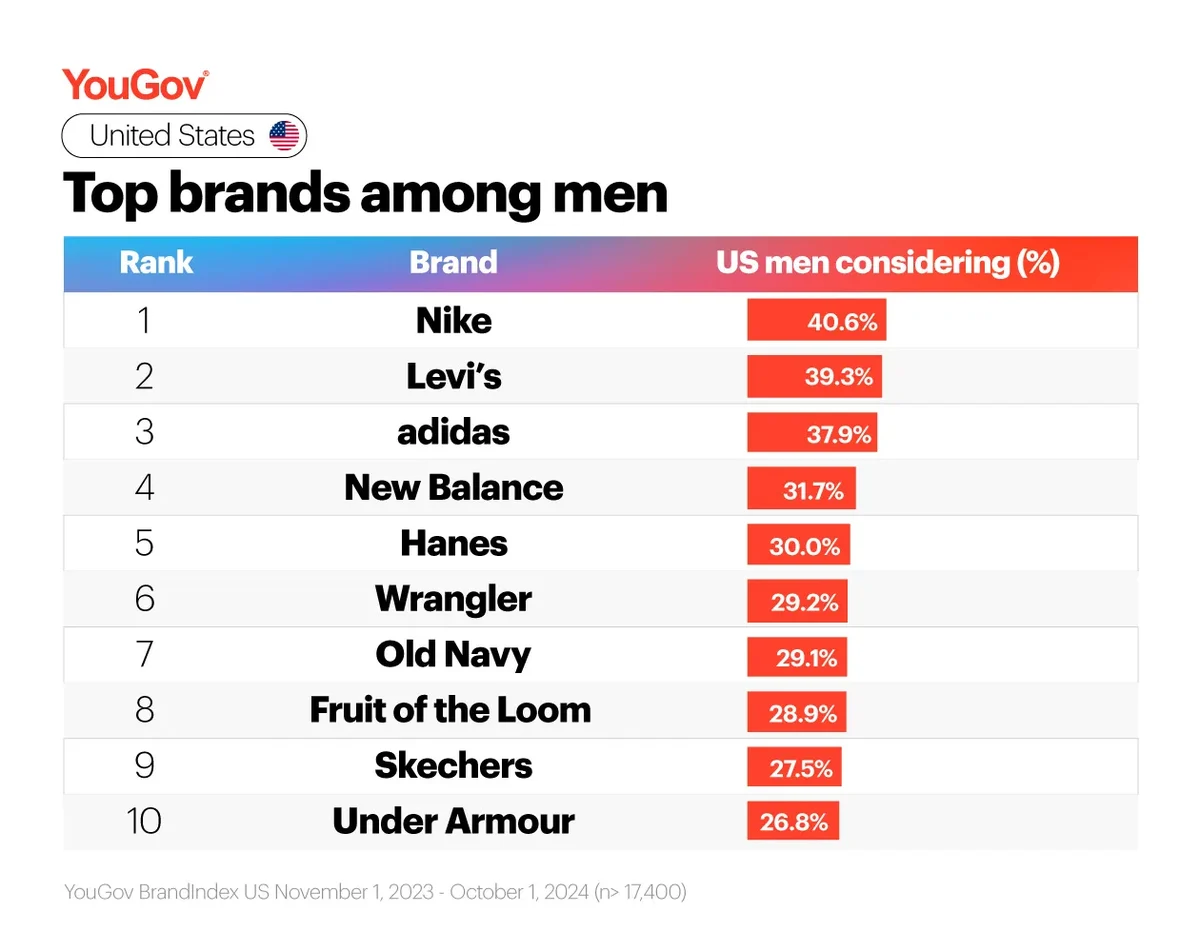

Top 10 fashion retail brands among men in the US

Looking into consideration among US men, athletic and casual wear brands have strong appeal.

Nike leads the way among the male demographic with a consideration score of 40.6%, followed by Levi’s (39.3%), adidas (37.9%), New Balance (31.7%), and Hanes (30.0%).

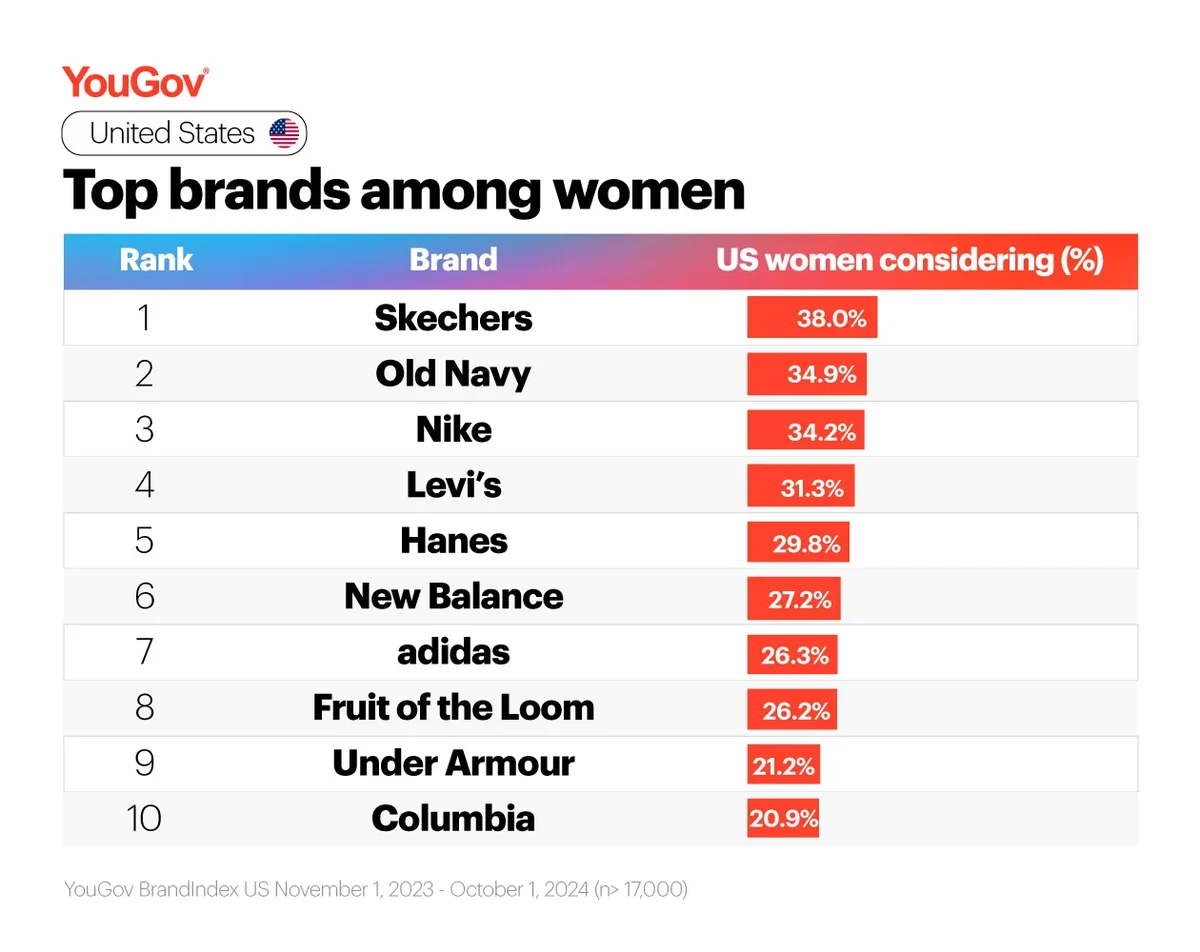

Top 10 fashion retail brands among women in the US

Skechers steps into the top spot as the most considered fashion brand among women in the US, with a consideration score of 38.0% – outperforming Nike among this demographic by 3.8 percentage points.

Old Navy secures second place (34.9%), followed by Nike (34.2%), Levi’s (31.3%), and Hanes (29.8%) to complete the top five.

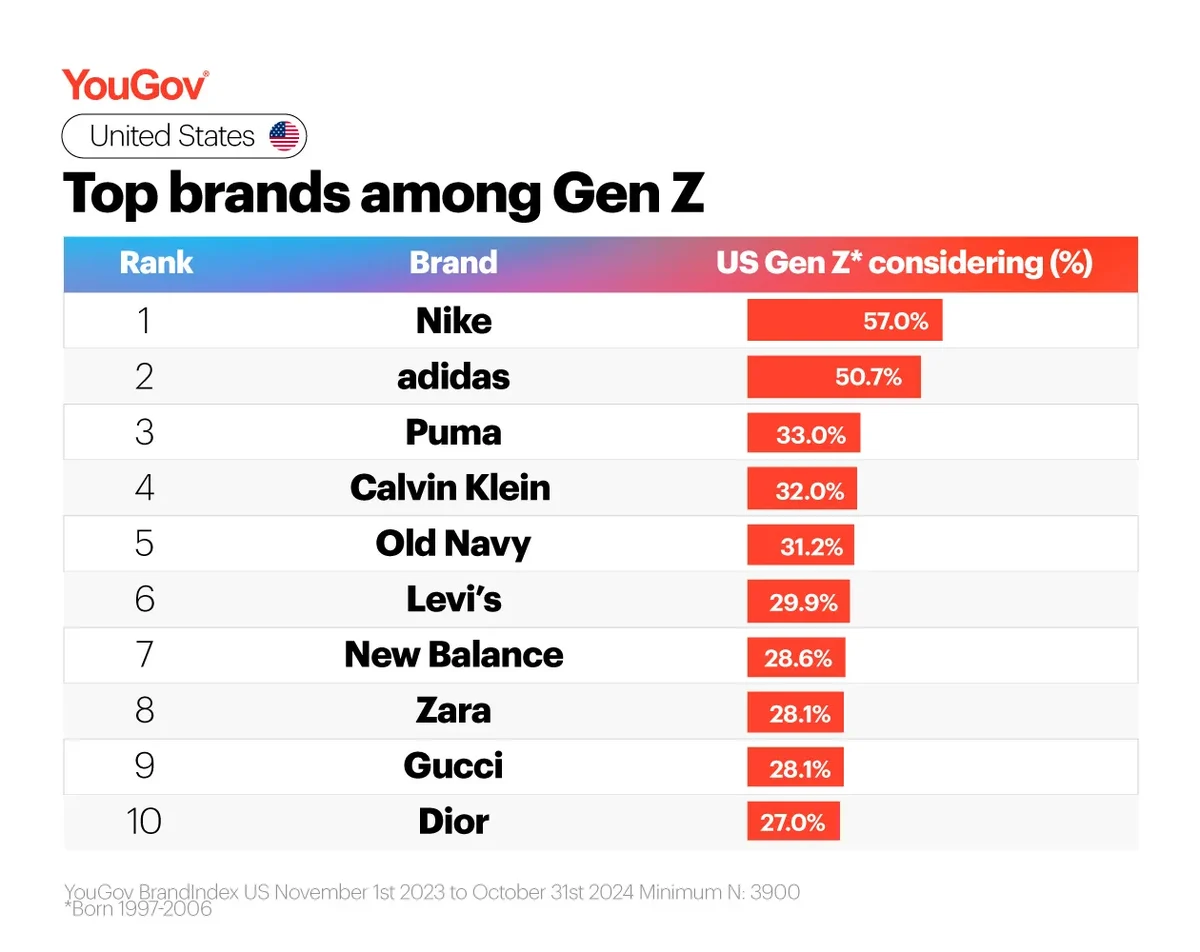

Top 10 fashion retail brands among Gen Z in the US

Sportwear brands reign supreme with Gen Z, with Nike, adidas, and Puma claiming the top three most considered brands among the demographic.

57% of Gen Z would consider Nike when they are next in-market, followed by adidas (50.7%), Puma (33%), Calvin Klein (32.0%) and Old Navy (31.2%).

Luxury brands such as Gucci (28.1%) and Dior (27.0%) also make the top 10 list, showing that Gen Z’s tastes span from streetwear to high fashion.

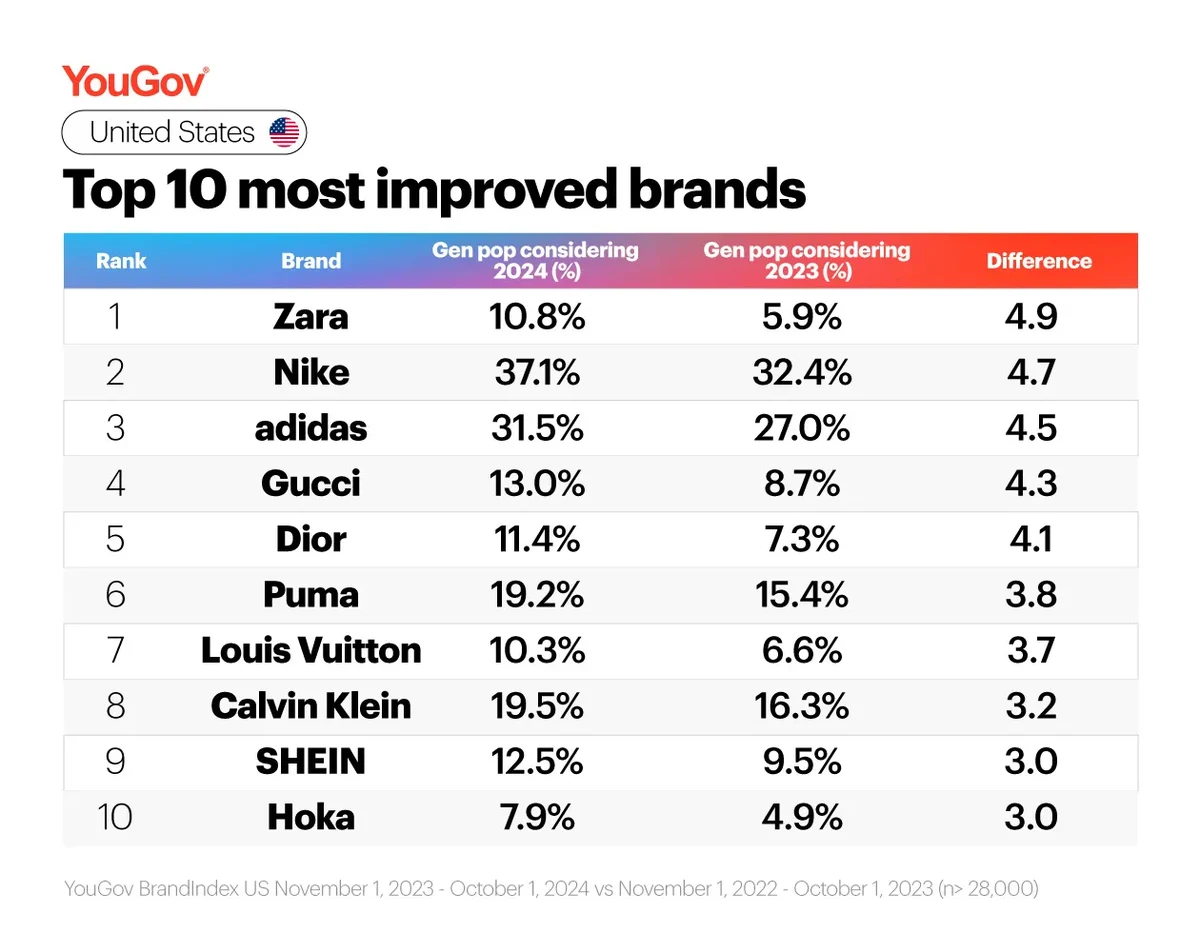

Most improved fashion retail brands year-on-year in the US

Zara leads the way as the most improved fashion retail brand in the US, with a year-on-year consideration increase of 4.9 percentage points.

Nike and adidas follow in second and third, recording growth of 4.7 percentage-points and 4.5 percentage-points respectively.

Gucci, Dior, and Louis Vuitton recorded significant growth, hinting at an increase in consumer consideration of luxury brands this year.

Americans' attitudes toward fashion

Beyond brand preferences, what do US consumers think about fashion, and how does this differ across gender, generation and geography? Here's a few key findings gleaned from YouGov Profiles:

Who's got fashion sense?

52% of Americans think of themselves as "well-dressed," with 54% of women holding that opinion of themselves, vs. 50% of men. However, asked whether they "keep up to date with current fashion trends," only 29% of Americans cast themselves as dedicated followers of fashion.

The most fashionable state of America?

Comparing state-by-state, New Yorkers (43%), Californians (41%) and Alaskans (40%) are the most likely to consider themselves to be “more fashionable than most people.” Residents of Wisconsin (16%) had the least confidence in their fashion sense, among states with reportable sample size.

Comfort or style?

79% of Americans say that when buying clothes, they choose comfort over style. Looking at this by generation, Baby Boomers were the most likely to opt for comfort, at 86%.

Investing in luxury

With luxury brands making a prominent appearance in the Gen Z rankings, we looked at attitudes towards high-end fashion among this generation. 41% of Gen Z Americans say they would pay more for luxury brands (compared to 32% of the general population), while 48% believe luxury goods are a "good investment" (vs. 34% of gen pop).

Socially responsible fashion

46% of all Americans say fashion brands should consider addressing social issues, with the percentage rising to 60% among Gen Z. Similarly, 45% of Gen Z consumers agree that they would "only buy clothes from sustainable brands."

Discover more brand rankings

Looking for a global view? Check out our fashion brand rankings for the United Kingdom, Germany, France, Singapore, and the Kingdom of Saudi Arabia.

Methodology

YouGov BrandIndex collects data on thousands of brands every day.

Brands are ranked based on their consideration score. To determine a brand’s consideration score, respondents are asked: When you are in the market next to purchase clothing and apparel, from which of the following would you consider purchasing?

For a brand to qualify, a minimum base size of 300 (N) is required. To qualify as a top ranked brand, brand must have scores for at least 6 months (183 days).

To qualify as a most improved brand, brand must have scores for at least 18 months (548 days).

Scores in this article are based on daily sample sizes of approximately 3,400 to 32,700 depending on audience.

Date ranges: November 1, 2023, to October 31, 2024 (stylized as 2024) and November 1, 2022, to October 31, 2023 (stylized as 2023).