Would lower cost options bring Starbucks new customers in Britain?

Coffee giant Starbucks recently revealed that global sales have dropped by seven percent between July and September, in response to which the company plans to introduce remedial changes, including changes to the pricing structure and simplification of the menu.

But can such changes win Starbucks new customers? New YouGov research, conducted via YouGov Surveys, reveals that 11% of Brits say they would be very likely to purchase from the brand more often if the brand introduced lower priced options. Another three-tenths indicate some likelihood of increasing their visits to or orders from Starbucks if lower priced options became available (29%).

Among those who consume food or beverage from other coffee chains regularly (at least once a week), but less often or not at all from Starbucks, the possible upside is even higher. About one in seven of these non-Starbucks coffee chain regulars (16%) say they would be very likely to purchase from Starbucks more often and another two-fifths (41%) say they would be somewhat likely to do so.

Compared to lower cost options, a simplified Starbucks menu has lesser draw, with only 20% of all Brits saying this would motivate them to visit the chain more frequently, and this share rises to 26% among non-Starbucks coffee chain regulars.

But what are the biggest deterrents to more frequent Starbucks consumption in Britain?

According to the same poll, the most significant factor deterring British consumers from purchasing from Starbucks more frequently is price, with 41% of all Brits and an identical 41% of non-Starbucks coffee chain regulars indicating this as a primary concern. Preference for other coffee chains is the second most cited reason, topping the list among non-Starbucks regulars (46%), while 24% of all Brits shared this sentiment. Some Brits simply give Starbucks the miss because they prefer homemade coffee.

Other potential deterrents include long waiting times and complicated menu options, each mentioned by a smaller share (7% and 6%, respectively, for both groups). Additionally, ambience or atmosphere and customer service scored relatively low in discouraging frequent visits.

Analysing key brand metrics for Starbucks

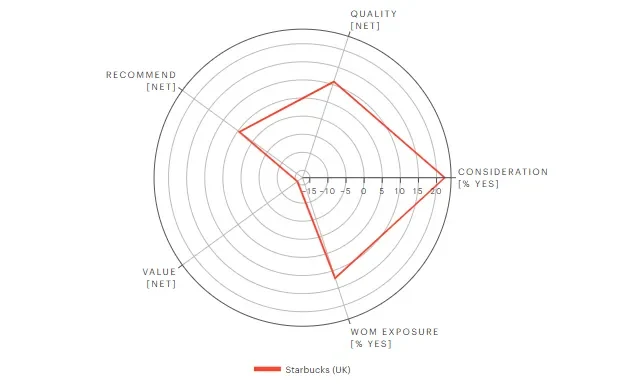

YouGov BrandIndex data lends further credence to the idea that price might be a hindrance to Starbucks consumption, even though the brand scores positively in various other key metrics.

The radar chart below shows scores that net Value score for Starbucks is -15.3 – which is to say that Brits are far likelier to say that Starbucks provides poor value relative to the asking price than to say it provides good value. For reference, the Value score of Costa Coffee is -6.9 and that of Greggs is 35.5.

WOM Expousure for the brand, which measures the share of people who are talking about a brand stands at 12.2. The net Recommend score is 4.5, and the brand scores a Quality rating of 10.9.