3 steps to building a successful market penetration strategy

In this how-to article, we delve into the key components of market penetration and why it’s important, to help you build a successful strategy that grows your buyer base:

- What is market penetration?

- How to measure market penetration

- What are the common market penetration tactics?

- What are the core market penetration drivers?

- 3 steps to growing your market penetration and FMCG buyer base

- Putting it into practice: market penetration use case

- Client success story: PepsiCo Benelux market penetration growth case study

- How YouGov works on market penetration growth

What is market penetration?

Market penetration is king! It measures how much your goods are being purchased by customers in comparison to the total estimated buyer market for your product and is a key strategy for growing your business.

Boosting your market penetration involves increasing the number of buying households consuming your product, with the aim of growing your overall market share against competitors.

In fast moving consumer goods (FMCG or CPG), increasing your purchase frequency might seem like a viable strategy, however improving penetration in the market is proven to be significantly more effective:

- 9 out of 10 growing brands have increased their market penetration*

- 4 out of 10 growing brands have increased their frequency*

*source: BG20, based on absolute change per year for 8.081 top 10 category brands in 79 categories in 16 countries

How to measure market penetration

To understand your current market penetration, you can review your potential buyer market against the number of customers you currently have.

The simple formula to use when measuring market penetration is to divide your number of customers by the overall target market size, and multiply this by one hundred:

(Number of Customers / Target Market Size) x 100 = Market Penetration Rate

Why is improving market penetration hard?

Improving market penetration is not necessarily easy.

Byron Sharp, market penetration research expert, claims that “improving market penetration is hard because it involves overcoming consumer habits, achieving widespread mental and physical availability, and dealing with the challenges posed by the Double Jeopardy Law. The need for significant and sustained investment in marketing and distribution adds to the difficulty, especially in competitive markets where brands are constantly vying for consumer attention.”

Achieving significant improvements remains particularly challenging, especially within the Fast-Moving Consumer Goods (FMCG) sector. Several factors contribute to these difficulties:

- Overcoming entrenched consumer habits: In the FMCG market, where consumer involvement is typically low, breaking through established buying routines is a formidable task. Consumers often stick to familiar products out of habit, making it difficult for brands to persuade them to try something new.

- Achieving widespread mental and physical availability: For a brand to thrive, it must be top of mind for consumers and readily accessible across various retail channels. Building this level of presence requires extensive resources and continuous effort, especially in such a competitive space.

- Differentiating in a saturated and highly competitive market: The FMCG sector is characterized by a high level of market saturation, where countless brands vie for the attention of the same consumer base. Standing out in crowded markets is increasingly difficult, requiring innovative strategies and compelling value propositions.

As a consequence, every brand must contend with the inevitable and ongoing challenge of shopper churn. Consumer preferences are constantly shifting. Maintaining, let alone increasing, market penetration is a continuous battle for most manufacturers. Pursuing market penetration demands continuous focus and adaptability.

Top 5 market penetration tactics

1. Increase mental availability

Use distinctive brand assets (logos, colors, slogans, etc) to ensure your brand is easily recalled by a broad audience. Maintain consistent, frequent advertising to stay top-of-mind.

2. Increase physical availability

Expand distribution across multiple locations, channels, and formats. Optimize shelf space and use distinctive packaging to catch attention and make the brand easy to find.

3. Build and maintain distinctive brand assets

Ensure consistency in branding (logos, taglines, jingles, colors, etc) to reinforce brand recognition. Focus on distinctiveness, not just differentiation on functional attributes, to make your brand memorable.

4. Leverage promotions and pricing strategically

Use promotions to attract new buyers while avoiding deep discounts and price wars that erode brand value.

5. Ensure consistent quality and availability

Maintain product quality and ensure reliable stock levels to avoid driving customers to competitors.

What are the core market penetration drivers?

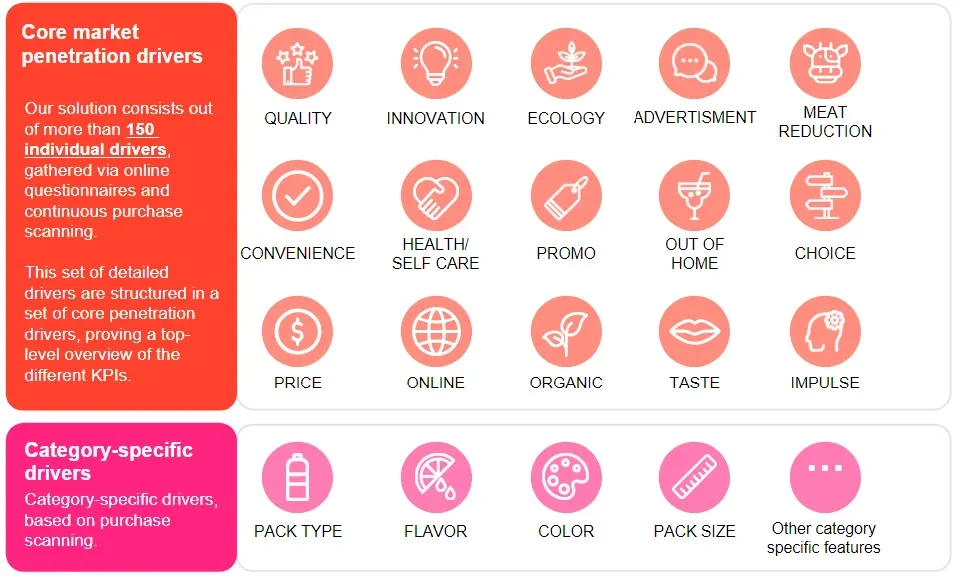

Our Penetration Growth Driver tool covers over 150 individual FMCG shopper needs related to actual purchasing behavior, attitudes, and lifestyle.

This set of detailed drivers is structured into 15 Core Penetration Drivers, providing a top-level overview, and 5 category-specific drivers:

- Quality

- Innovation

- Ecology

- Advertisement

- Meat reduction

- Convenience

- Health/self-care

- Promotions

- Out of home advertising

- Choice

- Price

- Online

- Organic

- Taste

- Impulse

Category-specific penetration drivers example:

- Pack type

- Flavor

- Color

- Pack size

- Other category-specific features (e.g. if you are a soft drinks brand, the amount of sugar becomes a very important feature)

3 steps to growing your market penetration and FMCG buyer base

To develop an effective penetration growth strategy, it is important to understand shopper needs within the consumer goods market. This involves identifying and measuring drivers that both motivate your existing buyers to stay loyal and continue purchasing, and also attract new shoppers to your products.

Our Penetration Growth Driver solution provides an overview and quantification of the key drivers that are responsible for your market penetration growth. It focusses on the recruitment of new buyers in your FMCG base and retention of existing buyers separately, as these will often require different strategies.

Our solution for measuring and growing market penetration consists of a 3-step approach.

- Evaluation: What shopper needs are driving your penetration growth?

Shoppers’ needs differ and market penetration changes are influenced by various factors. It’s important to assess exactly what needs are driving growth.

We help clients evaluate these individual needs by considering shopper base size and brand performance within each need to determine their roles in penetration growth.

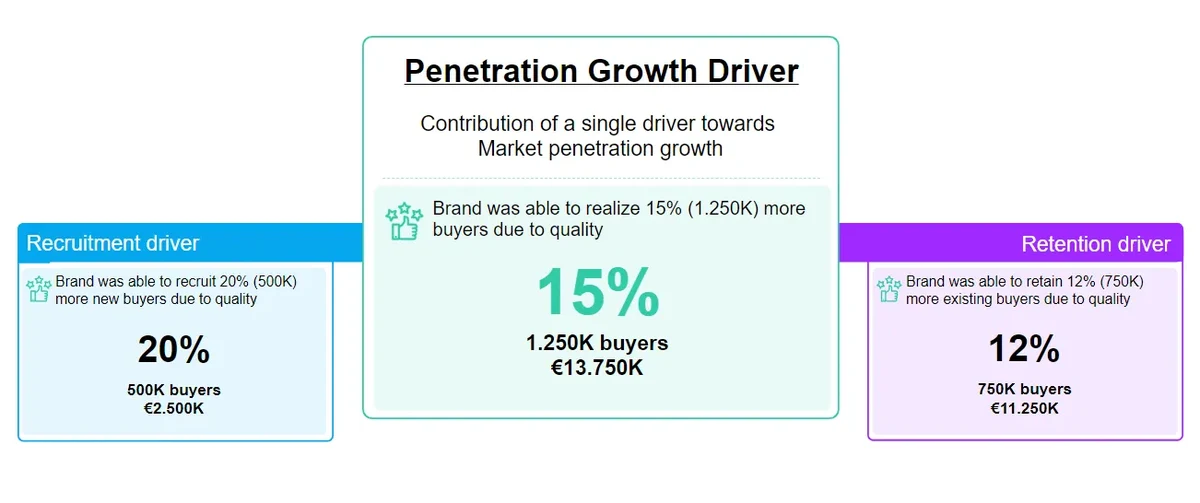

For example, if quality is a clear contributing factor, our solution will assess:

a) Impact: How many shoppers are looking for quality?

b) Strength: How strong is your brand’s performance among shoppers who are looking for quality?

c) Contribution: How much do shoppers focused on quality contribute to your market penetration growth?

2. Quantification: How much do different drivers contribute to your penetration growth?

Examining each driver individually offers insights into its contribution towards recruitment, retention, overall penetration, and turnover rates.

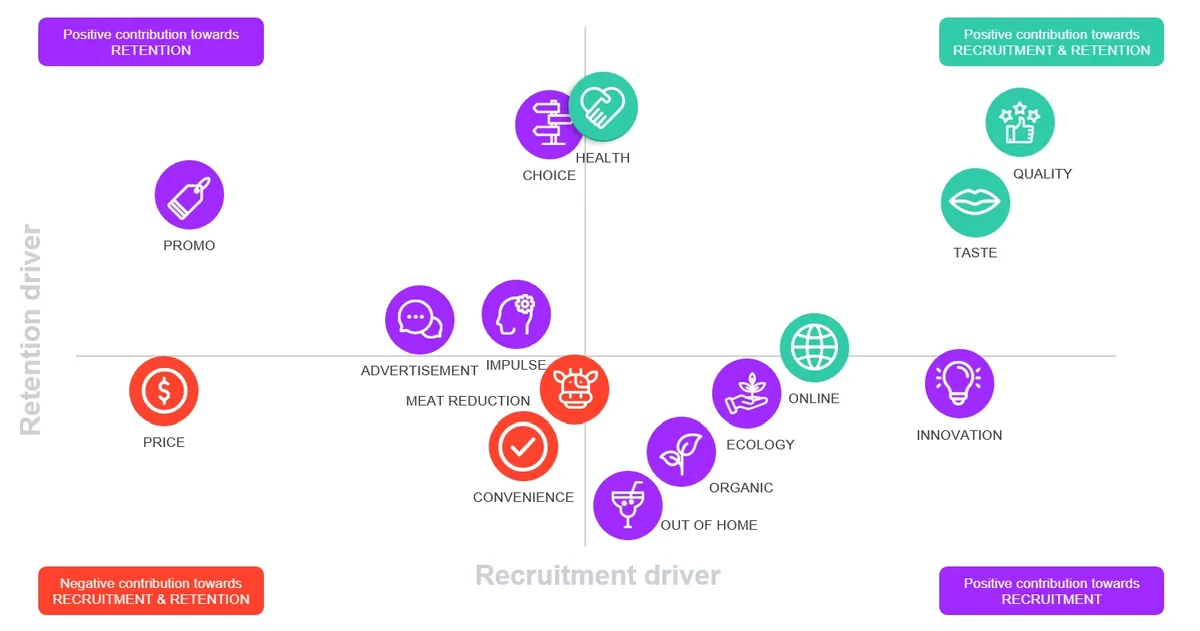

3. Prioritization: What drivers should you focus on to grow your penetration?

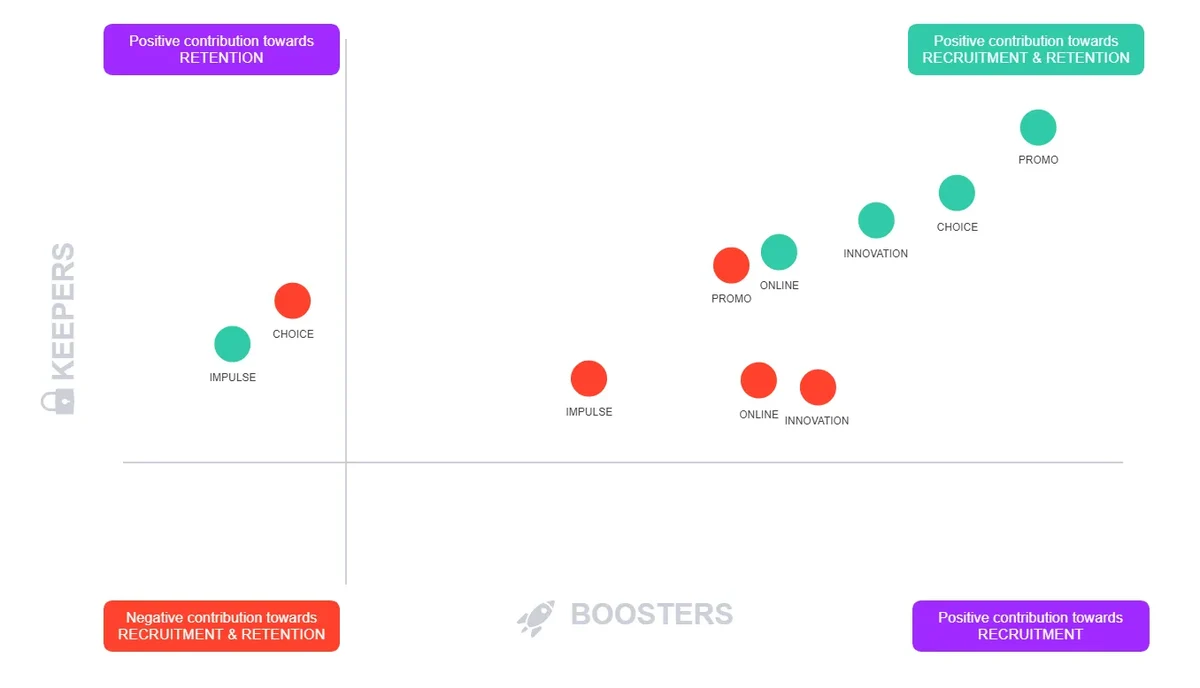

Prioritization is essential. Analysis can help you focus on the important drivers by mapping them against recruitment and retention.

In the below example, quality both boosts your recruitment of new shoppers in market and helps to retain current shoppers.

In contrast, some things such as promotions are very important for maintaining current buyers, but less effective in recruiting new shoppers. While innovation is helping to recruit those new shoppers but not helping keep current ones.

Market penetration examples: putting it into practice

Category use case: Carbonated soft drinks (CSD)

In the German carbonated soft drinks (CSD) category, identifying the right drivers can help to boost shopper recruitment and retention.

The CSD category expanded its value by +9.7%, driven by more buyers and higher frequency. Our analysis identified drivers with a strong positive impact on recruitment and retention: choice, impulse, price, online, promotions, and especially innovation. Secondary drivers included out-of-home consumption, taste, convenience, and advertisement. Drivers like health, organic, and ecology had a negative impact.

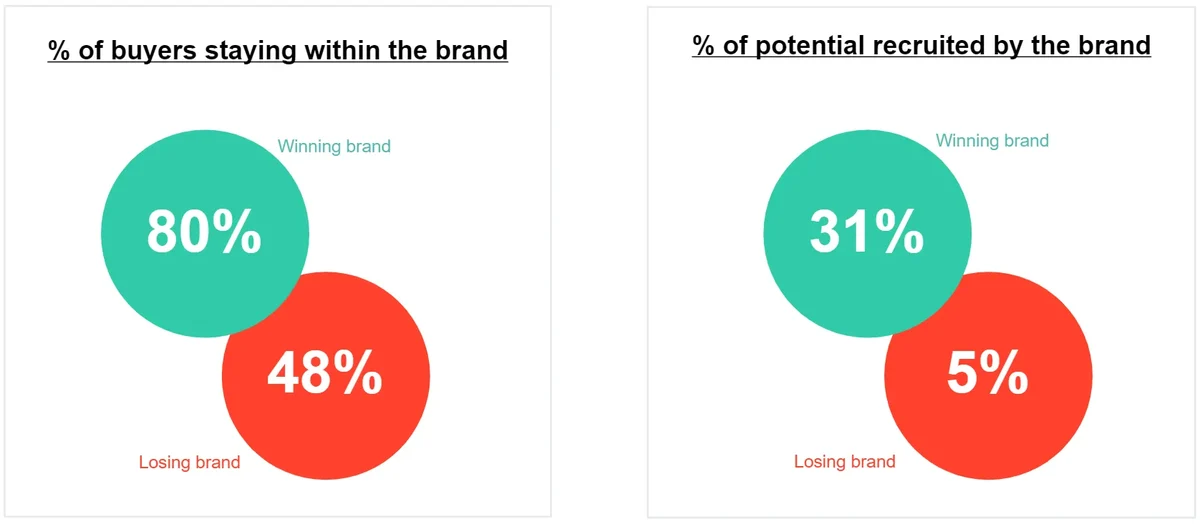

To understand growth levers for category buyers, each brand's unique positioning and salience must be considered. In the German CSD category, we compared two well-known brands – one that was gaining and one that was losing market penetration.

The winning brand retained 80% of its buyer base year over year, while the losing brand retained less than half and recruited only 5% of the headroom. This signals a need to prioritize market penetration growth.

Further analysis shows both brands targeted the same audience but differed in performance across key drivers.

In the below diagram the winning brand (green) outperforms each strength of the losing brand (red). Moreover, the losing brand is not recruiting shoppers looking for choice.

“Choice” was a crucial differentiator – when we deep dive into the drivers contributing to choice, the losing brand failed to recruit buyers seeking variety in pack size, availability, and assortment. Impulse buying also helped the winning brand to recruit, so further amplification through secondary placements and in-store activation can be advised for the losing brand to compete.

Market penetration growth case study

We work alongside our clients to achieve all-important market penetration growth.

The below testimonial from Pepsico Benelux describes their experience working with us on market penetration growth gains.

“The Penetration Growth Driver solution is a novel way to influence shopper behavior in our category by combining attitudes and panel data. The ability to tailor strategy by recruitment and retention, and target specific demographics, adds a lot of value. It helps us prioritise marketing and media efforts.’’

Our experts understand the importance of market penetration in driving your FMCG buyer base growth.

“Penetration is the ultimate growth driver. Recruiting and keeping shoppers must be an ongoing mission for any brand. To define an effective penetration growth strategy, understanding shopper needs and desires is crucial.”

How YouGov works on market penetration growth

We work alongside leading FMCG brands to grow their market penetration with our consumer panel insights and solutions.

Tailored to your specific needs, we offer 4 unique modules within our Penetration Growth Driver:

- Penetration drivers

Identify core market penetration drivers to maintain and boost your market penetration. Understand what specifics define these drivers, and what category-specific drivers grow market penetration. - Socio-demographics

We can help you discover which type of shopper to focus on to better retain and boost market penetration. - Competitive field

Understand your competition in depth, as we assess which competitive brands to watch closely for indicators of their market penetration growth and new tactics. - Retailer landscape

We’ll help you analyse which retailer formats and banners are best suited for your market penetration strategy