Subdued buyer confidence amongst British renters

Despite a better mortgage outlook in 2024 with the cost of borrowing starting to fall, most renters aren’t expecting to get on the housing ladder this year.

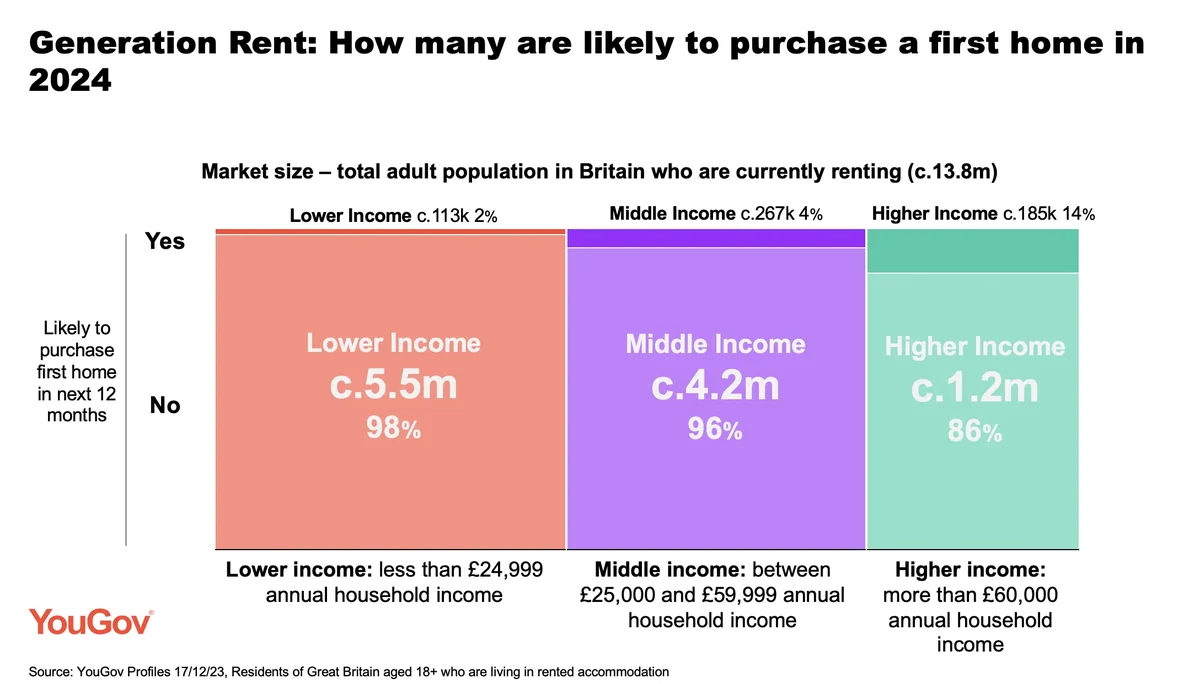

Latest data from YouGov Profiles shows that only 4% of renters are expecting to purchase a first home in 2024, down compared to this time last year. In total, the number of renters expecting to buy has decreased from 657,000 at the end of 2022 to 565,000 at the end of 2023, a drop of 14%.

Buying confidence has fallen the most amongst middle-income renters (those with annual household income of £25,000 to £59,999) where numbers expecting to buy have dropped by almost a third.

Although earnings have risen faster than house prices in recent months, making it slightly easier for people to find a deposit, elevated mortgage rates and entrenched cost-of-living pressures is impacting confidence.

On the flipside, the number high-income renters (those with over £60,000 annual household income) expecting to buy has risen by 8%, while expectations amongst low-income renters (those with less than £24,999 annual household income) have remain stable.