APAC Biggest Brand Movers – July 2023

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

Singapore: Pocky hits the sweet spot with Baskin Robbins collab

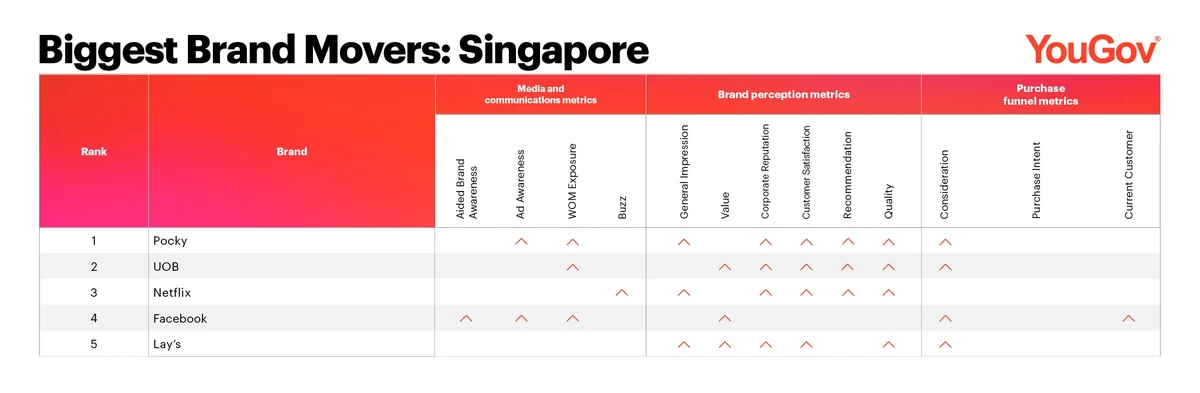

Pocky is Singapore’s Biggest Brand Mover for July.

The confection brand made gains in eight out of 13 YouGov BrandIndex metrics, in the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration).

The biscuit stick brand recently collaborated with ice cream chain Baskin Robbins to release three special flavoured editions of its crunchy snack – Love Struck Strawberry, New York Cheesecake and Chocolate Forest – available for purchase at grocery chain Cold Storage’s Plaza Singapura outlet and e-commerce platform Shopee Supermarket.

UOB is the runner-up, with the local bank scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Netflix takes third place, with the OTT streaming platform seeing improvements in six metrics across the Media and Communication plus Brand Perception categories.

Social media platform Facebook and potato snack brand Lay’s round out the top five, making gains in six metrics each.

Malaysia: Dashing plays a winning game with PUBG campaign

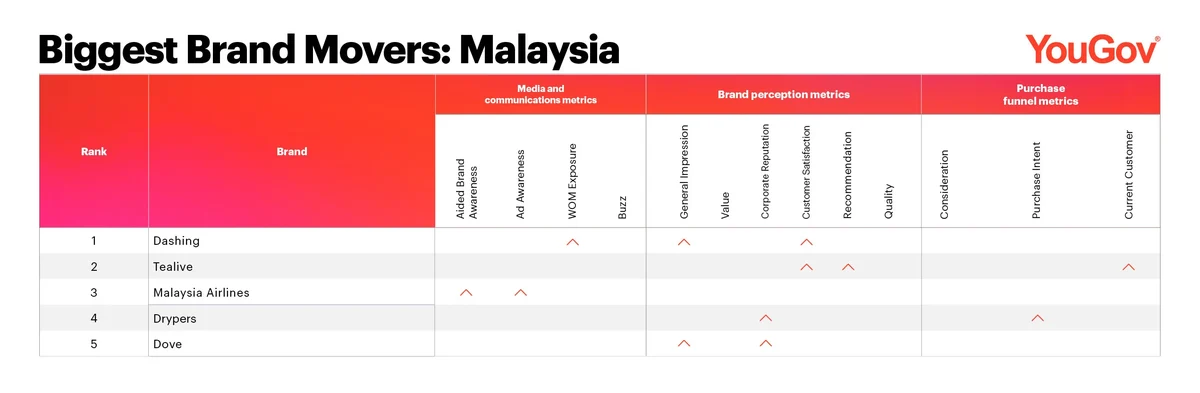

Dashing is Malaysia’s Biggest Brand Mover for July.

The male grooming brand made gains in three out of 13 YouGov BrandIndex metrics, across the Media and Communication category (WOM Exposure) and Brand Perception category (General Impression, Customer Satisfaction).

Dashing recently ran a promotion targeted at players of the popular battle royale video game: PUBG Mobile. Consumers who purchased any Dashing/Elite products worth RM15 and above in a single receipt, from July 1 – August 31 stood a chance to win a Steam Deck gaming console or 3850 of PUBG in-game currency.

Tealive is the runner-up, with the bubble tea brand scoring upticks in three metrics across the Brand Perception and Purchase Funnel categories. Malaysia Airlines takes third place, with the flag carrier seeing improvements in two metrics across the Media and Communication category.

Diaper brand Drypers and Unilever’s Dove soap round out the top five, making gains in two metrics each.

Was your brand one of APAC’s Biggest Movers in July?

Uncover the other brands that were among the top ten in Singapore and Malaysia

by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for July 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Australia, China, Hong Kong, Indonesia, Japan, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for July 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between July and August 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time