As Birkenstock prepares for IPO, what’s driving its brand health and who is buying its shoes?

Birkenstock is on the brink of a major milestone in its journey: the iconic sandals and clogs brand plans to go public with an $8 billion value in September.

As the brand prepares for its IPO, we’re taking a look at its overall health and consumer sentiment leading up to this significant moment.

To receive monthly insights about the retail industry register here.

Who’s thinking of buying from Birkenstock?

Between January 1st, 2022 and June 30, 2023, an average of 8.7% US adults said they would consider purchasing from Birkenstock.

Delving deeper into the data reveals that young women aged 18-34 are significantly more likely to be in the market for Birkenstocks compared to both young men (12.6% vs. 5.9%) and to the general American population.

But Birkenstock draws a significant amount of interest from consumers under the age of 50 generally: roughly one in 10 US adults aged 18-34 (9.6%) and 35-49 (9.6%) would consider buying from Birkenstock and both groups over-index in their propensity to say so compared to the overall US population. As for those ages 50 and over, 8% say they would consider purchasing from Birkenstock.

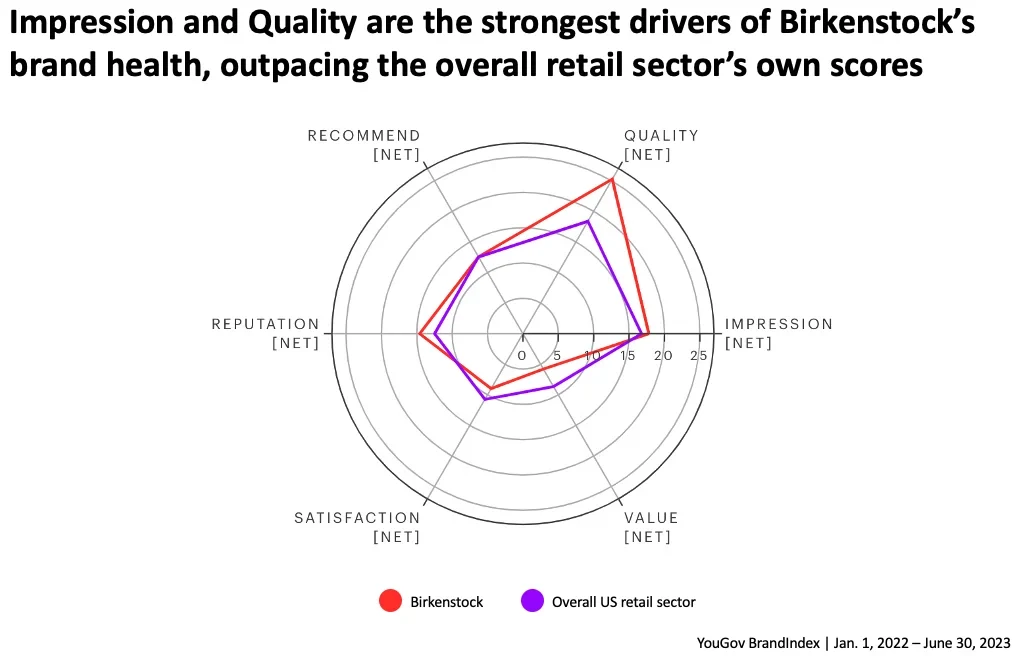

Drivers of Birkenstock’s brand health

Across six measures of overall brand health, we see that the strongest driver of Birkenstock’s brand health is in perceptions of Quality (whether a consumer considers a brand to represent good or poor quality). Birkenstock recorded a Quality score of 25.3-points over the last year and a half, outpacing the overall retail sector by 6.9-points.

Birkenstock also surpasses the retail sector in perceptions of Reputation (whether a consumer would be proud or embarrassed to work for a brand) by 2.1-points (14.6 vs. 12.5) and Impression (how favorably consumers view a brand) by a slimmer margin (17.8 vs. 16.8).

Birkenstock’s Recommend (whether consumers would recommend a brand to friends and colleagues) score is comparable to that of the retail sector’s at 12.6 and 12.5-points respectively.

Areas of improvement

There are two categories in which consumer scores for Birkenstock trail behind those of the overall retail sector.

Satisfaction (whether consumers are currently satisfied or dissatisfied with a brand) is the first of these weaker categories. Between January 1st, 2022 and June 30, 2023, Birkenstock recorded a Satisfaction score of 9-points compared to the overall sector’s score of 10.7.

Consumers also appear to be less impressed with the brand’s Value. At a score of 5.8, it sits below that of the retail sector’s own score by 2.8-points and is by far Birkenstock’s weakest category of the six measures comprising brand health.

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Photo by Haley Truong on Unsplash