APAC Biggest Brand Movers – December 2022

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

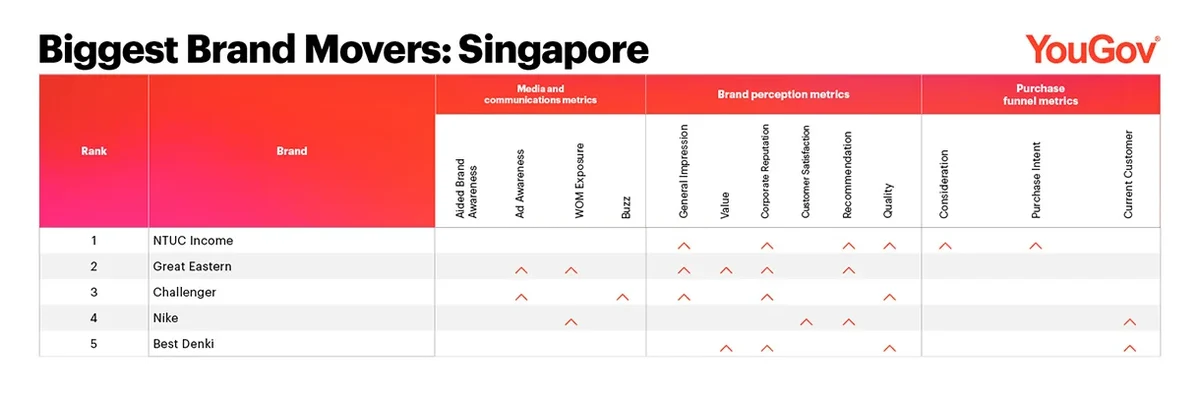

Singapore: NTUC Income comes out tops with attractive travel insurance plans

NTUC Income is Singapore’s Biggest Brand Mover for December.

The insurance provider made gains in six out of 13 YouGov BrandIndex metrics, across the Brand Perception category (General Impression, Corporate Reputation, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent).

Income’s travel insurance plans were recently featured on personal finance website SingSaver in December, which reviewed the products favourably against competing products by MSIG, FWD and Tiq.

Great Eastern is the runner-up, with the insurance provider scoring upticks in six metrics across the Media and Communication and Brand Perception categories. Challenger takes the third place, with the consumer electronics retailer seeing improvements in five metrics across the Media and Communication and Brand Perception categories.

Sports apparel brand Nike and electronics retailer Best Denki round out the top five, making gains in four metrics each.

Indonesia: Teh Kotak climbs to first place with retail chain promo

PT Ultrajaya Milk Industry and Trading Company’s Teh Kotak is Indonesia’s Biggest Brand Mover for December.

The box tea brand made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (Value, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

From 16-31 December, the beverage maker partnered with Indonesia convenience store chain Indomaret to run an IDR 500 promotion on its Jasmine box tea and less sugar teas.

Vidio is the runner-up, with the OTT streaming provider scoring upticks in seven metrics across the Media and Communication and Brand Perception categories. Tiket.com takes third place, with the online travel platform seeing improvements in all three categories as well.

Internet cellular provider IM3 and consumer electronics company Lenovo round out the top five, making gains in six metrics each.

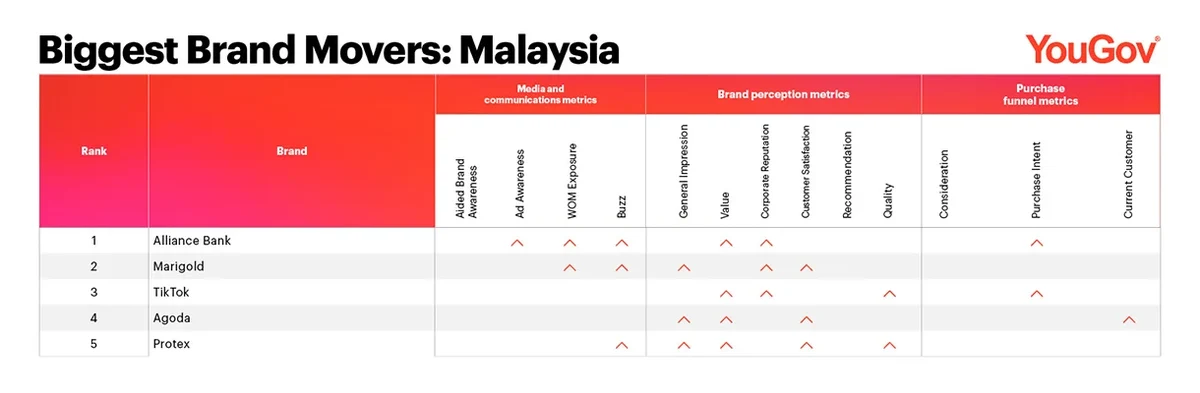

Malaysia: Alliance Bank scales up the ranks with new business focus

Alliance Bank Malaysia Bhd (ABMB) is Malaysia’s Biggest Brand Mover for December.

The company made gains in seven out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (Value, Corporate Reputation, Recommendation) and Purchase Funnel category (Purchase Intent).

Alliance Bank recently announced that it would be scaling up its small and medium enterprises (SMEs) and consumer banking business. It also declared a first interim single-tier dividend of 12 sen per share, to be paid on Dec 28.

Marigold is the runner-up, with the dairy and beverage company scoring upticks in six metrics across the Media and Communication plus Brand Perception categories. ByteDance’s TikTok takes the third place, with the social media platform seeing improvements in five metrics across the Brand Perception and Purchase Funnel categories.

Online travel platform Agoda and soap brand Protex round out the top five, making gains in five metrics each.

Was your brand one of APAC’s Biggest Movers in December?

Uncover the other brands that were among the top ten in Singapore, Indonesia and Malaysia by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for December 2022 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Australia, China, Hong Kong, Japan, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology: Biggest Brand Movers for December 2022 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between November and December 2022.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time