Global: Do consumers expect their financial situations to get better or worse over 2023?

2022 was an expensive year for many consumers: Russia’s invasion of Ukraine drove gas prices to historic highs, and record inflation led to a sharp increase in the cost of living for many consumers.

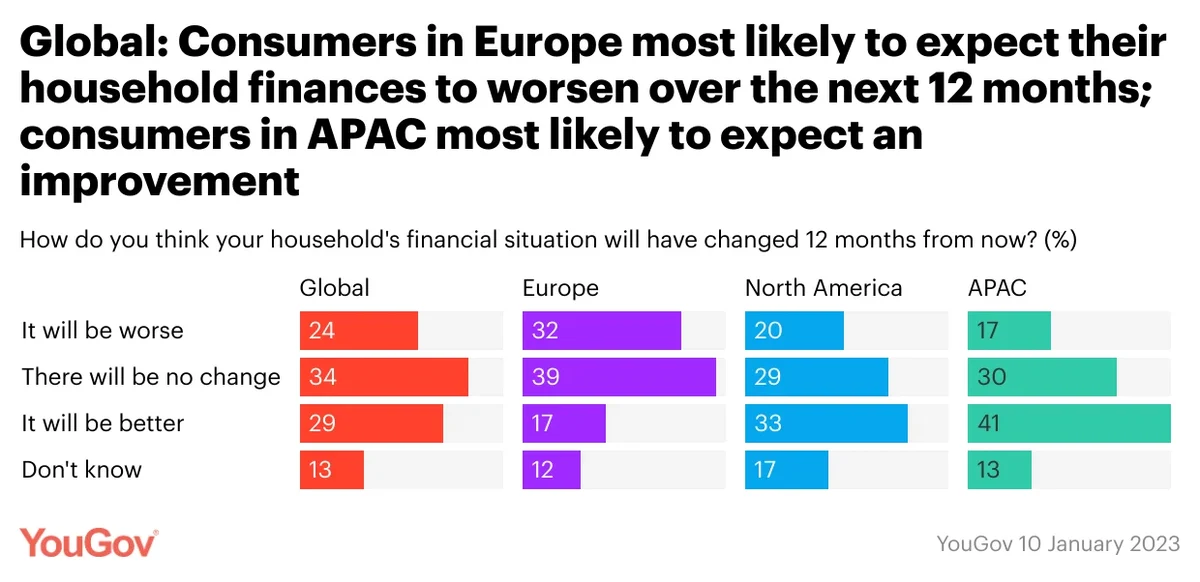

YouGov data shows that, despite this bleak backdrop, on balance, global consumers are more likely than not to say they expect things to get better over the next 12 months. Three in ten (29%) anticipate an improvement in their finances, with a third (34%) saying they do not expect any change. A quarter (24%), however, expect their household finances to get worse.

That said, there is significant variation according to region. In Europe, for example, people are far more pessimistic. Here, a third (32%) expect a deterioration in their household finances, and fewer than one in five (17%) expect they will get better. In APAC, it’s the opposite situation: under a fifth (17%) think their finances will worsen, but three in five (41%) think they will improve over the next year. North Americans are similar: a fifth say they’ll be poorer (20%), a third (33%) say they’ll be richer, and three in ten (29%) expect no change.

YouGov tracks global household finance data on a monthly basis; we will revisit these attitudes over the next year to see how they change – or don’t change – in response to events.

Methodology

YouGov RealTime Omnibus provides quick survey results from nationally representative or targeted audiences in multiple markets. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples. Learn more about YouGov RealTime Omnibus.

Banking and insurance

Discover more banking and insurance content here

Want to run your own research? Run a survey now