UK – Biggest Brand Movers – October 2022

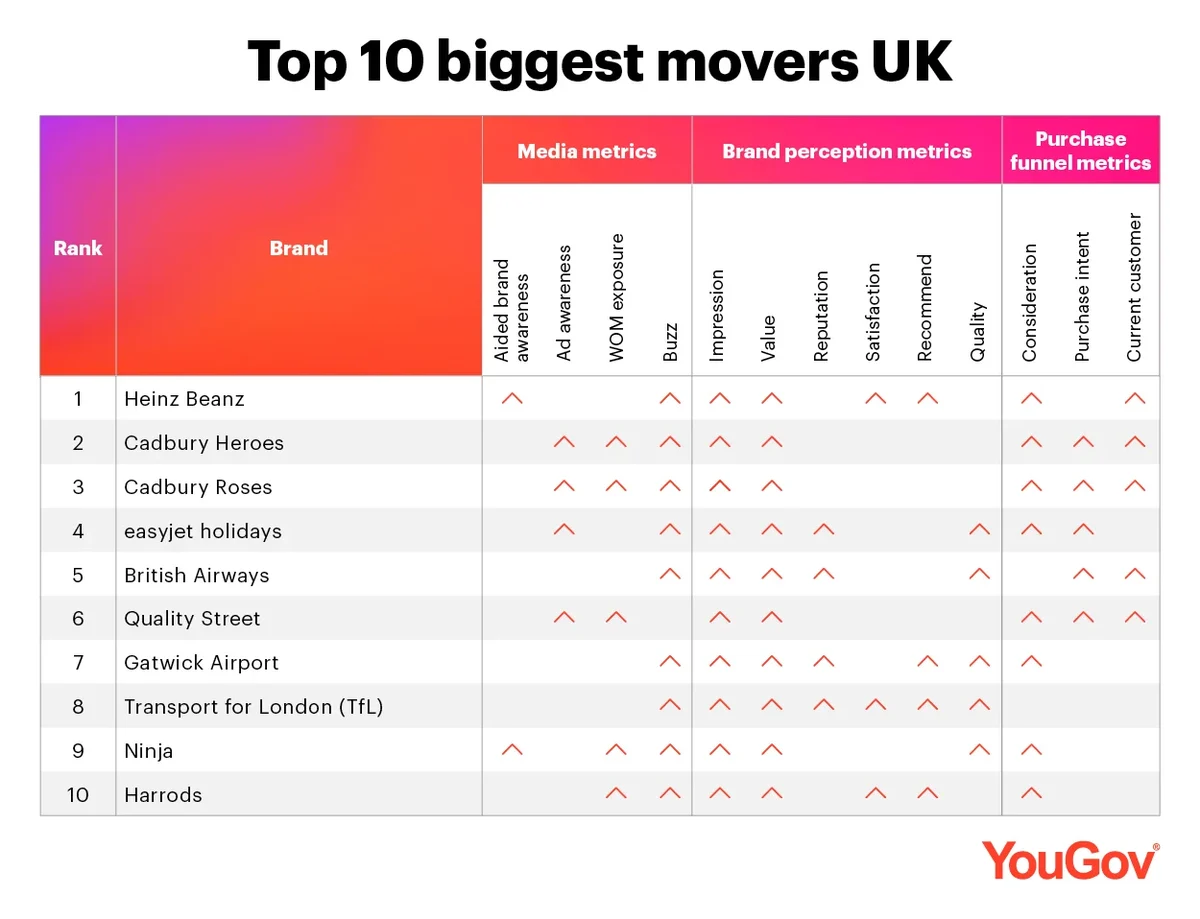

Heinz Beanz tops the list of YouGov’s Biggest Brand Movers for October 2022, with gains in eight metrics out of 13.

UK’s Biggest Brand Movers is a monthly report highlighting the brands that made statistically significant, month-over-month upticks in the most metrics tracked by YouGov BrandIndex among consumers in the UK.

Heinz has been expanding the Beanz brands into new segments, the latest and most notable foray coming in the frozen food segment, under the banner of Beanz Bolwz. The brand gained upticks in two media metrics (Awareness, Buzz), four brand perception metrics (Impression, Value, Satisfaction, Recommend) and two purchase funnel metrics (Consideration, Current Customer).

While Heinz Beanz claimed the top spot due to bigger improvements in its metrics, it is joined by three other brands with upticks in eight metrics each. Cadbury duo of Heroes and Roses both made gains in the exact same metrics – Ad Awareness, WOM Exposure, Buzz, Impression, Value, Consideration, Purchase Intent and Current Customer. Parent company Cadbury was able to whip up online chatter for the brand with its mystery bars campaign that was launched in late July.

Another confectionary brand that makes it to this month’s list is Quality Street, with seven upticks across all metric categories.

Travel brands EasyJet and British Airways appear next on the list in an indication that these brands were able to gain traction amid late summer demand for travel. EasyJet gained in eight metrics, while British Airways moved upwards in seven metrics.

In keeping with the travel theme, Gatwick Airport also makes an appearance on the list, with upticks in seven metrics, including five out of six brand perception ones (Impression, Value, Reputation, Recommend and Quality).

Transport for London also saw improvements in seven metrics, including full marks under the brand perception section.

Domestic appliance brand Ninja ticked seven boxes, including three out of four media metrics – Awareness, WOM Exposure and Buzz.

The list is closed out by luxury retailer Harrods, which also witnessed improvements in seven metrics. Notably, the store had partnered with Pokémon to theme a section of its toy department around the beloved franchise to help promote the Pokémon World Championships, which were held in London in August. Additional research shows that these upticks for Harrods in several metrics were more pronounced among British gamers – defined as those who play video games on PC/Console for at least an hour each week.

Explore our living data – for free

Methodology

Data for the Biggest Brand Movers in October compared statistically significant score increases across all BrandIndex metrics between August and September 2022. Brands are ranked based on the number of metrics that saw a statistically significant increase from month to month. Metrics considered are:

Media Metrics

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Health Metrics

Awareness – Whether or not a consumer has ever heard of a brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Impression – Whether a consumer has a positive or negative impression of a brand

Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Recommend – Whether a consumer would recommend a brand to a friend or colleague or not

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within in a specified period of time

Discover how the nation feels about your brand. Sign up for a free brand health check