Banks offer a better digital experience than streaming services and tech companies, say consumers

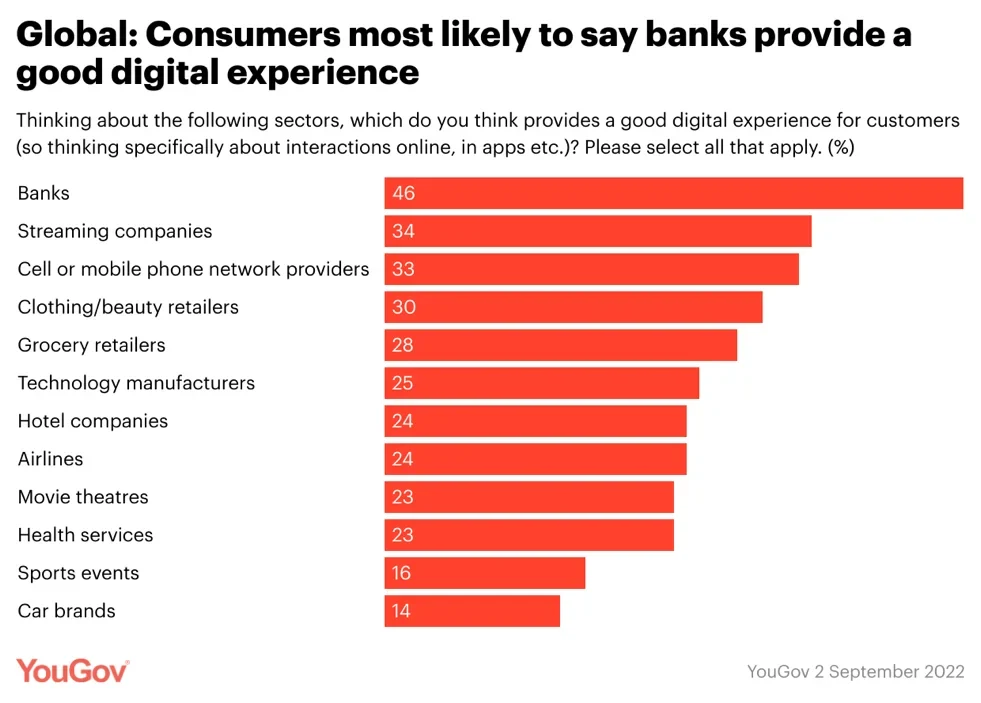

According to data from YouGov Global Profiles, by 38% to 24%, consumers agree that banks try to trick them out of their money, and by 43% to 24%, they agree that all banks are the same. But let’s not assume public perceptions of banks are uniformly negative: data from our multi-market international PR survey shows that banks are the organisations that consumers are most likely to say provide a “good digital experience” (46%). They're more likely to provide a good experience than streamers, tech manufacturers - which encompass phone manufacturers, the makers of video game consoles, and other generalists - and telco providers.

Breaking it down more specifically, streaming companies (34%) come in a distant second to banks – which, given that the digital experience is the be-all and end-all for streamers, could be seen as a rather damning verdict – while cell phone companies come a little behind in third (33%). Of the provided list, car brands (14%) and sports events (16%) are least likely to provide a satisfying online experience for customers. Tech companies are somewhere in the middle of the pack (25%).

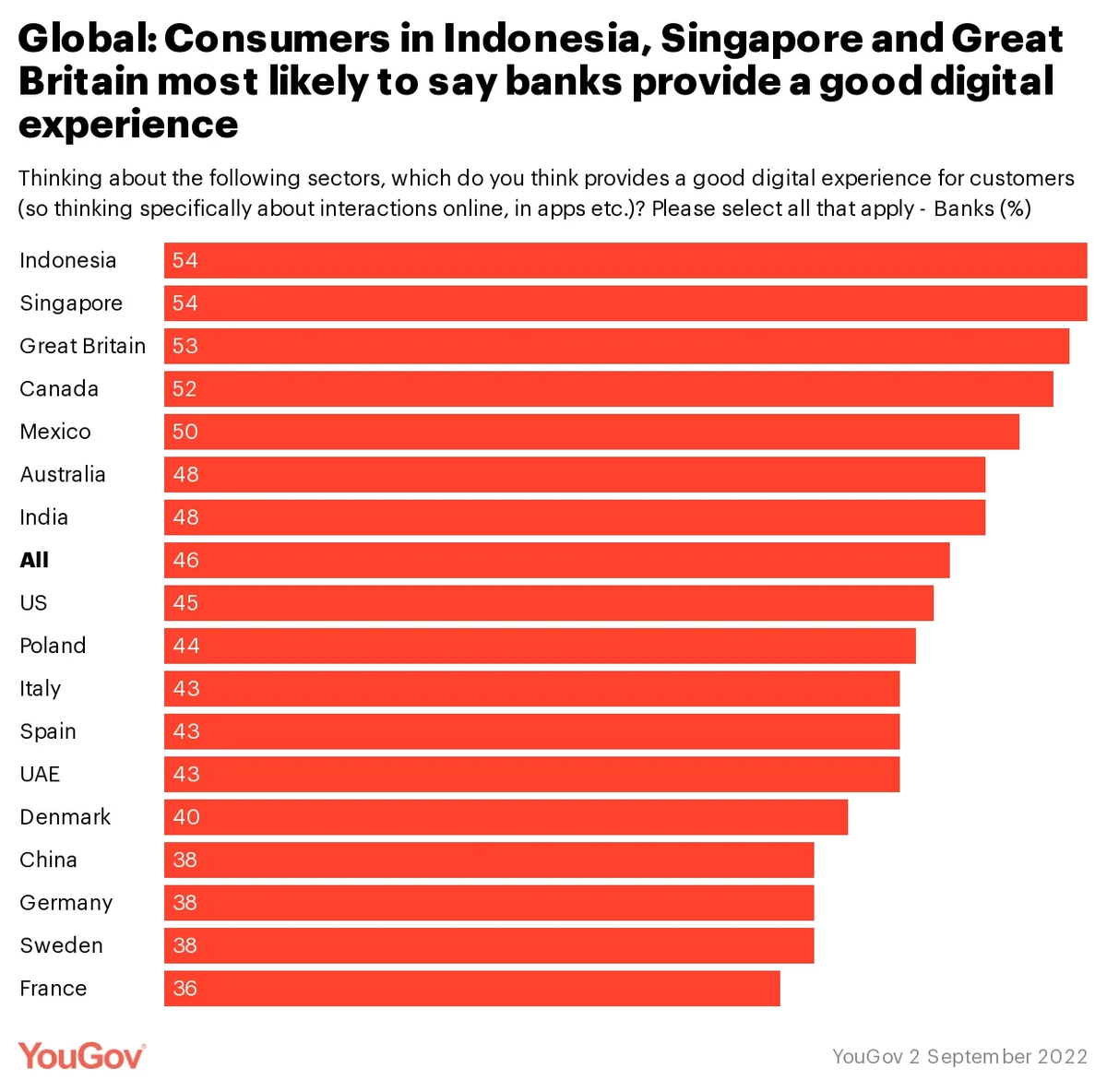

On a market-by-market level, consumers are most likely to say they’re happy with the experience provided by their banks in Indonesia (54%), Singapore (53), Great Britain (53%) and Canada (52%). French (36%) and Swedish (38%) consumers are the least keen on their banks’ online offerings.

We can perhaps attribute the stronger performance of banks to the fact that online banking has been – particularly in financial hubs such as Britain, Singapore, and the US – ubiquitous for some time now. Ask people whether or not they’re uncomfortable using online banking, for example, and Global Profiles data shows that just 27% agree, with 44% in dissent and 30% saying they neither agree nor disagree.

In some markets, we can certainly put this down to a growing acceptance of mobile banking. Looking at data from the September 23, 2018 version of YouGov Profiles in Great Britain, for example, shows that 19% of people said they used their mobile banking/banking app every day, while 44% said they “never” used it. But by September 25 2022, 26% said they used it every day – and the proportion who said they “never” used their mobile or app for banking fell to 27%.

A mark of growing consumer willingness, to be sure – but perhaps also an indicator of the industry’s progress in this area.

Methodology

YouGov RealTime Omnibus provides quick survey results from nationally representative or targeted audiences in multiple markets. The data is based on surveys of adults aged 18 and over in 18 markets with sample sizes varying between 1002 and 2008 for each market. All surveys were conducted online in August 2022. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples. Learn more about YouGov RealTime Omnibus.

Banking and insurance

Discover more banking and insurance content here

Want to run your own research? Start building a survey now