Cost-of-living cutbacks: Where are the public tightening their belts?

In May 2022, global inflation hit its highest levels since 2008 – which has raised questions about how consumers can cope with the rising cost of living. While government intervention may make a difference in some markets, it’s worth looking at where people are – and are not – likely to tighten their belts.

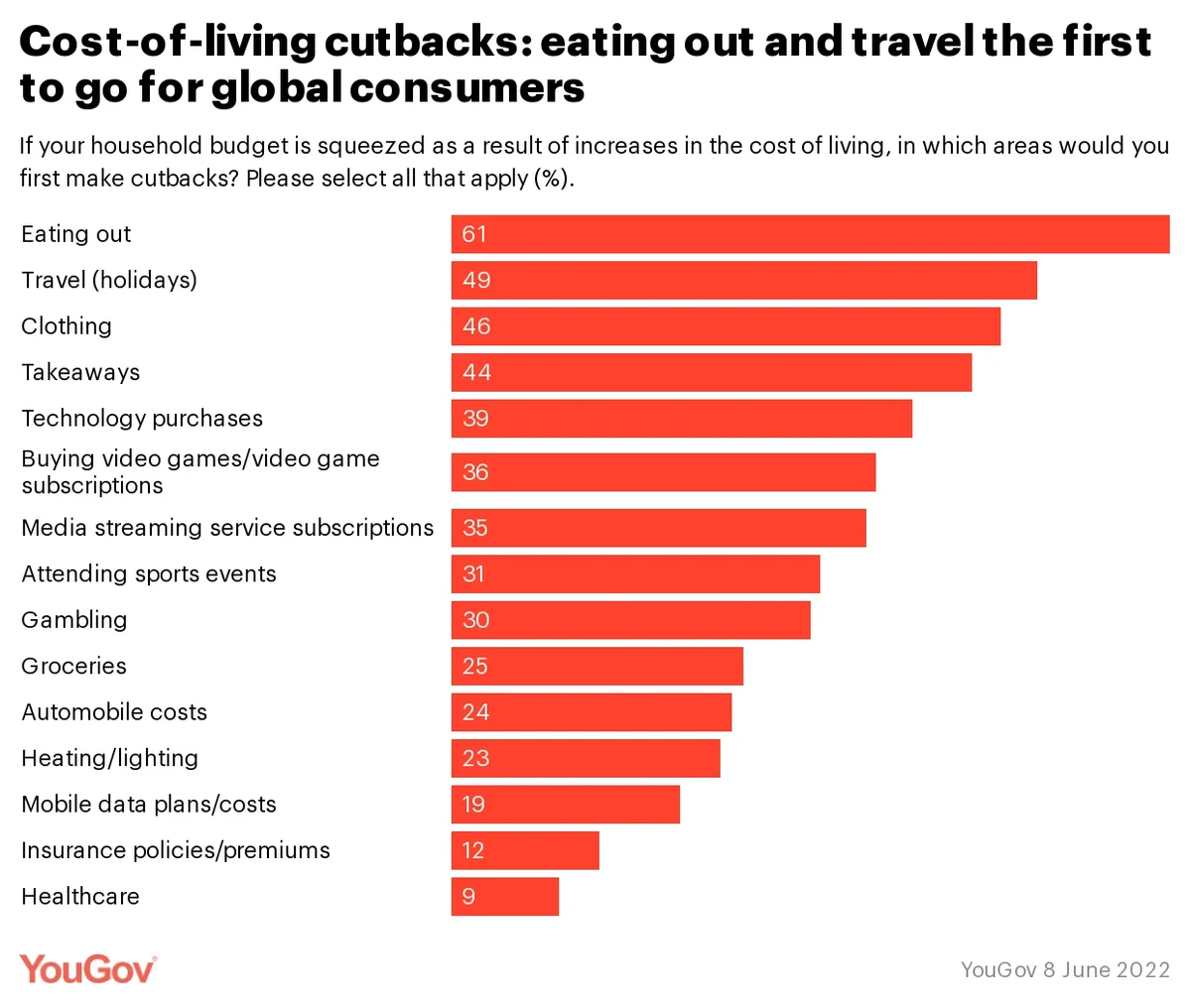

New YouGov data, focused on 17 different markets across Europe, APAC, the Americas, and MENA, indicates that three in five (61%) will be looking to reduce the amount they spend on eating out at restaurants first, saving money by preparing food at home. Half of the public (49%) also say they'd cut back on holidays and travel as a priority (49%); although with several markets reporting technical issues, queueing, and general chaos in international airports, saving money may not be the only motivation here.

Nearly as many plan to cut back on clothing (46%) first – which, with sustainability a significant concern in the fashion sector, may also be for reasons beyond simple cost-savings – and takeaways (44%).

Technology is another significant likely victim of inflation here: two in five (39%) say they are likely to prioritise cutting back on general tech purchases, with almost as many planning to limit their spending on video games (36%) or streaming services (35%)first. Leisure and entertainment may also take a hit: three in ten say they intend to spend less on sporting events (31%) or gambling (30%).

A minority are planning to reduce daily spending on expenses such as groceries (25%), automobiles (24%), and heating/lighting (23%) as a priority – in the latter case, markets such as the UK have seen prices of utility bills rise dramatically in recent months. A further fifth (19%) of global consumers will look to cut back on their mobile phone costs first.

The expenses consumers are least likely to attempt to reduce are insurance policies/premiums (12%) and healthcare costs (9%).

Methodology

The data is based on surveys of adults aged 18 and over in 18 markets with sample sizes varying between each market. All surveys were conducted online in June 2022. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.

To receive monthly insights about the financial services industry register here.

To read YouGov’s latest intelligence on the finance industry explore here.