APAC Biggest Brand Movers – May 2022

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

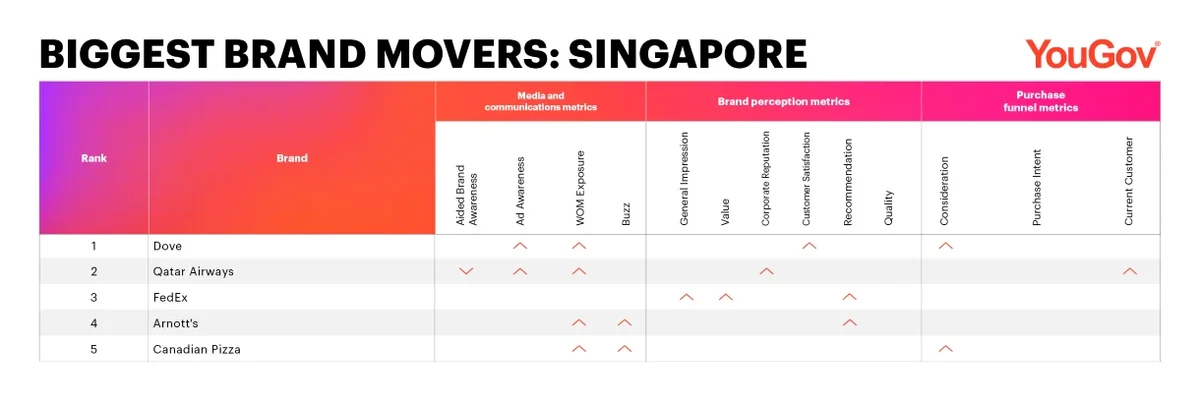

Singapore: Dove soars to top of table with caffeine-fueled campaign

Unilever-owned Dove is Singapore’s Biggest Brand Mover for May.

It made gains in four out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (Customer Satisfaction) and Purchase Funnel category (Consideration).

The personal care brand recently launched a new latte self-foaming body wash – containing oat milk, ceramides and arabica coffee extracts – with a “coffee hunt” contest open to all residents in Singapore. The integrated campaign comprised a series of “bean” hunting challenges, such as buying Dove’s new body wash, posting photos of #DoveCoffeeHunt branding on social media, and making purchases at Dove’s café partners: BootStrap Beverages, Moscano Enchanted Café and Tiong Hoe Specialty Coffee.

Qatar Airways is the runner-up, with the state-owned flag carrier scoring upticks in Ad Awareness, WOM Exposure, Corporate Reputation, Current Customer – although its Aided Brand Awareness dipped. FedEx takes the third place, with the American transportation company seeing improvements in three metrics in the Brand Perception category.

Australian biscuit brand Arnott’s and local quick service restaurant Canadian Pizza round out the top five, making gains in three metrics each.

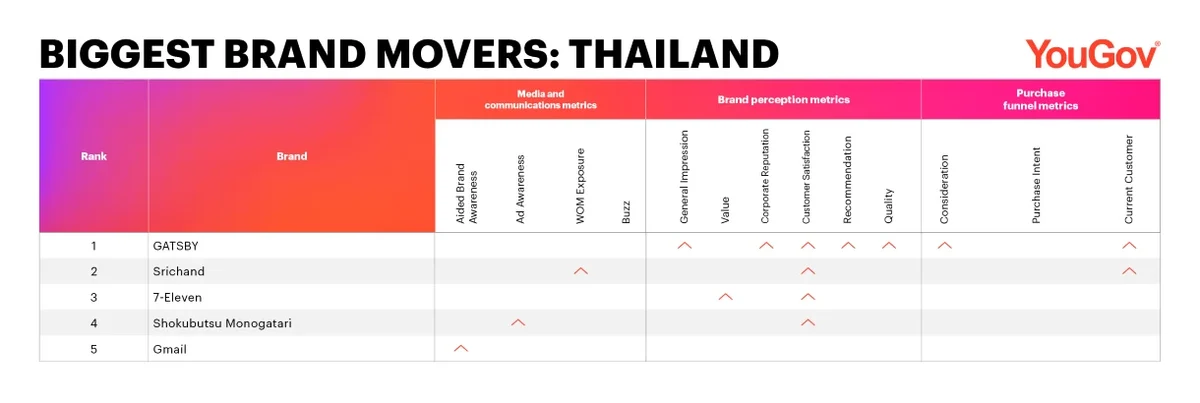

Thailand: GATSBY climbs up the ranks this summer

Mandom-owned Gatsby is Thailand’s Biggest Brand Mover in May.

It made gains in seven out of 13 YouGov BrandIndex metrics, across the Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

The male grooming brand promoted its Gatsby Ice-Type deodorant spray over a series of Facebook posts during the month. This culminated in a week-long social media contest from 13-19 May, which encouraged participants to share what they do after work on Fridays to “cool off” – in public Instagram posts with the hashtag #GATSBYCoolClub. The best entries stood to win free Gatsby merchandise.

Srichand is the runner-up, with the local cosmetics brand scoring upticks in three metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. 7-Eleven takes the third place, with the convenience store chain seeing improvements in two metrics in the Brand Perception category.

Lion Corporation’s Shokubutsu Monogatari body wash and Google’s email service Gmail round out the top five, making gains in two metrics and one metric respectively.

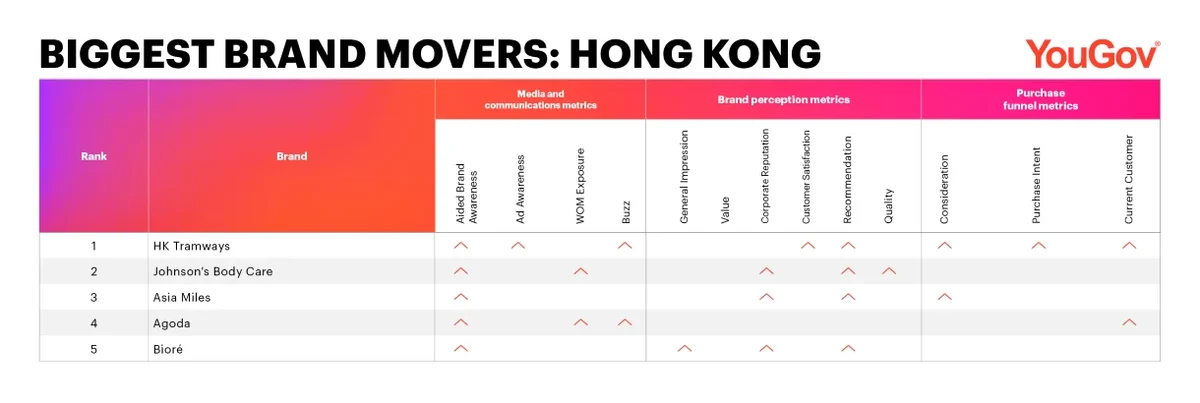

Hong Kong: HK Tramways rises to first place with pop idol’s birthday bash

HK Tramways is Hong Kong’s Biggest Brand Mover for May.

It made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, Ad Awareness, Buzz), Brand Perception category (Customer Satisfaction, Recommendation) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

The rail system had previously announced free tram rides for all on 30 April, sponsored by the Keung Show Hong Kong Fan Club in celebration of pop idol Keung To’s (of music group MIRROR) birthday. Various trams also sported pictures of the star, as advertising agencies witness a recovery in ad spend on trams. Recent examples include investment wealth management app StashAway’s tram shelter ads, and automotive maker Mercedes-Benz and whisky brand The Glenlivet’s tramcar ads.

Johnson’s Body Care is the runner-up, with the American personal healthcare brand scoring upticks in five metrics across the Media and Communication and Brand Perception categories. Asia Miles takes the third place, with Cathay Pacific’s frequent flyer program seeing improvements in four metrics in the Media and Communication, Brand Perception and Purchase Funnel categories.

Singapore online travel agency Agoda and Kao’s Bioré skincare brand rounds out the top five, making gains in four metrics each.

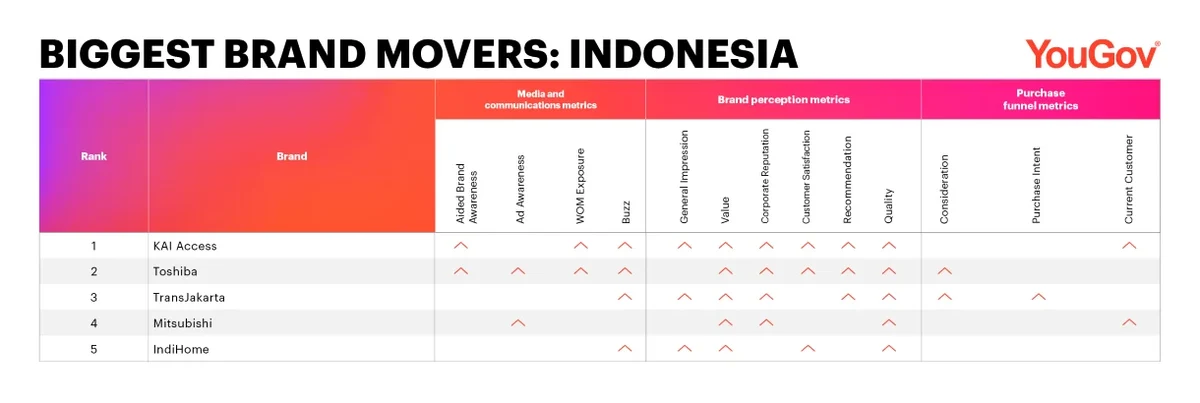

Indonesia: KAI Access surges to top spot with mudik travels

Train ticket booking app KAI Access is Indonesia’s Biggest Brand Mover in May.

It made gains in ten out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Current Customer).

The mobile application from state-owned rail transport provider PT Kereta Api Indonesia (Persero) was a major channel through which many Indonesians booked their annual Idul Fitri trips back to their hometowns – known locally as “mudik” – according to media reports.

Toshiba is the runner-up, with the Japanese technology conglomerate scoring upticks in ten metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. TransJakarta takes the third place, with the local bus rapid transit company seeing improvements in eight metrics in the Media and Communication, Brand Perception and Purchase Funnel categories.

Japanese conglomerate Mitsubishi and Telkom Indonesia’s internet service brand Indihome rounds out the top five, making gains in five metrics each.

Was your brand one of APAC’s Biggest Movers in May?

Uncover the other brands that were among the top ten in Singapore, Thailand, Hong Kong and Indonesia by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for May 2022 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Australia, China, Indonesia, Japan, Malaysia, Philippines, Thailand, Vietnam? Contact us and sign up for a free brand health check today!

Methodology: Biggest Brand Movers for May 2022 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between April and May 2022.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time