APAC Biggest Brand Movers – April 2022

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

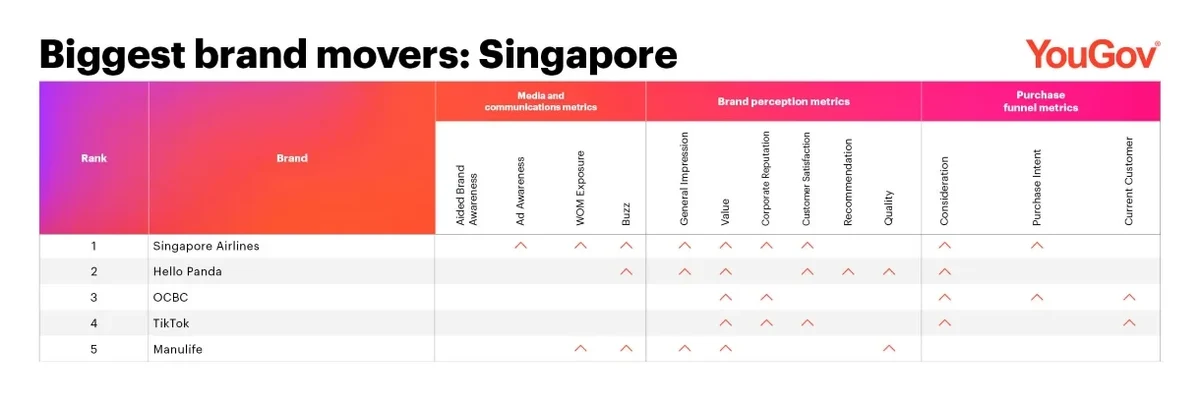

Singapore: SIA soars to top of table as border restrictions ease

Flag carrier Singapore Airlines is Singapore’s Biggest Brand Mover for April.

It made gains in nine out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction) and Purchase Funnel category (Consideration, Purchase Intent). SIA also registered the biggest increase in advertising awareness in Singapore for the month of April 2022.

The national airline began to restart flights to several destinations in Australia and Southeast Asia from March, leading to an almost nine-fold increase in passenger numbers from the previous year, right before Singapore reopened its borders to all fully vaccinated travellers from April 1. Separately, Singapore Airlines also launched new "wellness meals" for passengers onboard its 19-hour flights from New York to Singapore, which are specially designed to reduce insulin spikes and indigestion during the long plane ride.

Hello Panda is the runner-up, with the Meiji-owned biscuit brand scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. OCBC takes the third place, with the local bank seeing improvements in five metrics across the Brand Perception and Purchase Funnel categories.

Video-sharing social media platform Tik Tok and insurance company Manulife rounds out the top five, making gains in five metrics each.

Australia: Four'N Twenty leaps to first place with AFL’s Mark of the Week

Meat pie and sausage roll brand Four'N Twenty is Australia’s Biggest Brand Mover for April.

It made gains in eleven out of 13 YouGov BrandIndex metrics, across the Media and Communication category (WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

Four’N Twenty recently launched the 2022 edition of its popular Local Legends Mark of the Week competition – in partnership with the Australian Football League (AFL) – which encourages fans and players to submit videos and photos of the most dazzling catches of a kicked ball (called “mark” or “spectacular mark” if it involves leaping onto the back of another player) from any junior and senior local football club nationwide. Each week’s winners not only get their names and images published in Sports Entertainment Network’s official Four’N Twenty AFL Record but also receive 250 original Four’N Twenty pies for their club.

Facebook and Instagram clinch second and third place respectively; both social media platforms scored upticks in nine metrics across the Media and Communication, Brand Perception and Purchase Funnel categories.

Mondelez-owned confectionary brand Cadbury and real estate advertising company Realestate.com.au rounds out the top five, making gains in eight metrics each.

Indonesia: Tokopedia surges in consumer appeal with stock market debut

E-commerce brand Tokopedia is Indonesia’s Biggest Brand Mover in April.

It made gains in nine out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent).

Tokopedia made its stock market debut in early April as part of PT GoTo Gojek Tokopedia Tbk, formed from a merger with ride-hailing and digital payments company Gojek in mid-2021. GoTo’s shares rose as much as 23% during its first day of trading, before closing up 13% from its initial public offering. In late April, GoTo subscribed another 310,064 new Tokopedia shares worth 2.62 trillion rupiah in filings to the Indonesian Stock Exchange.

Cellular telecommunications provider Telkomsel’s PraBayar and Halo clinch second and third place respectively; both postpaid mobile plans registered upticks in nine metrics across the Media and Communication, Brand Perception and Purchase Funnel categories.

Telecommunications and consumer electronics company Nokia and e-commerce brand Blibli rounds out the top five, making gains in seven metrics each.

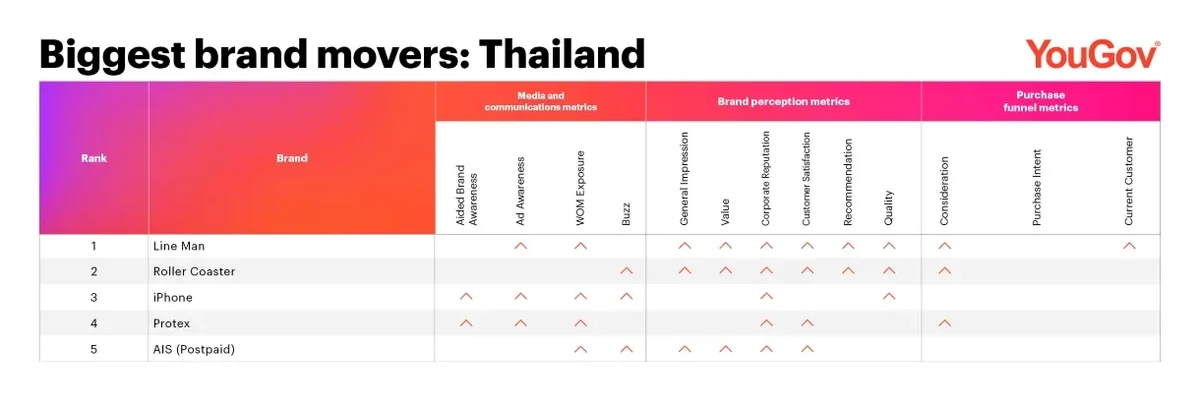

Thailand: Line Man vaults to peak position with its Foodieverse campaign

Food delivery brand Line Man is Thailand’s Biggest Brand Mover in April.

It made gains in 10 out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

Line Man recently launched a campaign to encourage current and would-be users to explore the "Foodieverse of 500,000 Delicious Restaurants" across Thailand on its app, which have been categorized into groupings of up to 5 stars. The food delivery provider has also been offering discounts to both new and existing customers, subject to a minimum spend at participating restaurants.

Roller Coaster is the runner-up, with the potato snack brand scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. iPhone takes the third place, with the smartphone brand seeing improvements in six metrics across the Media and Communication plus Brand Perception categories.

Bath and facial wash brand Protex and cellular telecommunications provider AIS rounds out the top five, making gains in six metrics each.

Was your brand one of APAC’s Biggest Movers in April?

Uncover the other brands that were among the top ten in Singapore, Australia, Indonesia and Thailand by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for April 2022 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Australia, China, Indonesia, Japan, Malaysia, Philippines, Thailand, Vietnam? Contact us and sign up for a free brand health check today!

Methodology: Biggest Brand Movers for April 2022 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between March and April 2022.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time