APAC Biggest Brand Movers – March 2022

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

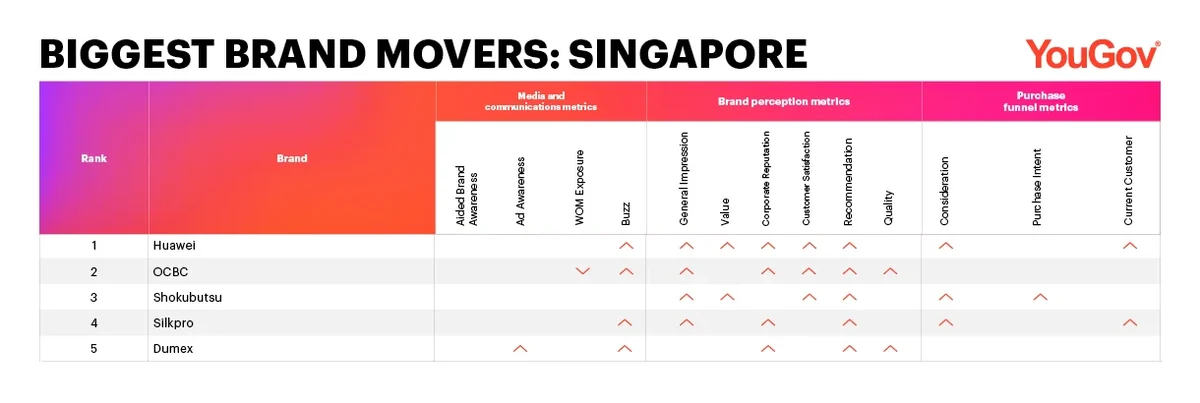

Huawei leads in Singapore following launch of MateBook 14s

Huawei claimed the top spot among Singapore’s Biggest Brand Movers in March.

The Chinese telecommunications equipment and consumer electronics brand made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Buzz), Brand Perception category (General Impression, Customer Satisfaction, Value, Recommendation, Corporate Reputation) and Purchase Funnel category (Consideration, Purchase Intent).

Just a month earlier, Huawei had launched its latest business laptop – the MateBook 14s – in Singapore. Besides promoting it in sponsored news articles, the technology provider also offered buyers of its new flagship notebook $333 worth of freebies that included a Huawei backpack, Huawei Bluetooth mouse, and a USB flashdrive.

OCBC was the runner-up, with upticks in Media and Communication metrics (WOM Exposure, Buzz) and Brand Perception metrics (General Impression, Customer Satisfaction, Quality, Recommendation, Corporate Reputation).

The Singapore bank sponsors the annual mass cycling event OCBC Cycle, which has announced the return of in-person races this year, after the event went fully virtual for two years due to the COVID-19 pandemic. Separately, OCBC announced digital transformation plans to hire about 1,500 technology staff over the next three years, with most of these positions to be based in Singapore.

Shokubutsu took third spot, with the Japanese body and facial wash brand seeing improvements in Brand Perception metrics (General Impression, Customer Satisfaction, Value, Recommendation) and Purchase Funnel metrics (Consideration, Purchase Intent).

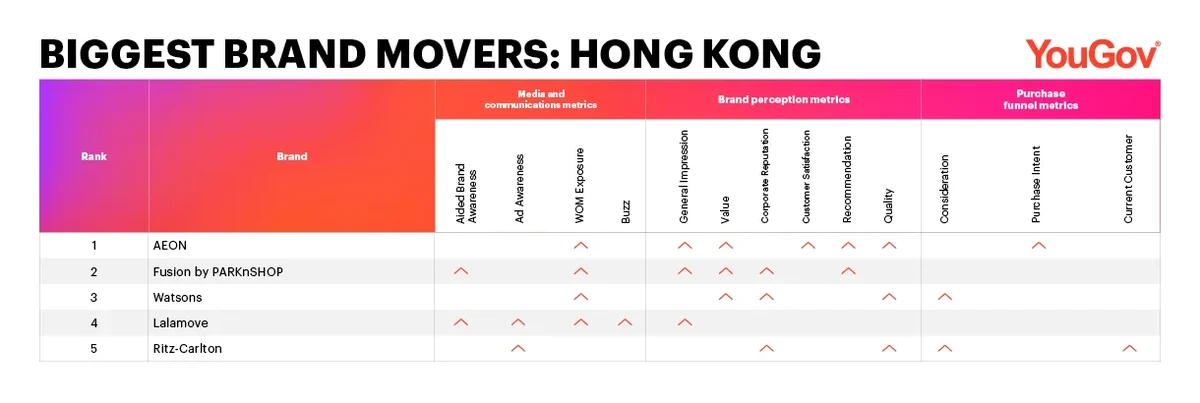

AEON top in Hong Kong as COVID-19 uncertainties fuel surge in grocery purchases

AEON clinched first place among Hong Kong’s Biggest Brand Movers in March.

The Japanese department store and supermarket chain made gains in seven out of 13 YouGov BrandIndex metrics, across the Media and Communication category (WOM Exposure), Brand Perception category (General Impression, Customer Satisfaction, Value, Quality, Recommendation) and Purchase Funnel category (Purchase Intent).

AEON cancelled its “Super Day” discounts every Wednesday in early March, after shoppers thronged various outlets and scrambled to buy various grocery items, amidst media reports of public concerns of a potential citywide lockdown due to the COVID-19 situation.

Fusion by PARKnSHOP – another supermarket chain – was the runner-up, with upticks in Media and Communication metrics (Aided Brand Awareness, WOM Exposure) and Brand Perception metrics (General Impression, Value, Recommendation, Corporate Reputation).

Watsons took third spot, with the health and beauty products retailer seeing improvements in Media and Communication metrics (WOM Exposure), Brand Perception metrics (Value, Corporate Reputation) and Purchase Funnel metrics (Consideration).

Both local retail brands, owned by tycoon Li Ka-Shing's CK Hutchison Holding, also experienced waves of panic buying, and had moved to limit purchases on various products to five units per customer in a single transaction.

Was your brand one of APAC’s Biggest Movers in March?

Uncover the other brands that were among the top ten in Singapore and Hong Kong by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for March 2022 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Australia, China, Indonesia, Japan, Malaysia, Philippines, Thailand, Vietnam? Contact us and sign up for a free brand health check today!

Methodology: Biggest Brand Movers for March 2022 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between February and March 2022.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time