YouGov Framework: Urban India’s attitudes to investing

Retail investing had been rising in India even before the pandemic hit the world. Covid-19 gave just the push required to send new and young investors all over the world to the financial markets. Therefore, understanding consumer attitudes towards investing has never been more critical.

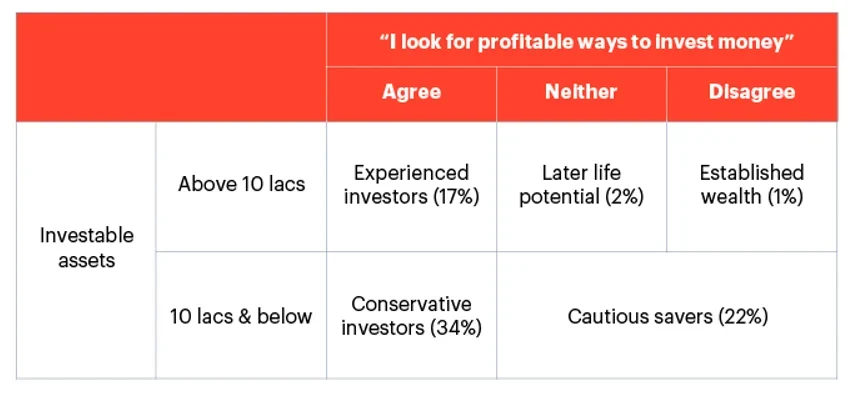

Using Profiles, YouGov has developed a framework designed to help marketers better understand the portion of the Urban India online population with investable assets and their varying propensity to invest. It highlights the attitudes and behavioural traits of core consumer groups based on the value of the investable assets and the extent to which they look for profitable ways to invest money.

Download the full framework and audience profiles.

Here is a quick glimpse at each segment:

Cautious savers: This group have a limited interest in investing, minimal risk appetite and have investable assets of 10 lac or below.

Conservative investors: This group have a lower appetite to invest but are looking for profitable ways to invest with 10 lac or less investable assets.

Experienced investors: The most willing and able group to invest with 10 lacs+ investable wealth.

Established wealth: This group have 10 lacs+ investable assets but are not interested in investing.

Later life potential: With assets worth 10lacs+, this group is neutral on the question of investing it profitably.