YouGov Framework: Mobile network switchers in Great Britain

While customer churn represents one of the biggest challenges for mobile network operators, it’s also a perpetual opportunity for competitors who play the game well to grab a larger slice of the pie.

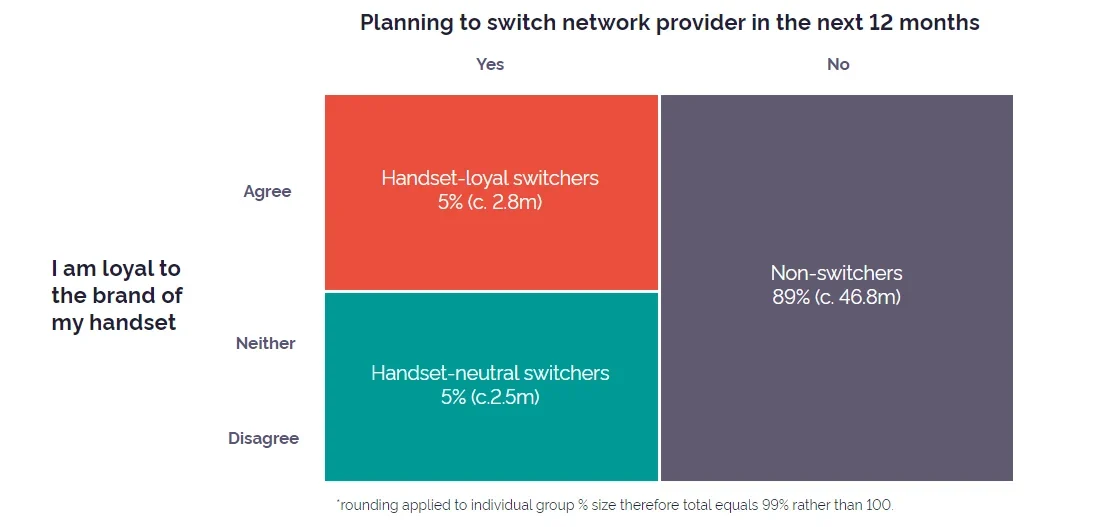

In our latest framework, we dissect the group of customers who plan to switch their network provider in the next 12 months – looking specifically at:

- Switchers who are loyal to a particular handset brand

- Switchers who are not faithful to any particular manufacturer

Handset-loyal switchers

This group make up around 5% of the British public, an addressable market of around 2.8 million consumers.

They plan to switch network in the next year but they also tell us that they have an affinity to the brand that makes their current handset. Let’s find out more about them.

‘Handset-loyal switchers’ are more than twice as likely as the general public to be motivated by new phone releases – 25% of them say that they always want to have the newest model of their preferred handset brands, compared to just 11% of the general public. And that’s good news for Apple, because more than half of these consumers (55%) currently own an iPhone. By comparison, just a quarter of them (25%) own a Samsung phone.

As you might expect from a group who are more likely to own a premium handset, this group also skews more towards being affluent than the general population. Almost three-quarters (73%) are ABC1 compared to 65% of the general population and 29% of them have a household income over £60,000 (compared to 18% nationally).

So what’s motivating this group to find a new network?

The most popular reason is price. More than a third (34%) want to find a cheaper network that offers a data plan similar to one these consumers already use. But coverage is also important. More than a quarter (28%) are on the hunt for a more reliable network and that’s no surprise given that poor indoor coverage ranks as another top reason given by this group for why they are unhappy with their current provider (a factor cited by 38% of this group).

In fact, coverage issues of one kind or another make up the top three most common factors for dissatisfaction with their current network, with 29% having an issue with out and about signal and 19% having trouble with data connections.

But is the grass greener with another network? Well, handset-loyal switchers are optimistic it will be – and many have some idea where they’ll defect to.

EE is the most popular option, with 11% of handset-loyal switchers intending to use the Kevin Bacon-endorsed carrier next. Sky Mobile is close behind on 10%, with O2 further back on 7%, alongside Vodafone. However, over a third of these consumers (36%) are undecided which network they are heading to next – suggesting that they are up for grabs with the right deal.

Handset-neutral switchers

This group is also made up of 5% of Britons – so that’s 2.8m consumers in all. They, too, plan to switch carriers in the next 12 months but unlike our first segment, ‘handset-neutral switchers’ have no loyalty to their current phone brand.

This group is pretty male-dominated (59% vs. 47% of the general population) and it significantly over-indexes in the 35-49-year-old age category (35% vs. 28%).

They are much less likely to own an iPhone (26%) compared to both the rest of the nation (40%) and our hand-set loyal group (55%). But they are also less likely to own a Samsung phone too (28% vs. 30%) – meaning that the big two handset OEMs cede a significant share of this segment to other players.

What’s going to attract these switchers to their new network? Well, the reasons they are unhappy are clear – 30% cite problems with signal indoors (compared to 38% of loyalists), 36% are concerned with their out-and-about signal (vs. 29%), and 17% are unhappy with their network’s customer service (vs. 16%). The reliability of their data service is less of a push factor for this group than our other segment (14% vs 19% of handset loyalists).

So much for the push factors – what will their new choice of carrier hinge on? About a third of ‘handset-neutral switchers’ (36%) are looking for a cheaper deal for the same data/minutes etc, while a quarter (27%) are seeking better coverage. The biggest difference between this cohort and the brand-loyalists in this regard is that they are less likely to be seeking more for their money – that is, paying the same but getting more minutes, data and messages (20% vs. 25%).

And what networks are the most likely destinations for this group? EE is again first choice and 9% of this group intend to sign up with the carrier. Giffgaff is in joint-second spot with 8%, alongside Sky Mobile. Vodafone and O2 are next up, each with 5%. But again, a plurality (39%) in this group is undecided and up for grabs by the networks with the best deals.

Download the full ‘Mobile networks switchers’ Framework here