Global: Auto shortages

The global supply chain crisis – including shortages of components such as semiconductors – has meant that consumers have found it harder than usual to buy many different kinds of products. The automotive sector has been no exception: the chip shortage has stalled the production at many facilities worldwide, with fewer cars being manufactured resulting in consumers having diffculty to buy a new car in some markets.

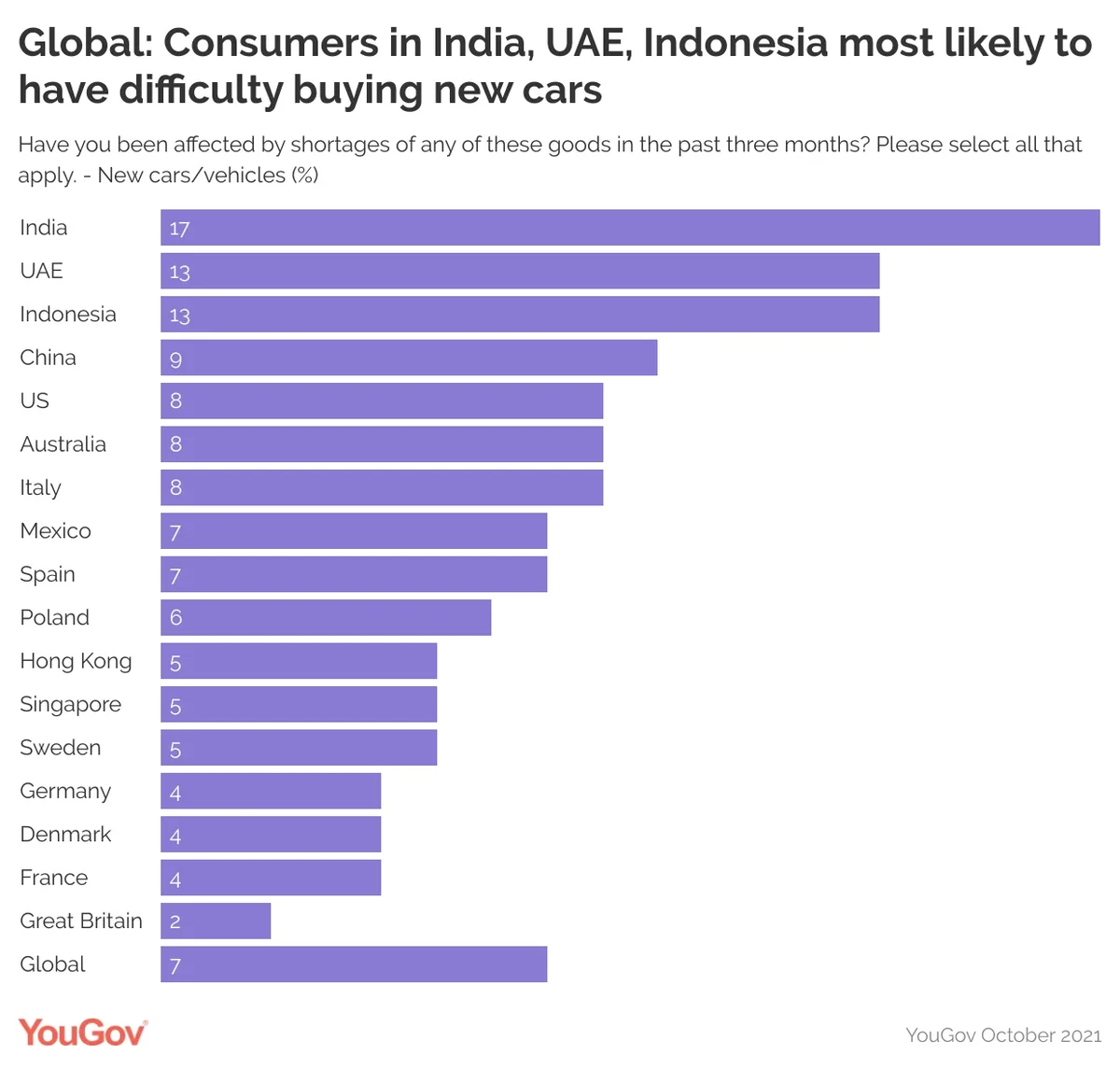

New data from YouGov shows the extent to which the public have been affected by car shortages in 17 different markets. On a global level, 7% of consumers have said that they have been impacted. Compared to the 22% of people who’ve been affected by grocery shortages or the 13% who’ve found it harder to come by medical supplies or tests, it may seem fairly small percentage– but then, new cars are not a product people buy on a regular basis. For example, only 17% of American households plan to acquire a new auto in the next twelve months.

Covering the three months before the question was put to them, the findings indicate that consumers in India (17% - national urban sample) have been most affected by shortages of new cars or vehicles, followed by the UAE (13%) and Indonesia (13%). Consumers are less likely to be affected in European countries: in Spain (7%), Poland (6%), Sweden (5%), Germany (4%), Denmark (4%), France (4%), and Great Britain (2%), fewer than one in ten reported being affected by shortages of new cars or vehicles. It’s a similar story in the Americas: just 8% of US consumers and 7% of Mexicans have been impacted by the supply chain crisis when it comes to buying a new car.

The proportion who’ve found it more difficult to buy a new car remains small, but significant given the value of a new car and the importance of the automotive sector output at country and global level. The hope is that the crisis doesn’t drag on too long – YouGov data shows that, if asked to wait for a specific model of car, just 12% of consumers would be willing to hold out longer than six months.

Methodology

The data is based on the interviews of adults aged 18 and over in 17 markets with sample sizes varying between markets. All interviews were conducted online in October 2021. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.