Deep dive: Direct Line

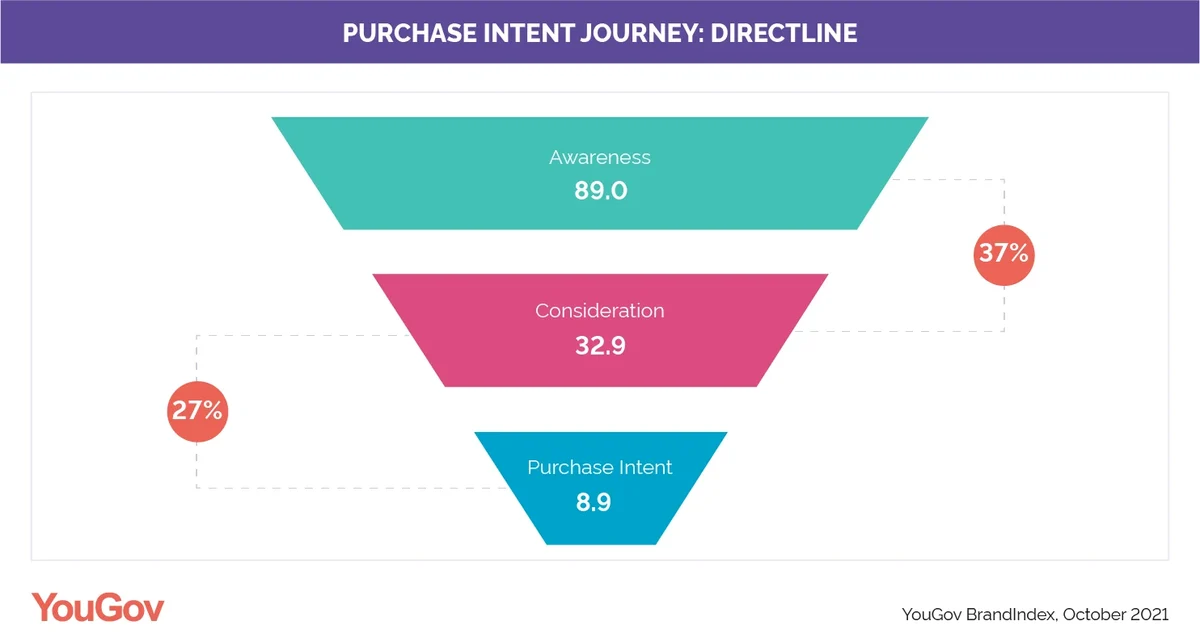

In October 2021, YouGov BrandIndex’s first annual purchase funnel rankings revealed the financial services brands that most effectively turn brand awareness into consideration over a 12-month period. This year, Direct Line are the insurance brand with the highest proportion of “aware considerers” – with 32.9% of UK adults aware of the brand and willing to consider them the next time they are in the market, giving them an overall conversion rate of 37%.

Digging a little deeper into this group reveals that, on a demographic level, they skew more male than female: 54% of aware considerers are men, compared to 46% who are women. Along age lines, they’re least likely to be part of the 18-24 demographic (8% vs. 12% nat rep), and most likely to be aged 35-44 (19% vs. 16%) and 45-54 (22% vs. 17%).

In terms of overall attitudes, this group are significantly more likely to switch their car insurance policies in the next 12 months (39%) than the general public (23%) – which is pretty bad news for Direct Line’s competitors. Members of this segment are also more likely to have money at their disposal: nearly half (48%) say they’re coping on their present income compared to two in five (41%) of the general public. Aware considerers of Direct Line are also more likely to say they use the apps provided by their bank for online banking on their smartphones compared to the general public – suggesting they’re a more technologically engaged group (74% vs. 64%). For Direct Line (or its direct competitors), that’s worth keeping in mind when courting this audience.