UK – Biggest Brand Movers – November 2021

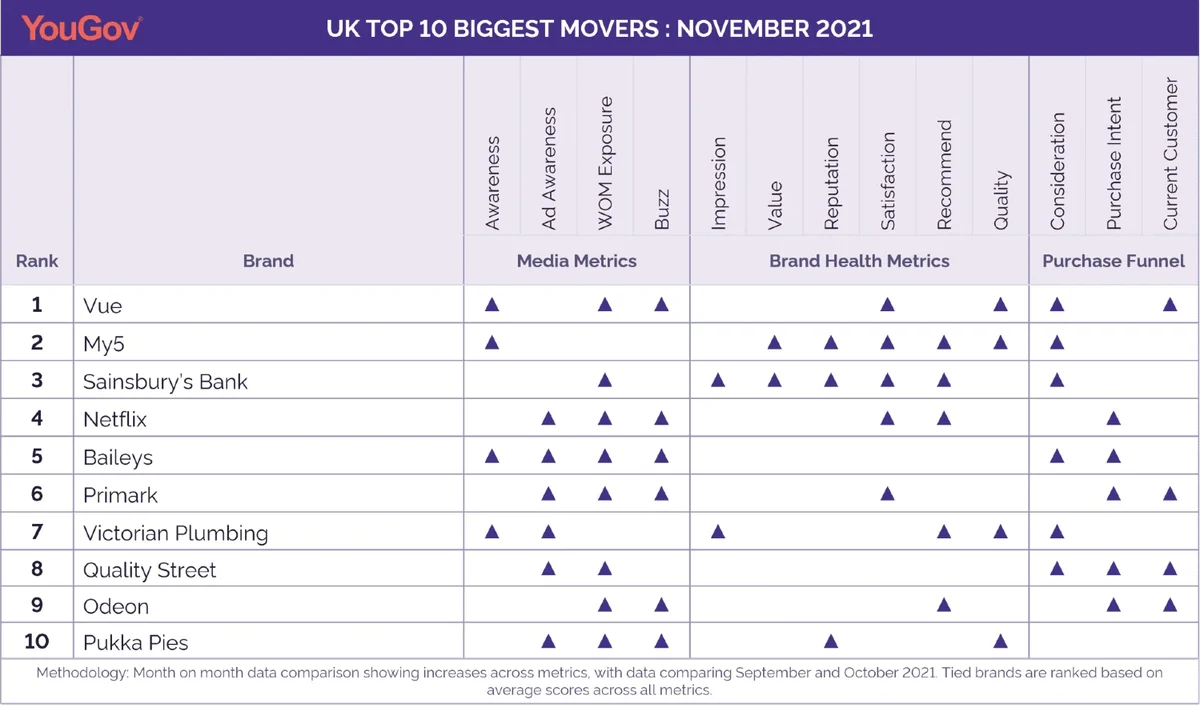

Brands dealing in moving pictures – whether on the big screen or small – are the flavour of the month. Two multiplex brands (Vue and Odeon) and two streaming services (My5 and Netflix) make it to the Biggest Brand Movers list in the United Kingdom in November.

UK Brand Movers is a monthly feature that highlights the brands that have registered statistically significant month-on-month growth across most YouGov BrandIndex metrics among consumers in the UK.

Vue generated upticks across all categories; media metrics (Awareness, WOM Exposure and Buzz), brand health metrics (Satisfaction, Quality) and purchase funnel metrics (consideration, current customer). This positive movement across a variety of metrics might be partially linked to the staggering success of the new James Bond film – No Time To Die. Alongside Vue, Odeon too features in the list with improvements in five metrics (WOM Exposure, Buzz, Recommend, Purchase Intent and Current Customer).

My5, the video-on-demand arm of Channel 5, also moved upwards in seven metrics – Awareness, Value, Reputation, Satisfaction, Recommend, Quality and Consideration. Streaming giant Netflix, which was in the headlines for hit Korean show Squid Games, gained in Ad Awareness, WOM Exposure, Buzz, Satisfaction, Recommend and Purchase Intent.

Sainsbury’s Bank gained in seven BrandIndex metrics – WOM Exposure, Impression, Value, Reputation, Satisfaction, Recommend and Consideration – amid news that the supermarket chain has decided against selling its banking operations.

Popular liqueur brand Baileys made improvements in all four media metrics and two out of three purchase funnel metrics. Baileys launched a new Birthday Cake flavour of its drink in October, which has been well-received by some consumers.

Another brand in the indulgent foods and beverages category that makes the list is Quality Street, which gained in five metrics, including all purchase funnel ones. The brand is set to roll out the return of in-store pick and mix stations at John Lewis stores, and has launched a new sweet for 2021.

Primark made gains in six metrics. In mid-September, the high-street retail brand had announced plans to make all its clothes using more sustainable materials within a decade.

Another retail brand, Victorian Plumbing, also features in the list with upticks across six metrics. Incidentally, the company announced a 29% jump in annual revenues in October.

Pukka Pies rounds out this month’s list with improvements in Ad Awareness, WOM Exposure, Buzz, Reputation and Quality. The brand launched two vegan options in October.

Find out if your brand is a Big Mover

Methodology

Data for the Biggest Brand Movers in November compared statistically significant score increases across all BrandIndex metrics between September and October 2021. Brands are ranked based on the number of metrics that saw a statistically significant increase from month to month. Metrics considered are:

Media Metrics

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Health Metrics

Awareness – Whether or not a consumer has ever heard of a brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Impression – Whether a consumer has a positive or negative impression of a brand

Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Recommend – Whether a consumer would recommend a brand to a friend or colleague or not

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within in a specified period of time