What’s in store for the FMCG sector in Asia?

The changing dynamics of consumer preferences in Asia due to the pandemic have posed opportunities as well as challenges for brands in the FMCG sector. Consumer needs and behaviors have transformed in response to the changes brought on by COVID-19 and YouGov has been tracking these changes in order to understand how they impact brands.

In our latest webinar, What's “in-store” for the FMCG sector?, we delve into the APAC FMCG market and explore how the pandemic has altered consumer outlooks and behaviors. Hosted by Elodie Causier – Head of Research at YouGov APAC – the session is joined by expert panelists Jeanette Phang (General Manager of Strategy and Insights, Publicis Groupe China), Ben Tuff (Chief Product Officer – APAC, UM Worldwide) and Dominique Touchaud (CMO, Shokunin Marketing).

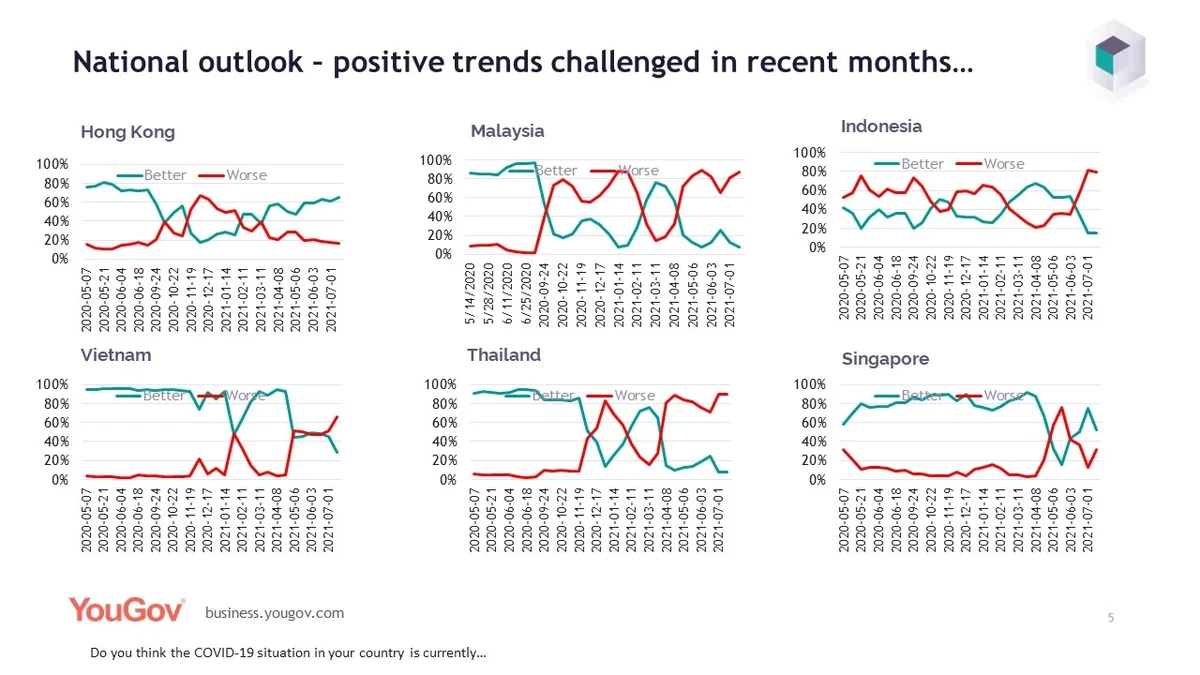

YouGov’s COVID-19 Public Monitor, which tracks consumer sentiments regarding the pandemic, found that consumers in Asia believe that the situation of COVID-19 in their market is getting worse (Malaysia, Indonesia, Vietnam, and Thailand). This was particularly noticed between March to June in most of these markets. When asked about this situation at a global level, more than half of the population in these markets show a similar attitude.

But what do these trends means for the FMCG sector?

Covid didn’t impact all FMCG sub-categories in the same way

A significant spike in demand for food and beverage products was observed in the initial days of the lockdown as consumers started spending more time indoors. But this was not the same for other subcategories within the FMCG sector. Our panelist, Ben Tuff, recalls that while the sale of cleanliness or well-being products skyrocketed, others, such as makeup had to face a turbulent time.

Pivot or fail: Adapting new models for consumer goods

One of the major challenges faced by many FMCG brands was transferring products from factories to warehouses amidst lockdown restrictions – forcing marketers to consider the impact of logistics issues and to sometime question the effectiveness of advertising at a time where product availability (on shelves) is challenged.

Relying on the effectiveness of their internal logistics system, big players in the FMCG sector (who do not rely on outsourced suppliers or distributors as much) were less likely to be affected by the pandemic as opposed to the smaller players. Small and medium enterprises were also hit by the challenge of making modifications in their manufacturing process to meet the changing demands of consumers during this time.

“I think marketers are going to have to remember that if they want to grow, they're going to have to flex back out. I think that's the next thing that marketers are going to have start considering as they go through 2022 and 2023 for this part of the world”, said Ben Tuff, Chief Product Officer, APAC, UM Worldwide.

Consumption occasions were also severely challenged. Brands strongly associated with specific occasions had to rethink their strategy.

Jeanette Phang of Publicis Groupe China explained, “If you're, let's say Coca Cola, that constantly talks about drinking, together with friends, there are no longer such occasions. What happens, how do you pivot quickly? How do you change your communications where it's concentrated so much on celebration for so long, and people are no longer celebrating?”

Even though brands are still dependent on retailers or supermarkets, the idea of connecting directly with consumers is gradually garnering attention with the advent of Direct-to-consumer (D2C) platforms in Asia. Of course, brands will also have to reconsider their logistics ability and the costs of sustaining such a platform along with the added responsibility of enhancing customer experience.

“…D2C will be just a way for marketers to tell the platforms - if you're bothering me too much to buy ad space on your e-commerce platform, I can go for D2C,” observes Dominique Touchaud, CMO, Shokunin Marketing. Clearly, retailers or intermediaries are important to this sector, yet the pandemic has taught that there is scope for the power to shift.

“How you find a way to get your products at the right price to the consumers is what makes you a performance marketer. The tools you're using are irrelevant - you can expect augmented reality to play a role. We all know that it's coming so, marketers need to get trained. But it will not be a different marketing - it's still about getting a product to a house,” explains Dominique.

The webinar further explores strategies brands could adopt to add value to customer experience – be it in-store or on their digital platforms. The discussion also covers the importance of training staff who represent a brand, use of consumer data in the coming years and the role of performance marketing as opposed to brand building.

Receive monthly topical insights about the FMCG/CPG industry, straight to your inbox. Sign up today.

Discover more FMCG content here

Start building a survey now with YouGov Direct