YouGov Framework: Fitness habits

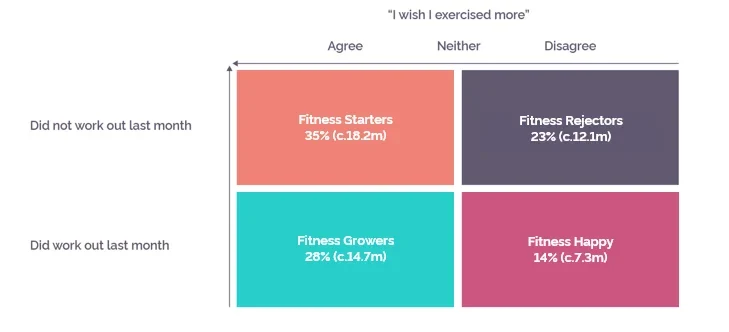

Over half the adult British population did not work out at all in the last 30 days, according to a new YouGov Framework analysis based on data from YouGov Profiles. And while 42% of the nation say they did exercise in the past month, a majority of them are keen to do more.

The framework drills deeper to explore the behavioural traits and attitudes of consumers segmented into groups on the basis of their current physical activity status and whether they would like to exercise more going forward. Before we dive into the details, let’s quickly define each group.

Fitness Growers: This group consists of consumers who exercised last month but wish to exercise more.

Fitness Happy: Consumers in this bracket exercised last month and aren’t actively looking to increase their volume of exercise.

Fitness Starters: The largest group of the lot, this segment comprises more than a third of adult Brits, and consists of inactive people who want to start exercising.

Fitness Rejectors: Consumers in this group haven’t exercised in the last month but aren’t actively looking to exercise more.

Fitness Growers

Over a quarter of British adults fall into the ‘Fitness Growers’ category (28%). The group has a younger skew, with over a fifth aged between 25-34 (21% vs 16% nationally). Seven in ten (70%) of them say they are looking to shed pounds, making them 17 percentage points likelier than the national population to say so.

This group is better acquainted with the world of fitness compared to the overall British population. For instance, over a fifth (21%) have gym memberships against just 13% of consumers nationally. Similarly, greater shares of ‘Fitness Growers’ use fitness apps (31% vs 19%) and they are far likelier to think of exercise as a “me-time” activity (44% vs 28%).

Fitness Happy

This group bears a strong representation of well-settled, retirement or near-retirement age consumers. Over half of them (52%) are aged over 55 compared to 38% of all British adults. Just under two in five of them are retired (37%) whereas only a quarter of Brits are retired overall (24%). More than two-fifths (43%) of them also own their houses outright against just three in ten (31%) among the overall population.

Members of this category are likelier to attach importance to exercising, with three-quarters of them (79%) saying “it's important for me to be physically active in my spare time”, compared to 57% of the total adult population. There is a high tendency among ‘Fitness Happy’ consumers to enjoy exercising outdoors (40% vs 23% nationally).

Fitness Starters

This is perhaps the group marketers of fitness products and services might find most traction with: the consumers who aren’t currently following a fitness regime but who are looking to get started. They make up about a third of the adult British population (35%).

About a third (34%) of ‘Fitness Starters’ are women aged over 55 (compared to one-fifth of the total adult population). While consumers in this bracket are looking to exercise more, messaging from marketers might need to be persuasive as over a half (53%) of them say “I've learned to accept that healthy eating and running just aren't for me” - compared to 42% of all Brits.

Fitness Rejectors

Forming less than a quarter of the overall population, consumers here have no interest in working out. This group has almost twice the share of over-55s when compared to the national population (75% vs 38%) and less than 1% of them have a gym membership.

The reluctance to work out might stem partially from the higher tendency among consumers in this group to enjoy other types of physical activities. For example, two-fifths (44%) of them describe gardening as a hobby compared to 34% of the overall population. Even so, there is a higher probability of health issues in the group, with three in ten having been diagnosed with high-blood pressure as compared to one in five Brits (18%).

Download the full framework and segment profiles

Contact us to learn more about how YouGov Profiles data could help you