Can luxury retailers win over domestic customers to stay afloat?

As coronavirus continues to affect tourism, a wider domestic customer base could provide a lifeline for luxury retailers

Nearly three in ten Brits (28%) say they are willing to pay more for luxury brands. While women and men are similar in this regard, younger people are more easily won over by expensive products. Two in five luxury shoppers (39%) are aged 18 to 34, compared with 28% of the wider population.

Better understanding this group could prove essential for luxury retailers who are missing out on income from wealthy tourists and struggle to offer exclusive in-store experiences with social distancing measures and less footfall in city centres.

Brits who are willing to pay more for luxury items are similar to the general population in terms of social grade. Just over half are ABC1s (56%), meaning they tend to be professionals – just above the rest of the country (54%). But their attitudes to money and retail differ.

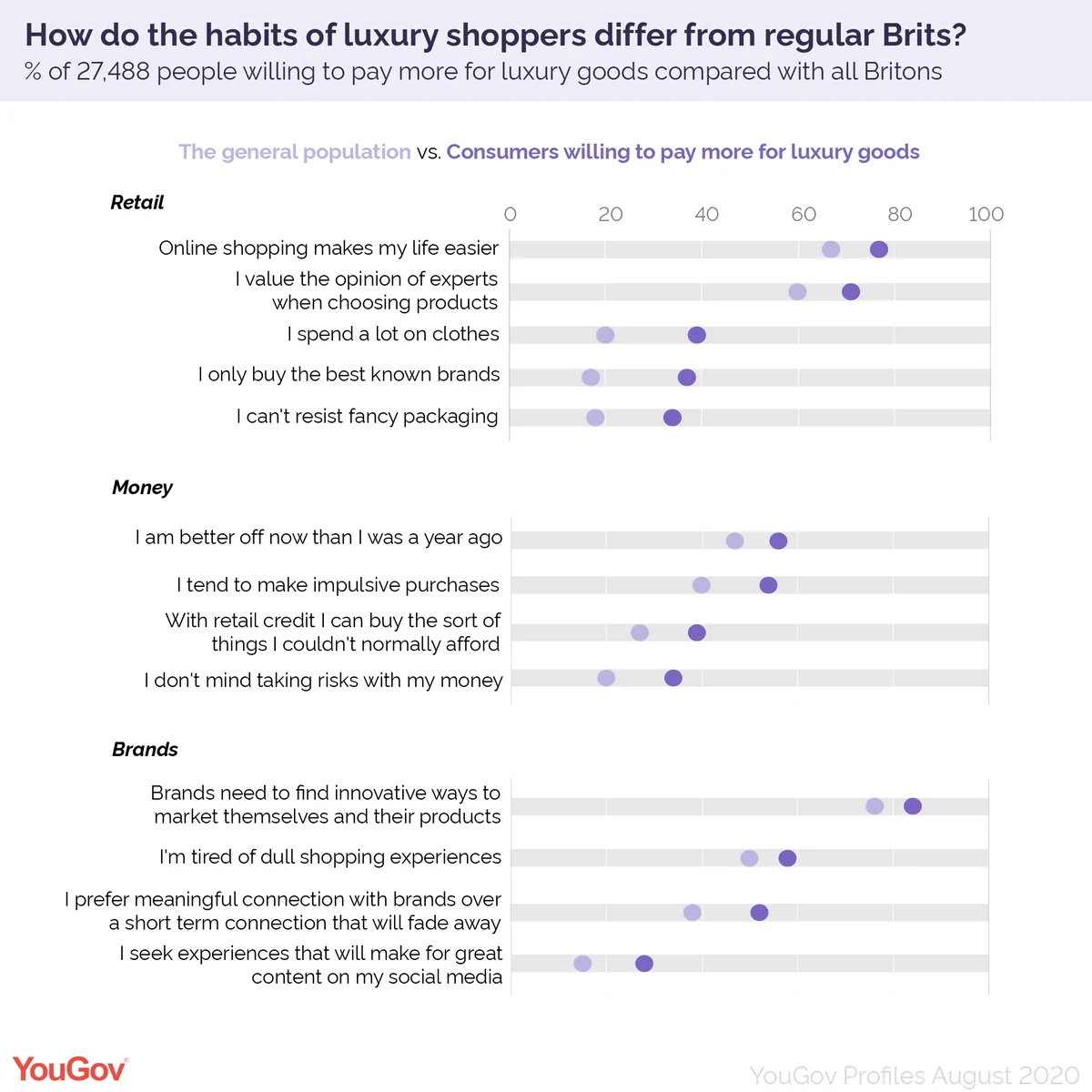

Luxury shoppers admit to spending a lot on clothes (39% vs 20% of all Brits), not being able to resist fancy packaging (34% vs. 18%) and only buying the best known brands (37% vs. 17%). They also overwhelmingly value expert opinion when shopping (71% vs 60%), and are fond of purchasing items online (77% vs. 67%).

When it comes to spending, they are more likely to have a positive view of personal debt, with two in five (39%) saying retail credit helps them buy things they couldn’t otherwise afford. This compares with a quarter of all Brits (27%).

People willing to pay more for luxury items are also more prone to impulsive purchases (54% vs 40%) and being open to taking risks with their money (34% vs. 20). Over half (56%) say they are better off now than a year ago.

They tend to expect more from brands than the average person. Over four out of five luxury shoppers (84%) believe brands need to find innovative ways of marketing their products, compared with 76% of all Brits. Similarly, they prefer longer term ‘meaningful connections’ with brands (52% vs 38%) and are tired of dull shopping experiences (58% vs 50%).

Luxury shoppers are also much more likely to attend Instagram-worthy events, with three in ten (28%) saying they seek out experiences that will make for great content on social media. This is nearly double the national average of 15%.