Paytm and Big Basket are the most used apps for ordering essentials during the COVID-19 lockdown

Although people have engaged with delivery apps during this period, only half are satisfied with the online ordering experience

YouGov’s latest survey run among 1000 respondents from 14th- 17th April reveals that despite the lockdown and strict norms around social distancing, the majority of urban Indians (52%) are stepping out and buying essentials from local retailers and hypermarkets. 39% are getting it delivered locally by neighborhood vendors.

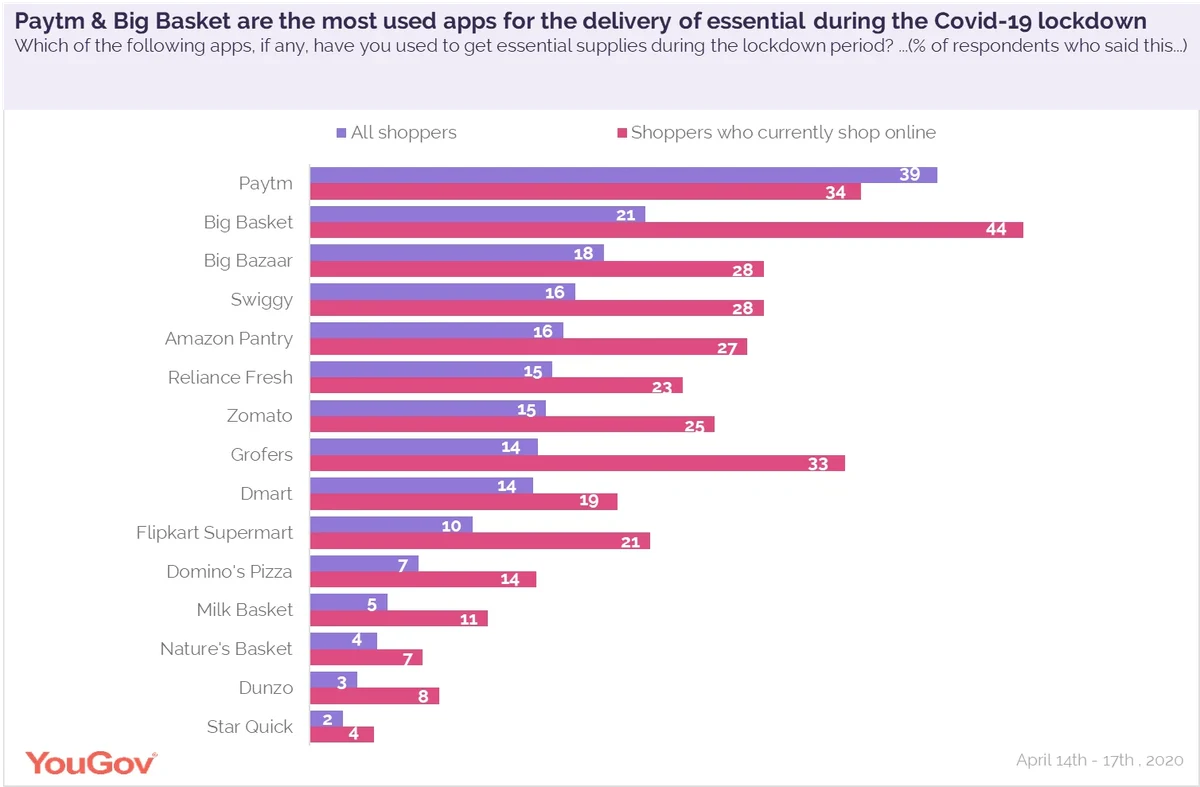

Most people have used delivery apps to order essential supplies during the lockdown period and Paytm is the most used app for this purpose (39%), followed by Big Basket (21%) and Big Bazaar (18%). Although slightly late, Swiggy and Zomato have entered the fray, and one in six people admitted to using these apps for the delivery of necessary items (16% and 15%, respectively).

Amazon Pantry (16%), Reliance Fresh (15%), Grofers (14%) and Dmart (14%) were some other popular channels of delivery. Comparatively, Flipkart Supermart (10%), Domino’s Pizza (7%), Milk Basket (5%), Nature’s Basket (4%) and Dunzo (3%) were less popular for ordering daily supplies.

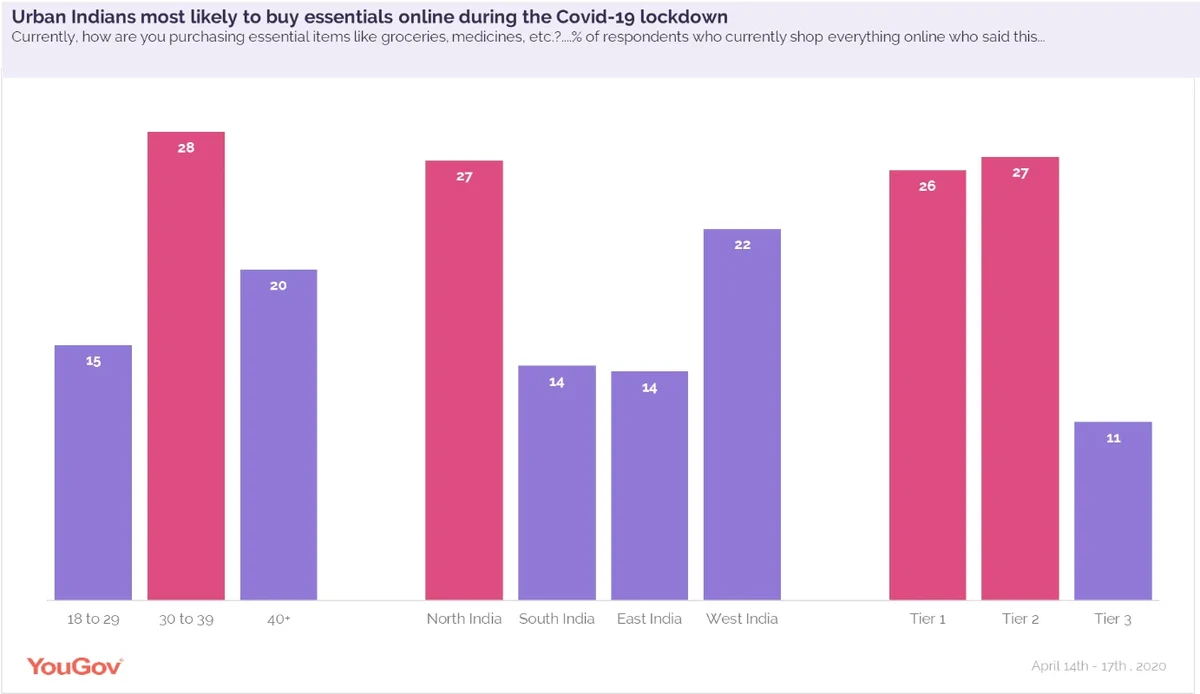

While people have indulged with delivery apps at some point during the lockdown, currently only one in five (20%) Indians are ordering essentials online through these apps. Residents in North India were more likely to say this- at 27%. Similarly, a higher number of tier-1 and tier-2 city residents are likely to order online through delivery apps as compared to tier-3 residents. Among the different age groups, people in their thirties (28%) are more likely than the rest to shop everything online.

Even though Paytm emerged as the most used delivery app for essentials during the lockdown, when it specifically comes to those who are currently only ordering online, Big Basket takes the top spot (at 44%), followed by Paytm (34%) and Grofers (33%). The e-grocer is especially popular among respondents from tier I cities, with 58% saying they shopped from Big Basket during the lockdown. Paytm on the other hand, is more popular in tier-2 and 3 cities.

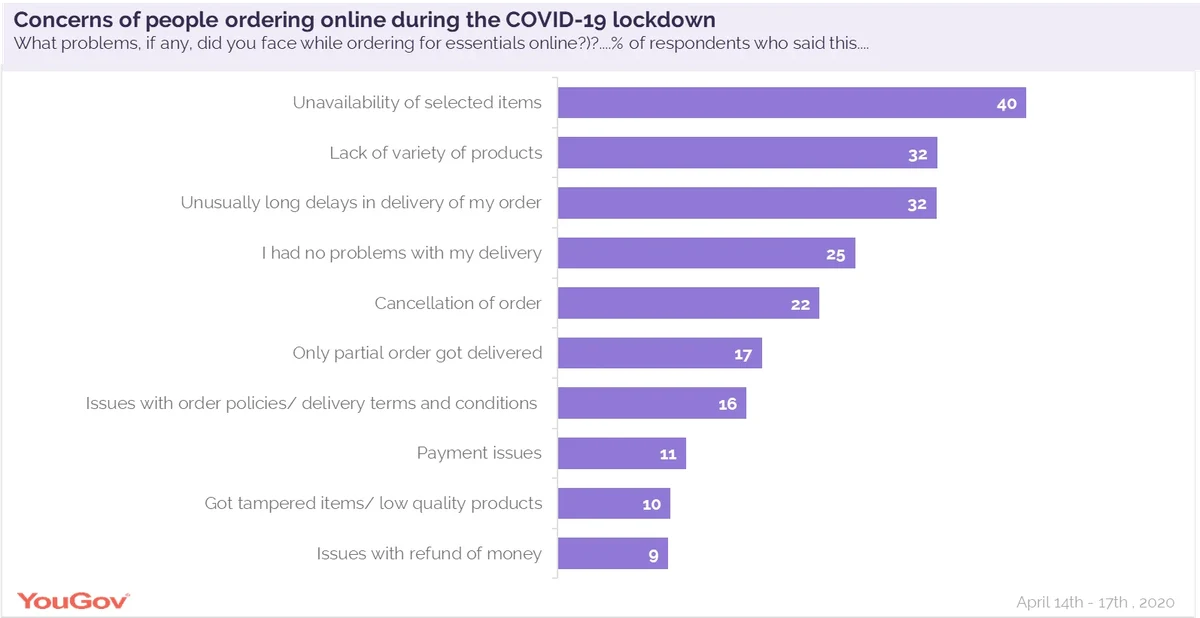

The high volume of people stepping out to buy necessities or getting them delivered locally could be due to problems faced with online grocery shopping. Unavailability of goods is the top concern among buyers ordering essentials online (40%), followed by lack of variety as well as unusually long delays in deliveries (32% each).

Some respondents experienced cancellation of their orders (22%), received partial deliveries (17%) and faced issues with order policies (16%). Few witnessed payment issues (11%) while a few others received low-quality products (10%). However, a quarter seems pleased with the experience and claim to have had no problems with their delivery.

At an overall level, half the respondents are satisfied or very satisfied with the experience of ordering essentials online. One in six (16%), however, are either unsatisfied or very unsatisfied while a third (33%) are unsure of their experience. Unsurprisingly, satisfaction is higher among those who currently order online as compared to those who either step out or order essentials locally through neighbourhood vendors and this presents an opportunity for e-grocers to win these consumers by offering better service and experience.

Speaking about this Deepa Bhatia, General Manager, YouGov India, said, “While the COVID-19 crisis has adversely impacted most businesses, it has been a boon for some e-commerce players, especially those catering to the daily needs of people. Along with serving new customers, it is imperative to satisfy and retain the existing ones. In such an environment, it is important for brands to win consumers’ trust by understanding their needs and concerns, and then targeting them with the appropriate communication and marketing strategies.”

Data collected online by YouGov Omnibus among 1000 respondents in India between 14

- 17

April 2020 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country