Uber Eats, Blue Apron brands see gains as Americans told to stay home

As more Americans are urged to “self-quarantine” in the midst of a rise in coronavirus cases, YouGov data suggests many convenience brands such as delivery apps and meal kits are getting a bump.

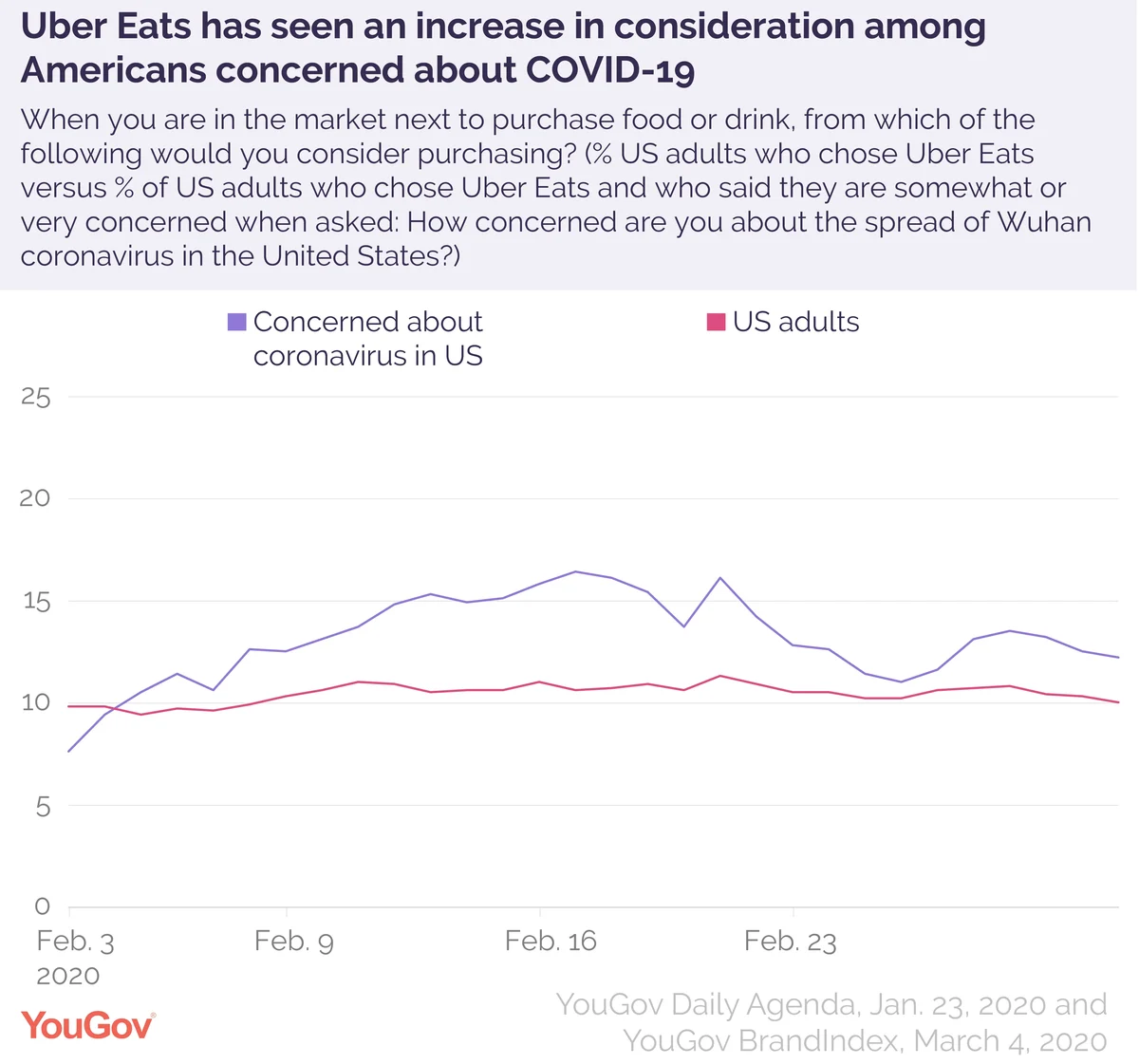

Food-delivery app Uber Eats has experienced a consideration bump as COVID-19 anxiety mounts. Between the beginning of February and March, the rate of Americans considering purchasing from the app went from 7.6 percent to 12 percent among those concerned about the virus. Scores among US adults in general have remained consistent.

The outbreak could be a mixed bag for Uber. Its car service may suffer with fewer people traveling, but it’s food delivery business is likely to thrive, according to Uber CEO Dara Khosrowshahi. YouGov data suggests Uber Eats rival Doordash is seeing similar gains in purchase consideration.

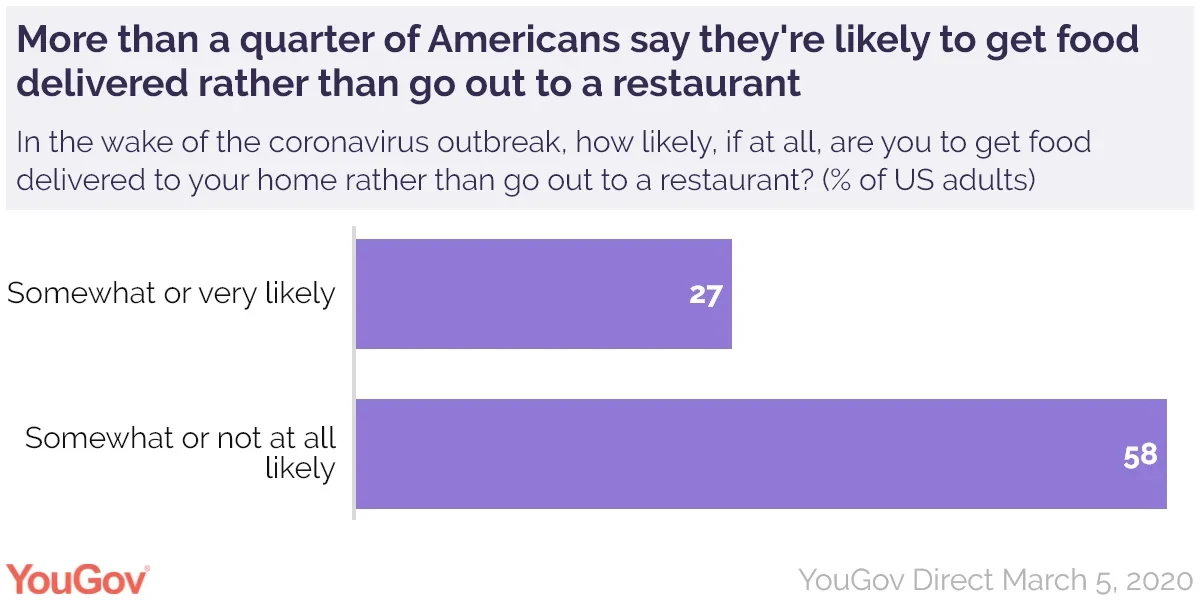

Further, new YouGov Direct data shows more than a quarter of Americans are more likely to get food delivered to your home rather than go out to a restaurant in the wake of the outbreak.

It’s not just delivery apps seeing a bump.

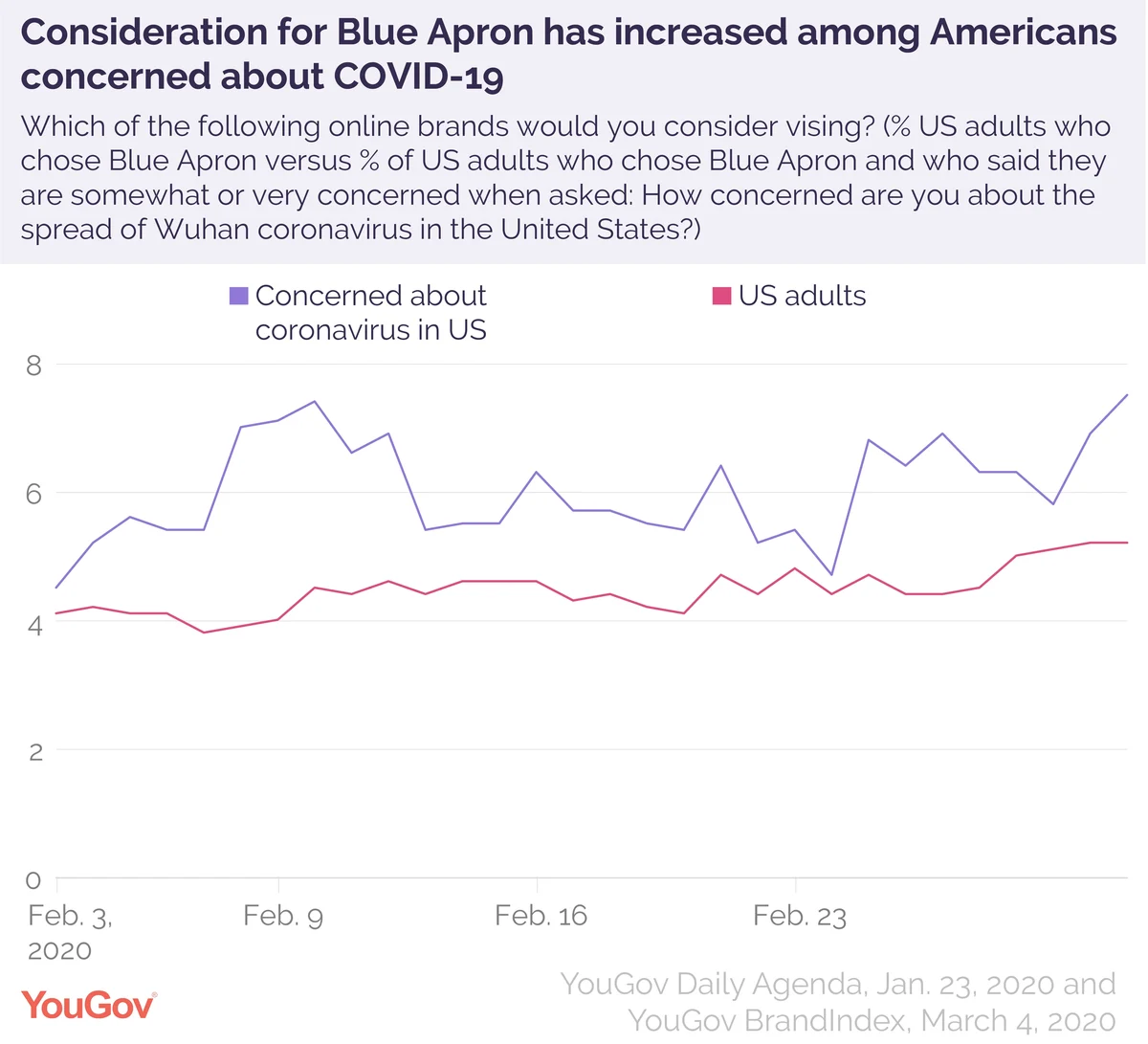

An increasing number of those who said they are at least somewhat concerned about the virus are considering Blue Apron, one of the largest meal-kit brands in the United States. YouGov data shows 4.5 percent of those concerned about the virus were considering Blue Apron at the beginning of February — that number rose to 7.5 percent in the first days of March.

The meal kit brand is also seeing modest increases among US adults in general, with 5.2 percent of Americans considering a Blue Apron purchase, up from 4.2 at the beginning of February.

Investors are paying attention. Stocks in Blue Apron saw a short-lived spike on Feb. 27, although this is a small blip in the larger picture in which the company's stock price and revenue has been tumbling for sometime. Even back in 2018, CFO Tim Bensley said the company will spend less on marketing to acquire new customers "while targeting customers that exhibit the attributes of our best customers."

Methodology: For Uber Eats, the group concerned about the coronavirus is based on an average daily sample of 151 US adults while the general population group is based on an average daily sample size of 1,449 US adults. For Blue Apron, the group concerned about the coronavirus is based on an average daily sample of 159 US adults while the general population group is based on an average daily sample size of 1,447 US adults. For both brands, groups concerned about the virus are based on responses to a January 23 survey which asked “How concerned are you about the spread of Wuhan coronavirus in the United States?” which had a sample size of 7,900. All BrandIndex figures are based on a 2-week moving average. YouGov Direct figures regarding home delivery versus eating a restaurant are based on a weighted sample of 1,377 US adults on March 5, 2020.

Image: Getty

More coronavirus findings from YouGov

February 6: America isn’t overly concerned about coronavirus but still want action

February 17: How do attitudes to coronavirus differ across the world?

February 26: Corona beer brand is impacted by the coronavirus news

March 3: