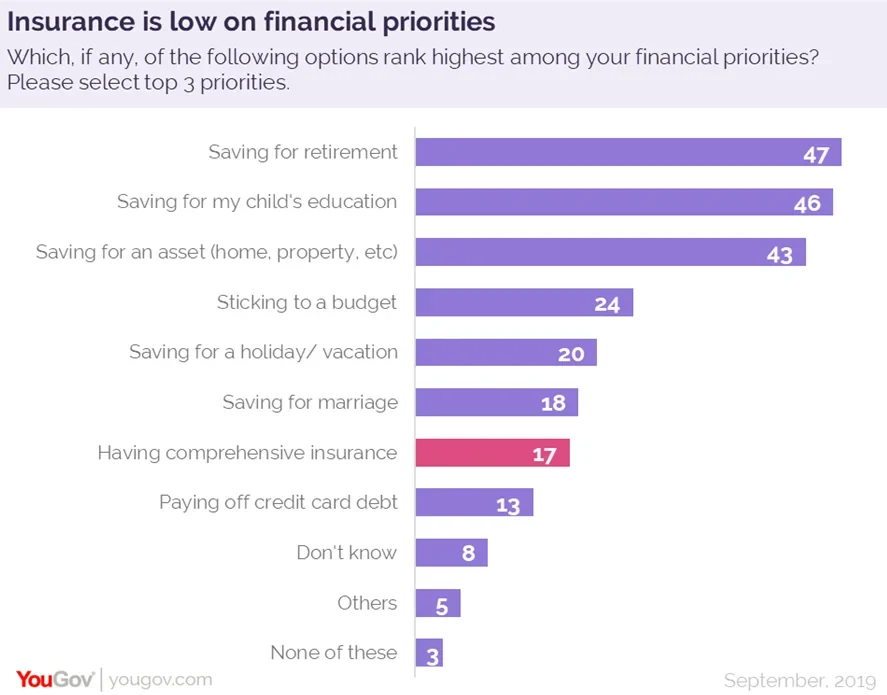

Only 17% of Indians consider having insurance as a top financial priority

Over half of Indians say that determining what insurance policies they need is confusing

Around two-thirds of Indians (67%) said they currently have insurance of some kind, according to new data from YouGov India.

YouGov’s new research surveyed respondents on their financial priorities and looked into their attitudes towards buying insurance. The survey shows that though a majority of Indians have some kind of insurance, fewer than one in five (17%) said that having comprehensive insurance is a top financial priority for them. When asked to choose their top three financial priorities, “saving for retirement”, “saving for my child’s education” and “saving for an asset” emerged as the top three goals. Sticking to a budget, saving for a holiday and saving for marriage are slightly lower on the priority scale and paying off credit card debt is the lowest on the list, with only 13% saying this important.said

GenX respondents were particularly likely to say that “saving for my child’s education” and “saving for retirement” were their top priorities; with 62% of them saying this. Likewise, half of the millennial respondents said saving for their child’s education (51%) and saving for an asset (49%) are their top goals. Interestingly, more than a quarter (27%) of GenZ respondents said saving for a holiday was one of their top financial priorities while for slightly under a quarter of respondents in South India (23%) saving for marriage was important.

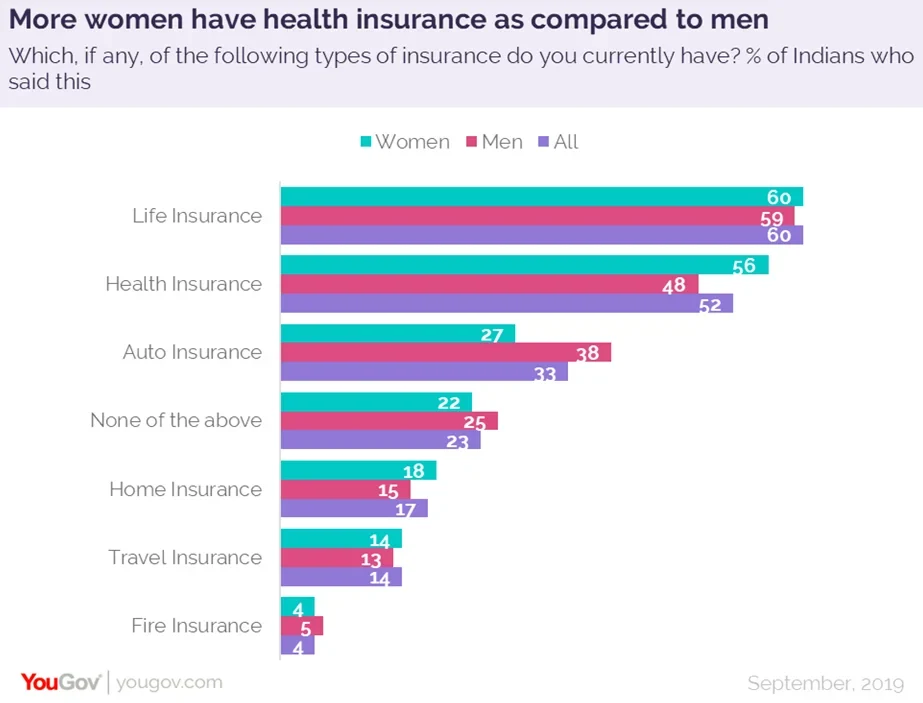

From all the available insurances, life insurance is the most commonly owned insurance (60% saying they have it), followed by health (52%) and auto insurance (33%). Just under a quarter (23%) have no insurance at all. Women are more likely than men to have health insurance (56% vs 48%) while men are more likely to own auto insurance (38% vs 27%).

When it comes to buying insurance of any kind, one thing is clear: half of Indians prefer dealing with a real person. Three in five (59%) people said that when they are purchasing any kind of insurance, they generally work with at least one insurance agent. A similar number (65%) agreed with the statement “I’d prefer working with an insurance agent to help me find the best policy.”

The next most popular method of purchasing insurance is “online” (27%), followed by “through a mobile application” (6%) and then “over the phone” (4%). The general preference for working with an insurance agent might be in part because many people do not have the adequate knowledge to buy the insurance and more than half (57%) “strongly” or “somewhat” agreed that “Determining which insurance policies I may need is confusing.”

Women are more likely than men to favour an in-person approach (53% vs 45%). Compared to people who are aged under 30, those above 30 are more likely to purchase insurance through both: a person (53% vs 44%) and online (30% vs 22%).

Looking deeper into their behaviours when buying insurance, we found that most people either search online and compare offerings/benefits of different insurance policies before buying (74%) or ask their family and friends to recommend the best policy to them (72%). 58% rely on media trends and trust companies or policies that are in news in order to make their judgement.

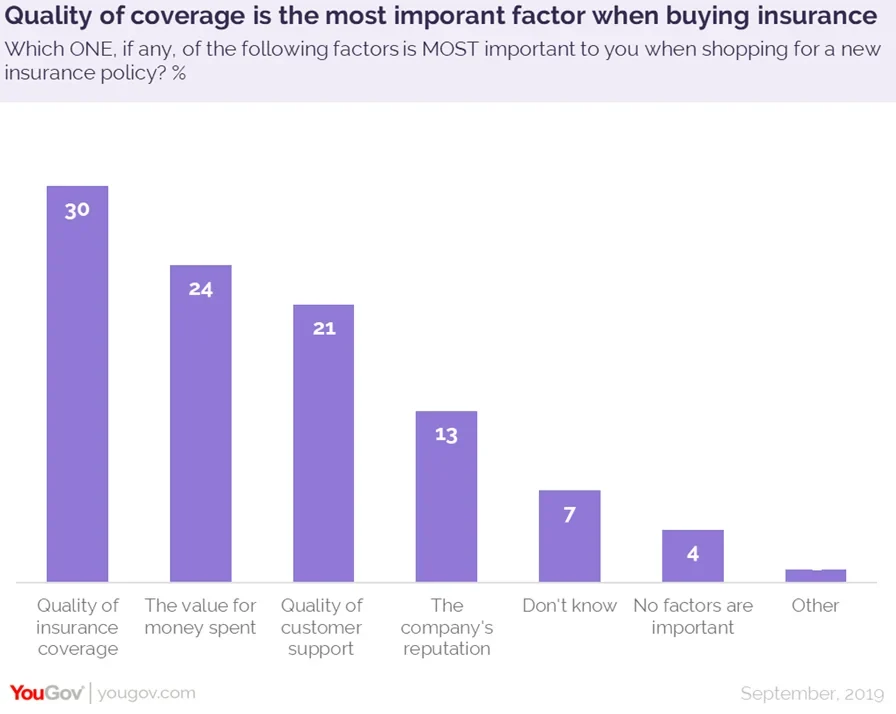

When shopping for a new insurance policy, quality of insurance coverage is the most important consideration factor (said by 30%), followed by the value received for the money spent (24%) and quality of customer support received (21%). One in eight (13%) even consider a company’s reputation while for one in twenty-five (4%) no factors are important when deciding which insurance to pick.

Data collected online by YouGov Omnibus among around 1027 respondents in India in September 2019 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country