43% of people in India are planning to spend more this Diwali season

Men and millennials are more excited to splurge during this time than their counterparts

89% look forward to sales & discounts during the festive season

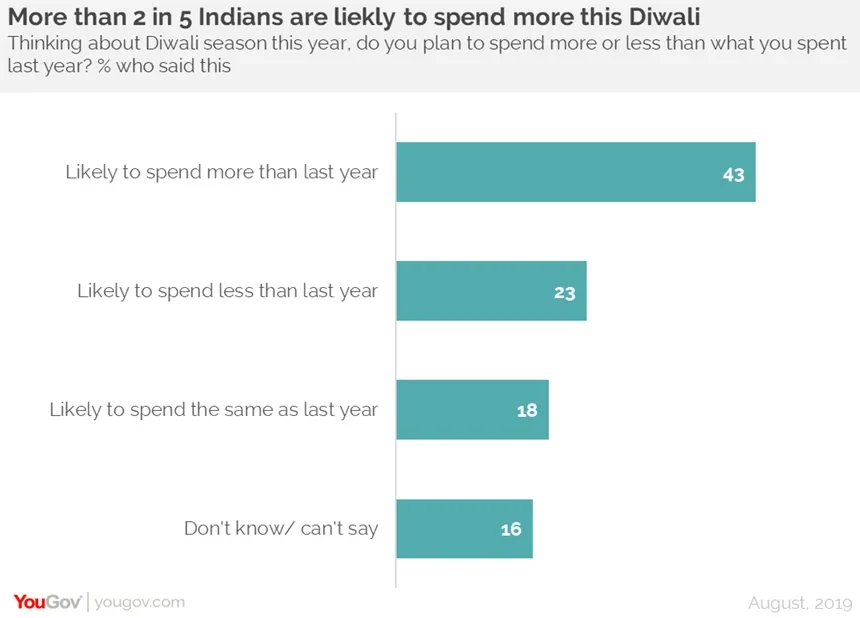

More than two in five (43%) Indians said they are likely to spend more this Diwali season than they did around the festival last year, new YouGov survey reveals. Just under a quarter (23%) are likely to spend less and three in sixteen (18%) may spend the same as last year.

YouGov ran a survey to gauge consumer sentiment around sales and to sense people’s excitement about shopping during Diwali time. The research shows that men are more likely than women to spend more this Diwali than they did last year (48% vs 37%). Even millennials seem to be more excited to splurge this festive season as compared to Gen Z (49% vs 35%).

Clothes (42%) and gadgets (31%) are the categories that people are likely to spend more this year. Interestingly, men are more likely than women to spend more in both these categories (45% vs 38% and 38% vs 23%, respectively).

Although the auto industry is at a standstill, the upcoming festive season could be a ray of hope for car manufacturers. A quarter of people (25%) said they are planning to buy a two-wheeler and more than one in five (22%) are looking forward to buying a four-wheeler in the next 3 months. Amongst other big-ticket items, one in seven (14%) are aiming to buy a house or property within this time period.

Traditionally, Diwali is a great opportunity for brands to lure consumers with festive sales and promotions. Looking deeper into people’s behaviours around sales, we see that around nine in ten (89%) agree with the statement ‘I love shopping during sales and discounts’. A large number (55%) hold up their purchases in anticipation of sales and agree with the statement - ‘I generally plan my shopping around sale season’. Millennials are more likely to say this as compared to GenZ (60% vs 47%). Furthermore, around one in six (15%) shop for only big-ticket items during sales while one in three (30%) don’t care about sales and shop when they need to.

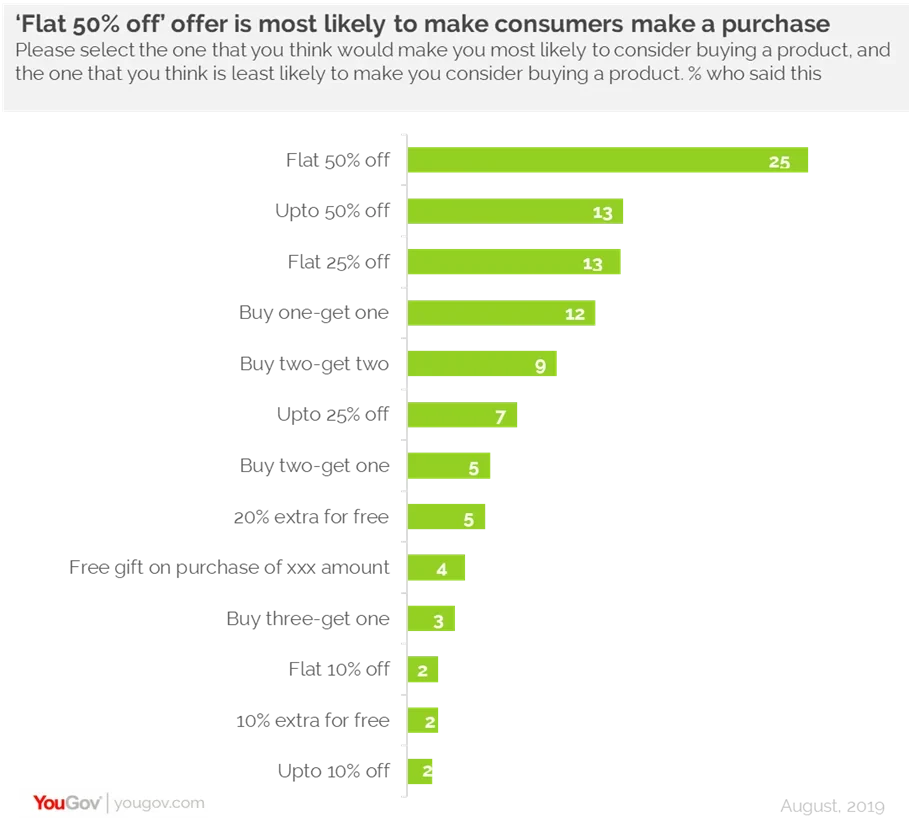

When looking at their sale preferences, we see that consumers are likely to respond better to offers that translate into direct discounts or cash benefits as compared to indirect offer and benefits. A quarter (25%) of people said a ‘flat 50% off’ discount is likely to make them consider buying a product, and half of this proportion (13%) said the same for offers such as ‘up to 50% off’ and ‘flat 25% off’. Comparatively, people said they are least likely to respond to promotional offers such as ‘up to 10% off’, ‘flat 10% off’ and ‘buy three get one’.

When asked about how these promotions affect their brand perception, 64% people said they feel positive about brands that regularly offer discounted prices and promotional offers and 90% from these further claimed they are loyal to such brands.

Generally speaking, clothes are the most purchased items during sale, with 77% saying they plan their shopping of clothes during sale. Gadgets (64%) and appliances (54%) are other popular items purchased around promotional offers.

Data collected online by YouGov Profiles among around 2011 respondents in India in August 2019 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country.