Vision 2030 sets great expectations for real estate investment in KSA

New research reveals a significant number of investors and home buyers expect the Kingdom’s economic blueprint for a post-oil era to increase real estate market development

GCC homebuyers and property investors looking to invest in Saudi Arabia have great expectations for the Kingdom’s real estate market development due to Vision 2030. The results are revealed by the latest Real Estate Barometer study, conducted in partnership between YouGov and Restatex Cityscape Riyadh to unveil investor sentiment within the Middle East real estate market.

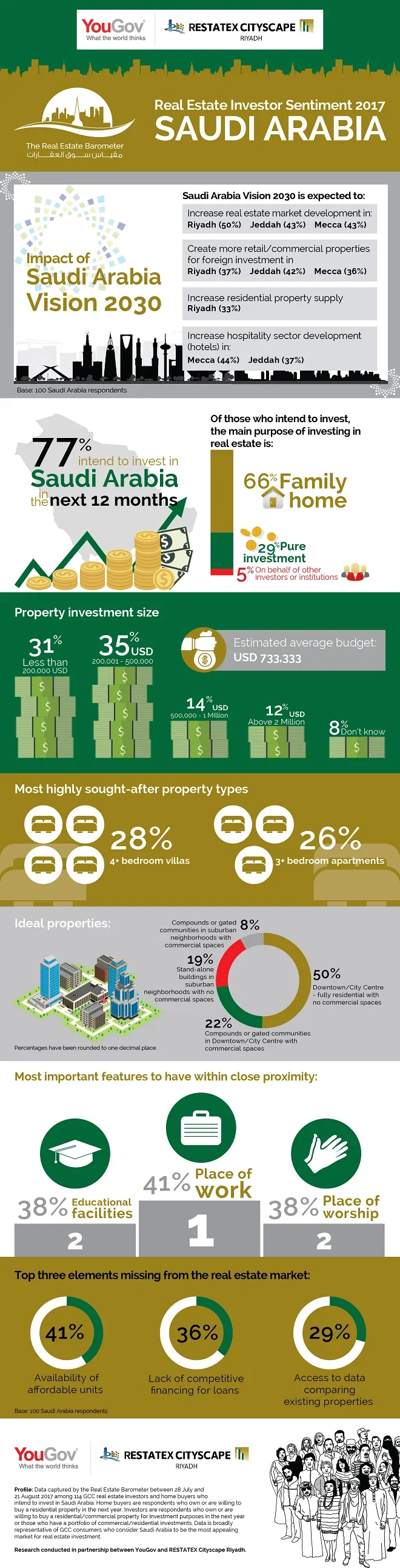

With Vision 2030 a major driver for real estate investment, respondents were asked what impact Saudi Arabia’s economic blueprint for a post-oil era will have on the country. Half of respondents expect the plan to increase real estate market development in Riyadh, particularly residential properties (33%), while 43% expect an increase in real estate development in Jeddah and Mecca respectively. Respondents also believe that the plan will create more retail/commercial units and enable foreign direct investment into the Kingdom.

The results also show the majority of respondents intend to purchase a property in the Kingdom in the next year, while 23% have already purchased a property.

The research has been revealed ahead of Restatex Cityscape Riyadh, which takes place at the Riyadh International Convention & Exhibition Centre from the 27th – 30th September.

Ahmed Zakaria, Exhibition Director at Restatex Cityscape Riyadh said: “It’s clear that there is a significant number of investors and homebuyers interested in investing in real estate in the Kingdom and they’re looking at plans set by government, like Vision 2030, as ways to boost real estate investment development.”

The survey also illustrated that affordability is a central issue in KSA, with 41% maintaining that there is a lack of available affordable units.

“The research findings give us great insight into the current market conditions,” said Hussain Farraj, CEO of Ramtan, co-organisers of Restatex Cityscape Riyadh. “We anticipate significant interest from homebuyers and investors who will be attending the event to capitalise on attractive price options, payment plans and discounts from a wide spectrum of real estate products to suit their budget. Our developers and brokers will be there to help them make informed purchasing decisions directly on the show floor,” he added.

Within the residential property price segment, the expectation in the market is for prices to come down; 60% of survey respondents expect a substantial decrease in the sales and rental prices of residential properties in Saudi Arabia in the coming year.

Respondents also indicated the importance of location. The research reveals that 50% consider their ideal residential property to be in Downtown/City Centre which is fully residential, while over a fifth want compounds or gated communities in Downtown/City Centre with commercial spaces (22%).

“The research tells us that respondents seek residential properties that are in close proximity to place of work/business (41%), places of worship (38%), educational facilities (38%) and healthcare facilities (35%). In addition, quality of house (86%) and value for money (83%) are some of the top factors investors and homebuyers look for when purchasing property,” added Zakaria.

Kailash Nagdev, Managing Director for YouGov in the Middle East region, commented; “The annual Real Estate Barometer is designed to track Middle East property market sentiment to help the industry expand with its future investors in mind. The 2017 results show Saudi Arabia to be an attractive market among GCC investors with Vision 2030 well recognised to be a catalyst for exciting future developments. The research also shows addressing affordability, financing options and availability of property information will be key for industry professionals as the Kingdom continues to expand its real estate market appeal.”