YouGov Affluent Perspective 2017: Vacation Rental Properties

Welcome to the fifth installment in a series that delves into the latest insights from the YouGov Affluent Perspective 2017 Global Study. Each year, we study the attitudes, lifestyles, values, and shopping behaviors of the world’s most successful households.

The demand for vacation rentals

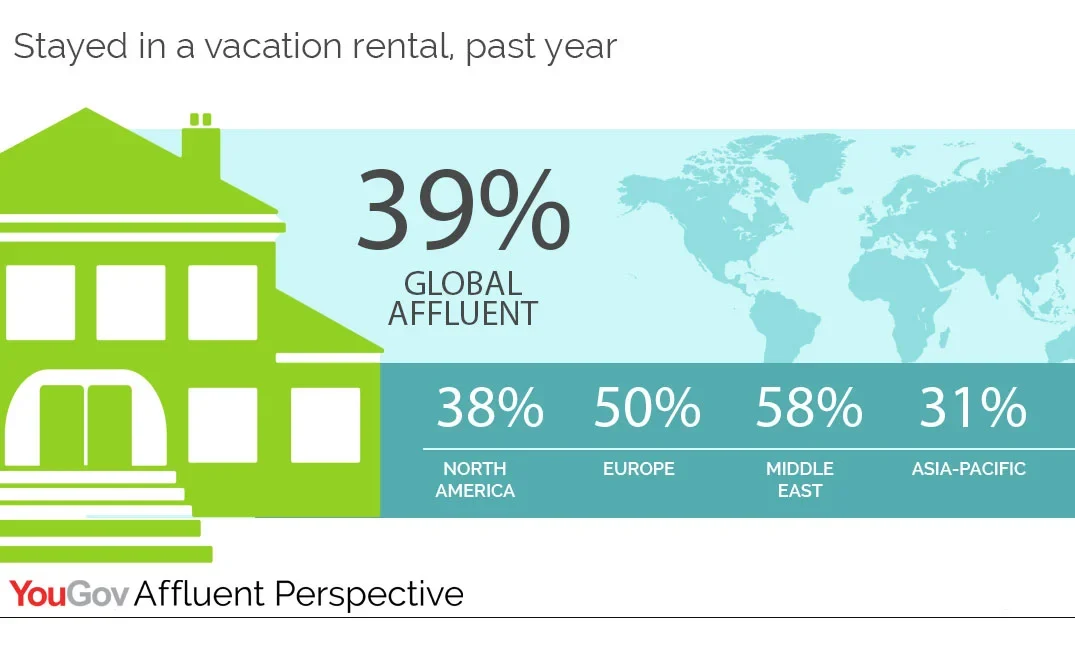

Over the past few years, members of the global affluent have greeted the topic of vacation rental properties with a growing sense of enthusiasm. While the idea of renting a vacation home isn’t new, especially to this cohort, companies such as Airbnb and VRBO have poured a fresh bucket of water onto the industry’s garden. Indeed, the global affluent market for vacation rentals is as popular as ever, with just under four in ten of the world’s wealthiest individuals reporting that they stayed in a rental property at some point last year.

Leading the charge is MENA, where nearly 60% of the region’s affluent have rented in the past year. This should come as no surprise, since more than half of MENA’s affluent residents are Millennials — the driving force behind vacation home rentals.

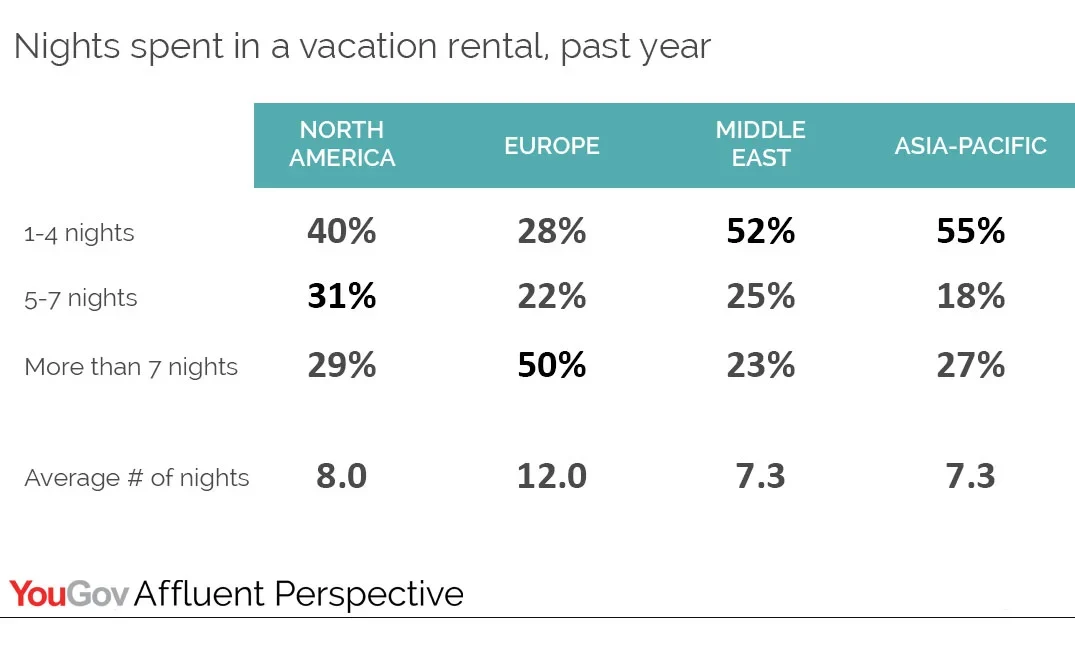

The popularity of this practice, however, is in no way confined to one part of the globe. At 50%, one in two affluent Europeans say they’ve rented a vacation home in the past year. This group also averages the most nights spent in a vacation rental per year, with 12, and reports the highest percentage of staying for seven nights or more, with 50%.

What this means for hotels

So where does all this activity leave more traditional accommodation providers, such as hotels?

Among the global affluent opting to rent a vacation home over a hotel room, 44% say they do so because the former tends to offer more space. At the same time, 37% report that rental properties offer lower prices and more privacy. Nearly a third think they situate renters in a better location, too.

Above and beyond concerns about space, price, privacy, and location, many members of the global affluent appear to be booking rental properties over traditional hotels because they crave something new. Indeed, nearly three-quarters of them feel premium hotels are more similar than different. Additional data shows that one-third simply “like staying at vacation rentals more than hotels.”

In the end, affluent travelers bored of the same old thing will continue to seek new experiences — putting pressure on hotel brands to rise to the occasion.

For more information, please visit AffluentPerspective.com