MasterCard Gets Boost from Contactless Payment

The UAE Government has taken several measures to move the UAE closer to adopt the latest cashless payment technology. By mandating electronic payment of wages through solutions like basic and inexpensive deposit accounts and payroll cards with debit payment functionality, the UAE government massively increased the accessibility of cashless payment methods. MasterCard, a key player in cashless payment innovation in the region, witnessed an increase in its YouGov’s BrandIndex Overall Brand Health Index score starting 2013.

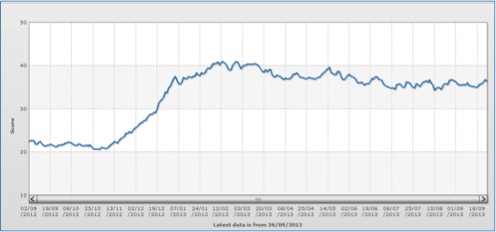

MasterCard’s overall BrandIndex Index score over witnessed a significant upswing in its score in the past 12 months, from 22.6 points in September 2012 to 36.3 points more recently. MasterCard continued to drive this trend launching innovative payment solutions for its customers.

The brand started seeing this upward trend from early November 2012 when MasterCard announced its collaboration with Network International, to enhance the acceptance infrastructure of its contactless payment solutions in the UAE with the installation of MasterCard PayPass terminals in more than 1000 stores.

MasterCard maintained its customer perception score in the UAE in 2013, and expected to continue to do so into the next quarter.

MasterCard’s brand perception was assessed using Index score, which is an average score of the six key Brand Health indicators (Quality, Value, Recommendation, Corporate Reputation, Customer Satisfaction and General Impression)