The path to prestige: Tracking conversion rates among German luxury car brands in the UK

Despite the manufacturing and distribution of luxury cars slowing down over the past few years, growing demand for premium automobiles and rising disposable income amongst the British population is expected to facilitate the growth of the British luxury car market over the next few years. Projected to register an annual CAGR of 8.42%, the luxury car market in the UK is estimated to reach a market volume of GBP 1173.51 million by 2027. In this fast-growing and dynamic luxury car landscape, automakers continue to compete for the attention of consumers.

Using data from YouGov BrandIndex — which monitors several key measures of brand health daily — let's explore the performance of three leading luxury car brands in the UK to uncover how successful they are at converting consumers, from Awareness to Consideration and finally Purchase Intent.

All three of our chosen brands - BMW, Mercedes-Benz, and Audi - earn a high rate of Awareness in the UK, but who is the most successful at converting this Awareness in actual sales?

BMW

BMW demonstrates a high Awareness score, with 95.8% of UK adults saying they are familiar with the brand.

Coming to consumers who say they would consider buying from the brand the next time they’re in the market for a luxury car, BMW lags behind Audi but edges out Mercedes-Benz with a Consideration score of 14.1 percentage points. This equates to a 15% conversion rate from the Awareness stage to the Consideration stage.

However, the brand makes up for this in the final stage of the purchase funnel. The German automaker’s Purchase Intent score of 4.2%, a measure of how likely someone would be to purchase from a specific brand, corresponds with a conversion rate of 30% from the Consideration stage – the highest amongst all three brands.

Mercedes-Benz

Much like BMW, Mercedes-Benz also has a high level of brand recognition among UK consumers, with 95.5% of consumers saying they’re aware of the brand.

In the first quarter of 2023, 13.5% of UK consumers report they would consider buying a Mercedes-Benz model. That indicates that the automaker is converting more than an eighth (14%) of those who are aware of the brand into potential customers.

Despite Mercedes-Benz's low Purchase Intent score of 3.6 percentage points, the brand enjoys a substantially high conversion rate of 27% from the Consideration stage, showcasing the brand's ability to solidify consumer interest.

Audi

Following closely behind BMW and Mercedes-Benz, Audi registers an Awareness score of 95.1 percentage points.

The brand stands out with its Consideration score (19.5 points), which signifies a conversion rate of 21% from the Awareness stage - the highest of our three selected brands.

The brand also leads the pack in the final stage of the purchase funnel with a Purchase Intent score of 5.2 points. However, a look at the rate at which Britons are being converted from the Consideration stage to the Purchase Intent Stage reveals that the brand comes in a close second behind BMW with a conversion rate of 27% (just like fellow German auto giant Mercedes-Benz).

Overall brand health

An analysis of our chosen brands’ purchase funnels reveals that BMW is the most effective of the three brands at converting consumers’ Awareness into Purchase Intent. However, a deeper look at BrandIndex data can help us understand the selected brands’ overall performance and success amongst consumers in the UK.

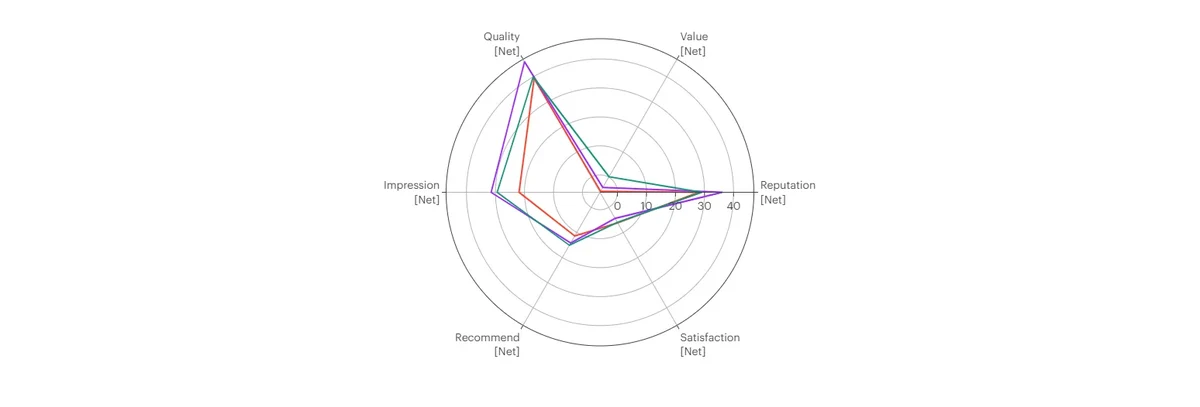

We can do so by examining the six metrics comprising each brand’s Index score – a measure of a brand’s overall brand health.

- Impression Score (how consumers view a brand)

All three brands have positive Impression scores, with Mercedes-Benz in the lead (31.5) followed by Audi (29.4) and BMW (21.9).

- Recommendation Score (whether consumers would recommend a brand to friends and colleagues)

Audi leads the pack in this category with a score of 15.1 points followed closely by Mercedes-Benz at 14.2 points and BMW at 11.4.

- Satisfaction Score (whether consumers are currently satisfied or dissatisfied with a brand)

While all brands are in positive territory, Satisfaction remains one of the weaker metrics for all three brands. BMW (6.2) and Audi (6) are the dominant brands in this regard with Mercedes-Benz trailing at 4.4 points.

- Reputation Score (whether a consumer would be proud or embarrassed to work for a brand)

All brands reflect relatively high Reputation scores – Mercedes-Benz (36.1), Audi (29) and BMW (28).

- Value Score (whether a consumer considers a brand to represent a good or poor value for money)

Value stands out as the weakest brand health metric for all three automakers, with two out of the three brands registering a negative score – Audi (0.2 points), Mercedes-Benz (-4.1 points), and BMW (-5.6 points).

- Quality Score (whether a consumer considers a brand to represent a good or poor quality)

Mercedes-Benz leads the three brands with a Quality score of 46 percentage points, followed distantly by Audi (40) and BMW (39.4). Quality is also the strongest metric of the six measured in overall brand health for all three brands.

Explore our living data – for free

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Try a subscription-free data snapshot of your brand performance, sector trends or audience profile, with a one-time deep dive into YouGov's flagship consumer intelligence and brand tracking products. Get your tailor-made snapshot here.

Discover more Automotive content here