Beyond window shopping: A study of conversion rates in US mall retail

2022 saw the global apparel market reach USD 1.5 trillion, led by the United States with a revenue of USD 311.97 billion. One of the largest in the world, the US apparel market is highly competitive and marked by the presence of a vast number of players - big and small, old and new. In this fast-paced landscape of apparel retail, clothing brands, especially mall retailers, continue to compete fiercely for the attention and loyalty of consumers.

Using data from YouGov BrandIndex — which monitors several key measures of brand health daily — let's explore the performance of three prominent US clothing and apparel brands and reveal their consumers' journey towards actual sales.

All three of our chosen brands - Banana Republic, Gap, and J. Crew - earn a high rate of Awareness in the US, but who enjoys the highest rate of conversion from Awareness to Consideration and finally Purchase Intent?

Stage 1: Awareness

At the top of the purchase funnel is Awareness, a measure of if consumers have ever heard of a brand. All three brands have high rates of Awareness among consumers in the US but it’s Gap that’s the clear leader at 88.1%. Banana Republic ranks second at 82.4% and J. Crew is in a slightly distant third at 71%.

Stage 2: Consideration

When it comes to the brands that Americans would consider buying the next time they’re in market for apparel, Gap once again leads the pack with a Consideration score of 15.5% followed by Banana Republic at 9.9% and J. Crew at just 8.2%.

Looking at their conversion rates from Awareness to Consideration, it’s Gap with the edge of 6-points (18% vs. 12% for Banana Republic and J. Crew), indicating that the clothing and accessories retailer is most effective at converting consumers into considerers.

Stage 3: Purchase Intent

The Purchase Intent stage shows the brands consumers would be most likely to actually buy from and much like in the case of the first two stages of the purchase funnel, this stage is also led by Gap with a score of 3.2% - a score that is almost twice that of Banana Republic (1.8%) and J. Crew (1.4%).

Converting at a rate of 21%, Gap fares the best at moving consumers through the purchase funnel - from Awareness to Consideration to Purchase Intent - and narrowly edges out Banana Republic (18%) and J. Crew (17%).

Banana Republic recently announced its latest capsule collection in collaboration with Peter Do, noted designer and recently appointed creative director of Helmut Lang. It will be interesting to see whether this new collection can change the tide for the brand and better its ability to convert consumers though the purchase funnel.

Overall Brand Health

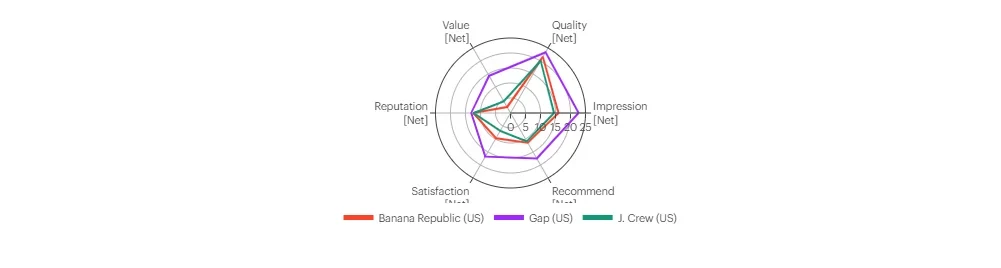

The Gap's performance throughout the purchase funnel journey marks it as the strongest contender of the three brands measured in this analysis. However, a deeper look at BrandIndex data can help us understand the selected brands’ overall performance and success amongst consumers in the US.

We can do so by examining the six metrics comprising each brand’s Index score – a measure of a brand’s overall brand health.

- Impression Score (how consumers view a brand)

All three brands have positive Impression scores, with Gap in the lead (22.7) followed by Banana Republic (16) and J. Crew (14.5).

- Recommendation Score (whether consumers would recommend a brand to friends and colleagues)

Perhaps unsurprisingly, Gap leads the pack in this category too with a score of 17.5 points followed distantly by Banana Republic at 11.4 points and J. Crew at 10.9 points.

- Satisfaction Score (whether consumers are currently satisfied or dissatisfied with a brand)

While all three brands are in positive territory, Gap (16.8) is the most dominant brand in this regard. Notably, Satisfaction represents one of the brands' strongest drivers of overall brand health.

- Reputation Score (whether a consumer would be proud or embarrassed to work for a brand)

All brands display similarly positive scores in the category - Gap (13.1), Banana Republic (12.4), and J. Crew (12.3)

- Value Score (whether a consumer considers a brand to represent a good or poor value for money)

While Gap stands out of the pack in this category with a score of 14.3 points, value for money is the weakest link for both J. Crew (4.5) and Banana Republic (2.3).

- Quality Score (whether a consumer considers a brand to represent a good or poor quality)

Much like with all other measured metrics, Gap leads the three brands with a score of 23.4 percentage points followed by Banana Republic (21.6) and J. Crew (20.1). Quality is also J. Crew’s strongest metric of the six measured in overall brand health.

Explore our living data – for free

Discover more retail content here

Want to run your own research? Run a survey now

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.