Crunching the numbers: Analysing the conversion funnel of top snack food brands in the UK

Understanding a brand's ability to move consumers through the various stages of the purchase funnel can offer critical insights into its competitive position within the sector and help evaluate its success in converting consumer awareness into tangible sales.

Brand conversion funnels can serve as effective customer journey models to identify areas for improvement and growth by illustrating the gradual decline of the number of potential customers as they are guided through the lower stages of the funnel towards becoming paying customers.

Using data from YouGov BrandIndex, which monitors several key measures of brand health daily, let's explore the performance of three leading snack food brands in the UK – Pringles, Walkers and Tyrells - to uncover how successful they are at converting consumers, from Awareness to Consideration and finally Purchase Intent.

Pringles

Unsurprisingly, the stackable potato-crisp brand registers a high Awareness score, with 94.7% of all UK adults saying they are aware of the brand.

Nearly two-fifths of all UK consumers (39.3%) say they would consider purchasing Pringles the next time they are in the market for potato-based crisps. This means that 41% of consumers who are aware of the brand would consider buying their products the next time.

Though the brand registers a high Awareness and Consideration score, it is on the last stage of the purchase funnel where it stands out the most. Pringles' conversion rate from Consideration to Purchase Intent (34%) is 13 percentage points more than Walkers and more than double that of Tyrrells.

Walkers

Much like Pringles, Walkers also has a high level of brand recognition among UK consumers, with 94% of consumers saying they’re aware of the brand.

In the first quarter of 2023, 29.1% of UK consumers report they would consider buying Walkers' crisps the next time. That indicates that Walkers is converting nearly a third (31%) of those who are aware of the snack food brand into potential customers.

Walkers' Purchase Intent score of 6%, a measure of how likely someone would be to purchase from a specific brand, corresponds with a substantially high conversion rate of 21% from the Consideration stage, showcasing the brand's ability to solidify consumer interest.

Tyrrells

A substantially smaller share of UK consumers are familiar with Tyrrells (77%) compared to Pringles and Walkers.

Tyrrells’ Consideration score of 18.5% signifies a conversion rate of 24% from the Awareness stage - the lowest of our three selected brands.

The brand’s levels continue to drop in the final stage of the purchase funnel. A Purchase Intent score of just 3% reveals that less than a fifth of consumers (16%) are being converted from the Consideration stage to the Purchase Intent stage, making it the least efficient of our brands at turning Consideration into Intent.

Overall brand health

An analysis of our chosen brands’ purchase funnels reveals that Pringles is the most effective of the three brands at converting consumers’ Awareness into Purchase Intent. However, a deeper look at BrandIndex data can help us understand the selected brands’ overall performance and success amongst consumers in the UK.

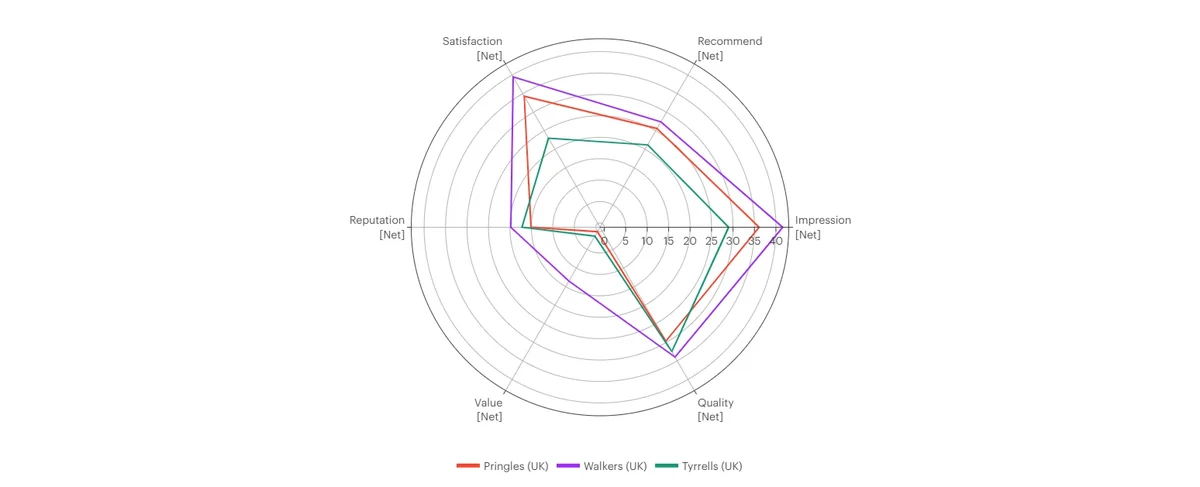

We can do so by examining the six metrics comprising each brand’s Index score – a measure of a brand’s overall brand health.

- Impression Score (how consumers view a brand)

All three brands have positive Impression scores, with Walkers in the lead (41.6) followed by Pringles (36.1) and Tyrrells (29).

- Recommendation Score (whether consumers would recommend a brand to friends and colleagues)

Walkers leads the pack in this category too with a score of 27.4 points followed closely by Pringles at 25.6 points and Tyrrells at 21.2.

- Satisfaction Score (whether consumers are currently satisfied or dissatisfied with a brand)

While all three brands are in positive territory, Walkers (39.5) and Pringles (34.3) are the dominant brands in this regard and Satisfaction represents one of the brands' strongest drivers of overall brand health.

- Reputation Score (whether a consumer would be proud or embarrassed to work for a brand)

Though all brands display positive scores in the category, Reputation remains one of the weaker metrics for all three brands - Walkers (19.8), Tyrrells (17.2) and Pringles (15,1).

- Value Score (whether a consumer considers a brand to represent a good or poor value for money)

While Walkers stands out of the pack in this category with a score of 13.5 points, value for money is the weakest link for both Tyrrells (1.4) and Pringles (0.2).

- Quality Score (whether a consumer considers a brand to represent a good or poor quality)

Much like with all other measured metrics, Walkers leads the three brands with a score of 34 percentage points followed by Tyrrells (32.5) and Pringles (29.7). Quality is also Tyrrells strongest metric of the six measured in overall brand health.

Interestingly, Walkers comes out on top in all metrics that make up overall brand health, as opposed to Pringles which is the most successful at moving consumers through the purchase funnel. That suggests that while the heritage brand has robust brand health, there may be more it can do to convert that into purchase intent.

Explore our living data – for free

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Try a subscription-free data snapshot of your brand performance, sector trends or audience profile, with a one-time deep dive into YouGov's flagship consumer intelligence and brand tracking products. Get your tailor-made snapshot here.

Discover more FMCG content here