APAC Biggest Brand Movers – June 2023

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

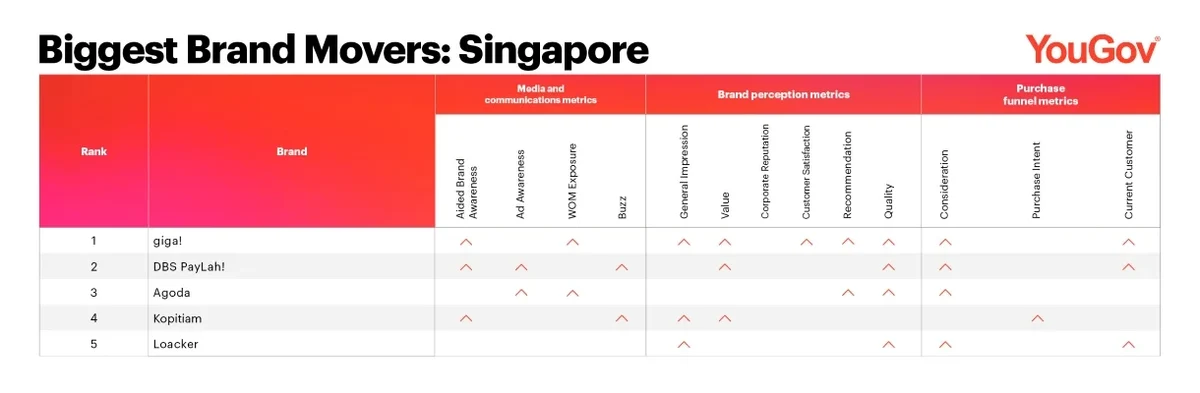

Singapore: giga! gets top spot with customer gifting campaign

giga! is Singapore’s Biggest Brand Mover for June.

The virtual telco brand made gains in nine out of 13 YouGov BrandIndex metrics, in the Media and Communication category (Aided Brand Awareness, WOM Exposure), Brand Perception category (General Impression, Value, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

To celebrate its 4th anniversary, giga! launched its ‘Feeling Good’ campaign, which offered existing users a chance to gift their friends and family a 10 GB mobile line – free for four months – by purchasing it at only $1, down from its original price of $10. The virtual sub-brand of StarHub also worked with Grey Group Singapore to release a series of advertisements, highlighting the promotion through short clips around the idea of gifting and ‘feels good’ experiences.

DBS PayLah! is the runner-up, with the mobile payment app scoring upticks in seven metrics across the the Media and Communication, Brand Perception and Purchase Funnel categories. Agoda takes third place, with the online travel booking platform seeing improvements in five metrics across all three categories.

Food court operator Kopitiam and chocolate wafer brand Loacker round out the top five, making gains in five and four metrics respectively.

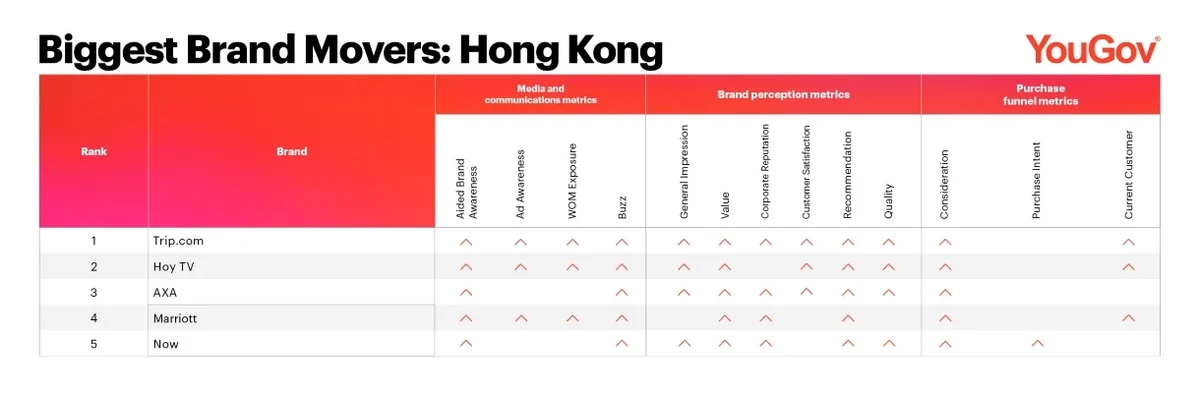

Hong Kong: Trip.com nets first place with NFT launch

Trip.com is Hong Kong’s Biggest Brand Mover for June.

The online travel agency made gains in 12 out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

Trip.com recently launched its first collection of non-fungible tokens (NFTs) – “Trekki” – which features a dolphin cartoon mascot available in 10,000 versions with distinct personas and travel backgrounds. According to Trip.com’s press release, customers who own a “Trekki” will be able to unlock more benefits through the NFT the more they travel.

Hoy TV is the runner-up, with the free-to-air television broadcasting company scoring upticks in eleven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. AXA takes third place, with the insurance provider seeing improvements in nine metrics across all three categories.

Marriott hotel and pay-TV operator Now round out the top five, making gains in nine metrics each.

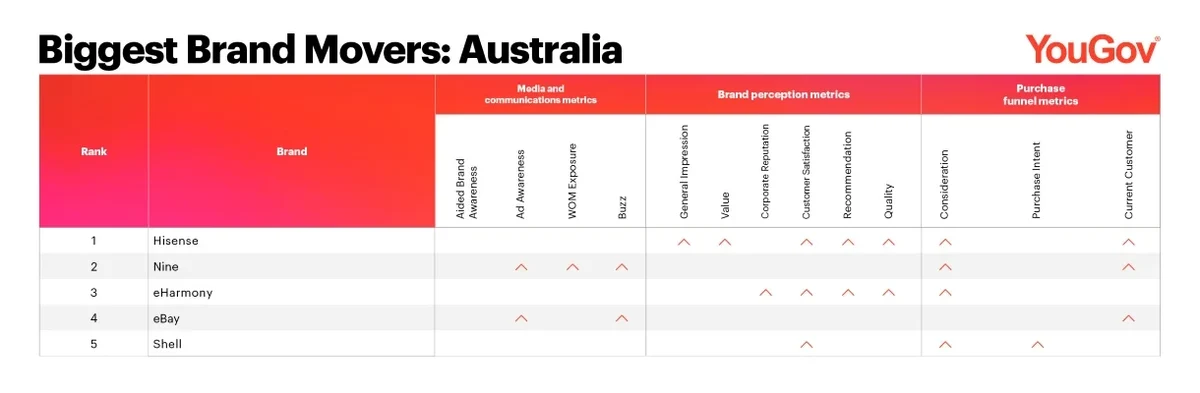

Australia: Hisense rises to top of table with reveal of 2023 TV range

Hisense is Australia’s Biggest Brand Mover for June.

The electronics manufacturer made gains in seven out of 13 YouGov BrandIndex metrics, across the Brand Perception category (General Impression, Value, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

Hisense recently unveiled its 2023 range of Laser and LED televisions, which are set to go on sale from July. The latest series promises to offer a wider colour palette, along with clearer and brighter pictures, thanks to contrast-enhancing Mini-LED technology.

Nine is the runner-up, with the free-to-air television network scoring upticks in five metrics across the Media and Communication and Purchase Funnel categories. eHarmony takes third place, with the online dating website seeing improvements in five metrics across the Brand Perception and Purchase Funnel categories.

Online shopping platform eBay and petroleum company Shell round out the top five, making gains in three metrics each.

Was your brand one of APAC’s Biggest Movers in June?

Uncover the other brands that were among the top ten in Australia, Hong Kong and Singapore by requesting your free copy of YouGov's APAC Biggest Brand Movers Report for June 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Japan, Indonesia, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for June 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between May and June 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time