Global Media Outlook, 2023: Growth in digital slows, live events may bounce back

A lot has happened since the last YouGov Global Media Outlook report. Global events, from the easing of the pandemic, through war in Ukraine, to the cost-of-living crisis and the threat of a recession, have presented new challenges for the media industry.

YouGov’s new Global Media Outlook Report examines how media behaviour has changed in the last 12 months and how it may look in the year ahead.

Digital media continues to dominate and grow while live events shrink

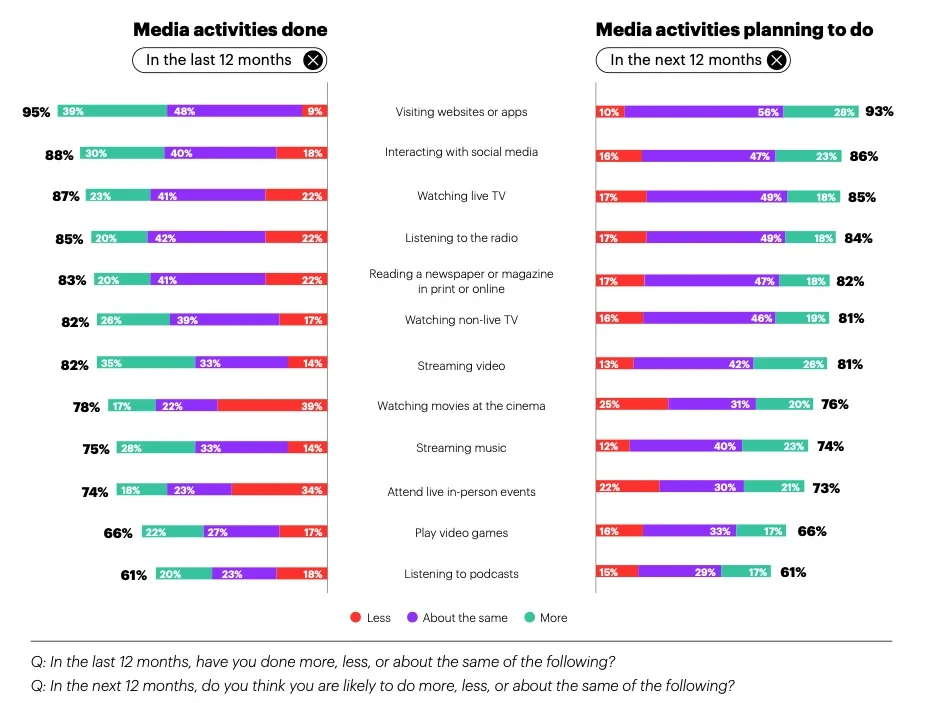

Digital media are the big winners of 2022, with 95% of consumers using websites or apps and 88% interacting with social media. Not only do digital media enjoy massive penetration, usage is swelling with 39% of consumers using websites or apps more often, 35% streaming more video and 30% spending more time interacting with social media. These trends are set to continue into next year with 28% of consumers predicting they’ll visit websites and apps more and 23% saying they’ll use more social media.

On the other end of the spectrum, live events and watching movies at the cinema have suffered major setbacks during the pandemic. In the past year, YouGov research shows that more than a third of global consumers (34%) have attended fewer events and 39% have visited the cinema less often. Our data also shows a decline in consumption of traditional media. About a fifth of respondents (22%) report a reduction in listening to the radio, reading newspapers or magazines and watching live TV.

A slow return to “normal”?

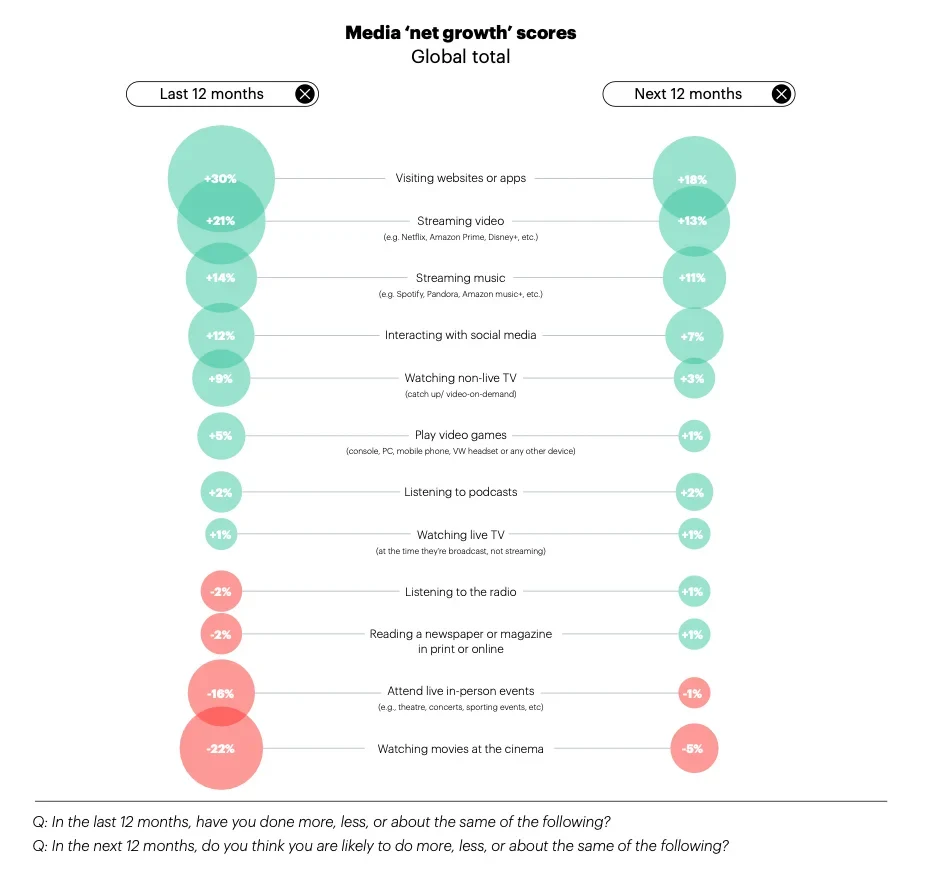

The chart below shows the ‘net growth’ scores for different media categories. Net growth is calculated by subtracting the percentage of people who are consuming less from the percentage of people who are consuming more.

“Net growth” figures show movement in the same direction—digital media usage will likely continue to grow—but at a slower rate. A net of 18% of consumers predict they’ll visit websites or apps more often next year compared to 30% who increased their usage last year. Similarly, a net of 7% of users predict they’ll use social media more compared to 12% last year. With COVID restrictions easing, the still-rapid growth of digital media is slowing somewhat.

The net growth figures also predict some relief for cinema and the live events industry. While many consumers predict further reductions in the coming year, they’re offset by those who predict greater consumption. For example, 22% of consumers predict they’ll attend fewer live events but 21% say they’ll attend more, yielding a net reduction of only 1%. This is down from a 16% net reduction for live events in the previous year. A similar pattern holds for cinema which predicts only a 5% net reduction in consumption in 2023 compared to a 22% reduction the year before.

However, consumer forecasts are not necessarily an infallible guide to future behaviour, so surprises may be in store. In October 2021, we asked consumers to predict their media consumption for the coming year and 29% respondents said they’d visit websites and apps more. In August 2022, looking back on the year that just passed, far more respondents (38%) said they ended up increasing their website and app usage. Similarly, only 27% predicted they’d stream more video whereas, in retrospect, 35% said they did so.

Read YouGov’s Global Media Outlook report to learn more about:

- How media behaviour may change in the year ahead

- The impact of sustainability and other issues on consumer opinion.

- The path ahead for subscription video services

Explore our living data – for free

Discover more media content here

Want to run your own research? Run a survey now

Photo by Matthew Guay on Unsplash